Dubai: When examining the investing, spending, working, and lifestyle habits of billionaires, it becomes apparent that there are some similarities. As most billionaires turned millionaires in their 30s, a common response on how they built their wealth fast is they start saving young, and in chunks!

Dubai prides itself in having more than 68,000 millionaires, over 200 centi-millionaires (with a net worth over $100 million (Dh367 million) and 15 billionaires. So, you can become one of them – and you can do it in just a few years of dedicated effort.

“If there’s a millionaire trade secret, it’s being relentless, and to make riskier-than-usual investments with money you can afford to lose,” said Parthiv Patnaik, a Dubai-based financial planner. “So, while billionaires do start by becoming millionaires in their 30s, you can apply the same strategies at any time in your life.

Turn possibilities to probabilities

“The point is, becoming a millionaire converts those possibilities to probabilities or percentages i.e. yields or return on investments. If you become a millionaire in your 30s, you’ll have those options available to you for most of your life. However, becoming a millionaire is a tough ask.”

As your wealth begins to grow, multiple new business or investment opportunities are at your disposal, which can eventually equip you to relocate to another country or maybe even enable you to retire early. Here we look at what habits billionaires have practised to turn dreams into reality.

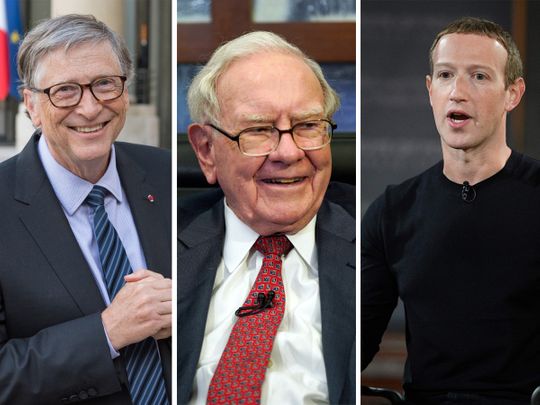

“Be it Warren Buffet, Bill Gates, or Mark Zuckerberg, all billionaires practise discipline when it comes to saving to become a millionaire first, regardless of age,” said Dubai-based financial planner Mirin Raul. “But the reality is those who save, limit it to a comfortable percentage of their income, like 10 per cent.”

Tip #1: Save an uncomfortable amount of your income

Both Raul and Patnaik opined that if you currently save only a comfortable 10 per cent of your income, aim 30-40 per cent higher. “While 10 per cent will help you live well within your means, it’s not realistic for bigger financial goals,” added Raul.

“The more successful you are at that, the easier it will be to commit outsized percentage of your income to savings. A modest household’s income in the UAE is Dh100,000 per year. If you save 30 per cent of your income, you’ll be putting Dh30,000 into savings each year, leaving you with Dh70,000 to live on.

“This means a UAE-based family can set aside nearly Dh6,000 a-month. Even if it means taking more effort with today’s cost of living, there have been several instances where that has still proven possible. A larger percentage should be allocated to savings with a higher income.

“If you earn Dh200,000 per year, saving 50 per cent would move Dh100,000 into savings. If you can save Dh50,000 each year, and invest it at 7 per cent, you’ll cross the million-dollar threshold in 13 years. In other words, get ready to be uncomfortable to be comfortably rich later.”

Tip #2: Debt is a detour on the road to becoming rich

Billionaires often recommend against keeping debt when saving to be a millionaire young. However, realistically speaking, that is not the case.

This is a real variable since people have different levels of debt. “For one individual or couple, it may mean paying off a couple of credit cards. For another, it may be a car loan and multiple credit card debt,” added Patnaik.

“So, while saving to be a millionaire when you’re young and debt-free is comparatively easier, if multiple loans hold you back, there are still options for you – even if it may mean pushing back your retirement plan a few years.”

In such a circumstance, Parthiv and Raul suggested that it’s financially prudent to focus on setting aside a larger chunk of your income to pay off your loans initially, and work towards becoming debt-free in the next few years.

“While you can keep saving on the side, saving after you’re debt-free will minimise unnecessary money going towards your debts’ interest payments, and keep you focused on amassing savings on zero-debt,” noted Raul.

“One of the debt obstacles for a lot of young people is student loan debt. With the average student debt now exceeding Dh35,000, you’ll have your work cut out for you just getting that paid off. Pay it off, along with all other debts. Debt payments reduce the amount of money you’ll have for savings.”

Tip #3: Invest the profits you make from a side hustle

Parthiv and Raul further agreed that another undeniable parallel that can be drawn among billionaire habits is that as you start saving as much money as you can from your salary, the next step is finding ways to make even more money and invest it.

“Although billionaire investors making most of their riches through market investments, if not investing your money right away, you need at least consider a secondary source of income before investing,” noted Raul.

“So, if your goal is to build your wealth you need money from means other than your full-time job, which can be through consulting, building websites, or a blog. Invest all the money you make in your side hustles.

“If it is Dh100 you get from participating in a market research study or Dh10,000 you get for building a website – send it all into your investment account. This way the future value of this extra income will be exponentially greater than spending it today, like being used for any miscellaneous daily expense.”

Tip #4: Invest only in what you're thoroughly confident in

Once you start to make money, with a side hustle and investing the profits, you need to figure out how to maximise the return on your investments.

“While it’s easier to invest in an index fund that tracks the stock market – it’s not recommended to invest it all in one place. Allocate and diversify your investments into assets like gold and bonds too,” added Patnaik. “This improves your chances of better returns.

“It is also often advised that you always allocate 20 per cent of your investment capital towards individual company’s products you use and believe in. It’s a fact that hyper-connected millennials have a perspective on firms and products that prior generations of investors don’t have.

“The stock market tends to favour things that are hip, useful, and essential. To pick a good stock, analyse what everyone else does and monitor social media platforms where investors come together to discuss.”

Final thoughts

The early success of billionaires like, Warren Buffet, Mark Zuckerberg and Bill Gates is certainly not the norm, and on average, it takes self-made billionaires 32 years to make it big, according to global research.

According to the Spectrem Group, which has tracked and polled the richest households for years, “millionaires are conservative with spending and aren’t out buying mink coats and jewellery every day”.

Studies have further showed that majority of millionaires surveyed don’t own BMWs, Mercedes, high-end watches, or suits. Research has also shown about 40 per cent of the ‘rich’ buy cars used.

_resources1_16a4a1613d8_small.jpg)