Oil rises as US sanctions on Iran, Russia offset bleak demand outlook

Despite weak demand forecast from IEA, sanctions offer counterpoint to price slump

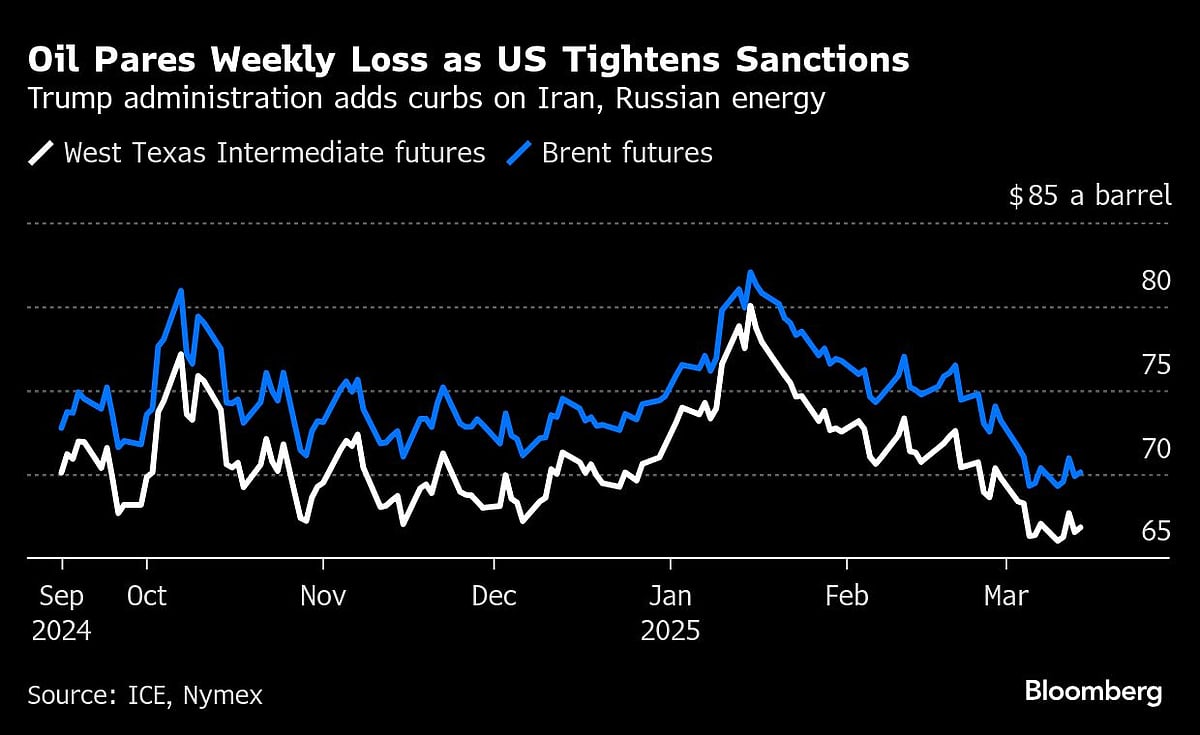

Oil advanced as the US tightened sanctions against Iran and Russia, countering some of Thursday’s slump following a dour demand forecast from the International Energy Agency.

Brent rose to above $70 a barrel after sliding 1.5% in the prior session, and West Texas Intermediate was near $67.

The White House imposed sanctions on Iran’s oil minister and on more companies and vessels used in the transport of the OPEC member’s crude, while also restricting payment options for Russian energy.

The decline on Thursday came after the IEA said a supply surplus is set to deepen as an escalating trade war pressures demand at the same time that OPEC+ is reviving output.

WTI is within a whisker of logging an eighth weekly loss, in what would be the longest stretch since August 2015, as global benchmark Brent is close to a fourth weekly drop.

“Looser balances in the second half of the year should see Brent crude push back toward $70 a barrel by year-end,” ANZ Group Holdings Ltd. analysts Daniel Hynes and Soni Kumari said in a note. There’s some short-term bullishness as “tariffs on Canadian crude and rising disruptions to supply from Iran and Venezuela keep the market tight.”

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox

Network Links

GN StoreDownload our app

© Al Nisr Publishing LLC 2026. All rights reserved.