Manila: Are you an overseas Filipino worker (OFW) hoping to earn more money on your savings than bank deposits, while not taking too much risk?

Soon, another tranche of Retail Treasury Bonds (RTB) is set to be issued by the Philippine government.

The much- anticipated issue by the country’s Bureau of Treasury (BTr), forms part of its efforts to raise the PHP2.46-trillion ($43.7 billion) total financing requirement this 2024.It’s where thousands of small investors, OFWs included, can earn extra at better-than-bank-deposits rates out of their savings.

When is the next RTB release?

It's set in March. In a statement, the Philippines’ Finance department said the Bureau of the Treasury (BTr) aims to issue the 30th “tranche” of its RTB before the first quarter is out.

Digital finance

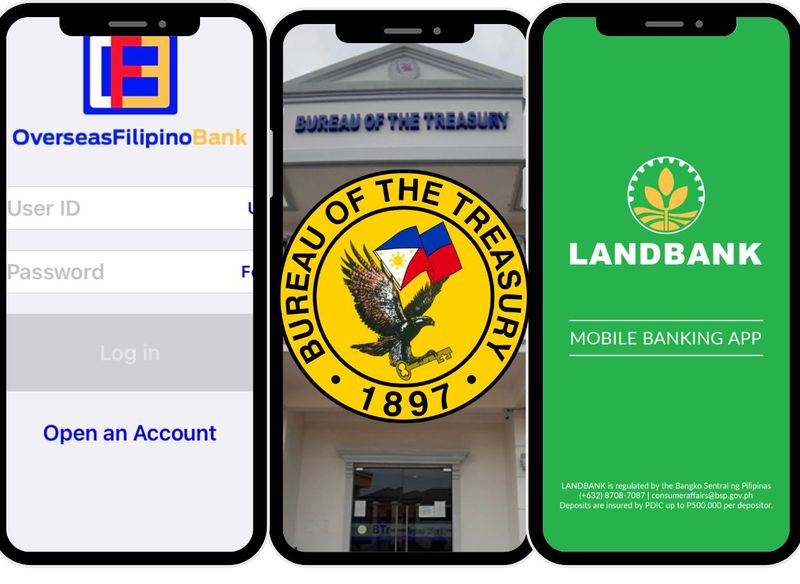

Finance officials here said that to boost “financial inclusion”, the BTr is also looking to engage more digital finance platforms, allowing the BTr to reach a wider investor base. Here’s what we know about the next RTB issue:

What are Treasury bonds?

Treasury Bonds (T-bonds) are low-risk instruments that are direct and unconditional obligations by the government. The bonds (a form of “I owe you” paper, or debt paper) are guaranteed by the taxpayers, the people, so it is the most low-risk investment out there.

What are Philippine Retail Treasury Bonds (RTBs)?

RTBs are fixed-income, medium- to long-term securities issued by the Philippine government to raise funds for various public projects and initiatives. These bonds are specifically tailored for retail investors – meaning individual investors like you and me. They pay interest regularly (known as “interest coupon payments”).

As its name suggests, it allows retail investors to purchase the bonds directly from the government through the Bureau of the Treasury or "authorised selling agents".

How much do I need to invest in RTBs?

In the Philippines’ case, RTBs typically have relatively low denominations – a minimum of Php5,000. This is a deliberate decision by the Finance and Treasury officials, in order to make them accessible to a wide range of investors.

How do I earn from RTBs?

RTBs typically offer a higher fixed interest rate than bank savings (or time deposits) over a predetermined period. It gives investors regular interest payments until maturity at which point they receive the principal investment back.

They pay interest regularly (known as “interest coupon payments”). As per the Philippine Department of Finance (DOF), you can invest your money for 5 years and earn 4.875 per cent per year in the March 2024 RTB issue.

Who can invest?

Those who can invest include:

- Individuals,

- Organizations (cooperatives),

- Fiduciaries (i.e. money managers, financial advisors, bankers, insurance agents, accountants, executors, board members, corporate officers,

- Corporate investors.

An Asian Development Bank (ADB) study shows millennials, 20-40-year-olds, are “active” in these investments, alongside retirees, cooperatives, and OFWs (overseas nationals).

Overall retail bonds represent 37 per cent of the outstanding domestic debt of the Philippines. (Source: Asian Development Bank)

How/where to invest in, or 'subscribe' to RTBs?

If you’re with BPI, BDO, PNB or any of the major Philippines banks, chances are they have staff trained who can guide you on ways to subscribe to an RTB issue.

Aside from the traditional over-the-counter subscription through the authorised agents, you may also use BTr’s Online Ordering Facility via www.treasury.gov.ph.

You may also opt to use mobile banking apps (MBAs), such as Bonds.PH, Land Bank of the Philippines MBA, and the Overseas Filipino Bank MBA.

Note: When you visit your bank branch, it is best to request for assistance by an SEC-licensed securities sales person, if available, or someone tasked to deal with RTBs.

Steps, if subscribing over the counter:

[1] Bring a photocopy of one (1) valid government-issued ID when you visit your local bank branch.

[2] Request for a form (RTB-27).

[3] Fill out all the necessary details and submit the complete documentary requirements.

[4] Give the cash to the branch personnel.

How safe are Treasury bonds?

Treasury Notes and Treasury Bonds are considered the safest, most stable form of investment.

In general, RTBs are considered low-risk investments since they are backed by the full faith and credit of the government. They are often seen as a stable investment option suitable for conservative investors seeking steady income streams.

For governments, retail bonds provide access to stable investments that remain committed for an extended duration, promoting financial stability. Investors typically adopt a buy-and-hold strategy, reducing reliance on foreign portfolio investment and mitigating vulnerability to sudden withdrawals.

Is it a good time to invest in RTBs?

If it suits your financial situation and risk appetite, your decision today to grab RTBs may be akin to planting a tree, with a regular “harvest time” intervals before you get your full money’s worth at the end of 5.5 years.

If you’re an overseas Filipino worker (OFW), or resident Filipino with extra cash to spare (and you won’t need it for your next grocery) it may be a good time to grab some of the upcoming RTBs.

It also gives you the chance to gain steady returns while supporting government projects, including infrastructure and social welfare initiatives, enhancing the nation's economic and social well-being.

What happens next?

The March RTB issuance may be just a potential curtain-raiser offering in the first semester of the year. The BTr has stated it is also looking at various global bond markets, part of its aim to "diversify" funding sources, going forward.

_resources1_16a4a1613d8_small.jpg)