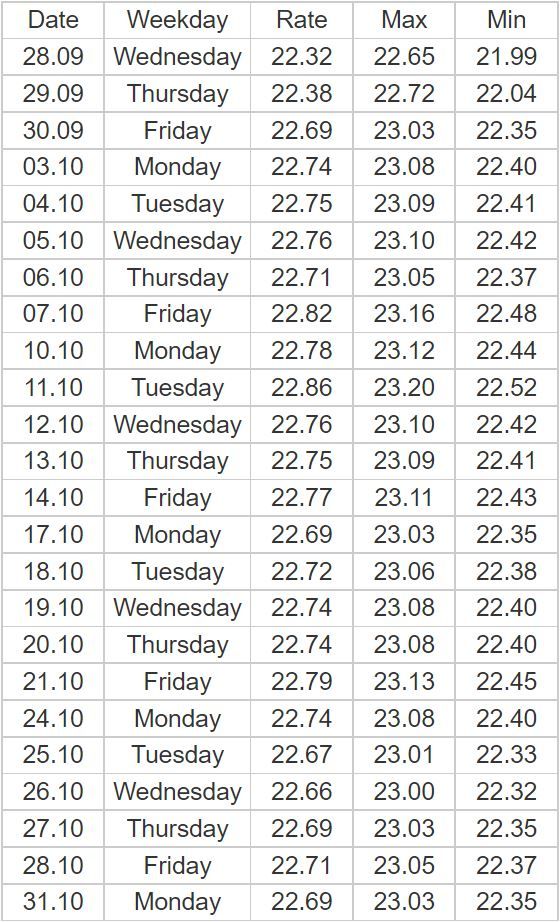

Dubai: Remittances from the UAE were seeing an uptick as several, particularly South Asian currencies, lost a bit of momentum and recorded remittance-beneficial rates in the past few weeks. But will the currency trend continue?

Evidently, yes. The Indian rupee, the Pakistani rupee, and the Philippine peso are expected to weaken in the coming weeks. Here’s how you can take advantage of these remittance-beneficial rates and when. Check the latest forex rates here.

Will currency back home rise or fall?

When it comes to sending money back home, it is vital to know whether it is currently an ideal time to remit. To understand whether it is or isn’t, one should first find out if your currency back home is expected to rise or fall in the days to come.

Here is an analysis of how the aforementioned currencies have been performing and expected to perform in the coming week, to help understand whether remitting money now is profitable or cost-effective, or should you wait it out for a few weeks for a better rate to come along.

If a currency is expected to weaken or depreciate, like the above-mentioned currencies in this instance, it's prudent to take advantage of more remittance-friendly rates after it drops further, rather than now. On the other hand, when it comes to currencies that are expected to appreciate in values, it would be cost-effective to remit now, as the rates would only rise over the near term.

Indian rupee value to drop more soon, hold remittance

The Indian currency has weakened 9.5 per cent so far this year, with the central bank defending the rupee via dollar sales that have depleted its forex reserves to $545 billion from the peak of $642 billion a year ago.

"The central bank should intervene to ensure that a falling currency does not eclipse India's fundamentals," India-based HDFC Bank Chief Economist Abheek Barua wrote in a note this week.

While there might be some benefits of a depreciated currency in closing the trade gap, the damage to the capital account in terms of reduced confidence of investors will outweigh this benefit, he said.

According to Barua, the central bank may need to think of ways to bulk up its forex reserves, should the pool shrink to near $500 billion in the coming months. "More capital is needed at this stage to stabilise the rupee and enable the RBI to replenish its reserves chest," he said.

In July, the RBI had allowed banks to raise foreign currency non-resident deposits at higher costs and permitted foreign investors to buy shorter term local debt as a way to encourage more inflows. Those measures have only helped marginally, analysts say.

It may be time for the central bank to ready other options such as those in 2013 when the rupee came under pressure due to the U.S. Federal Reserve announcing plans to taper bond purchases. It may be time to think yet again of the taper tantrum playbook, subsidize forwards and get lumpy non-resident deposits in, Barua said.

"NRIs are sensitive to India's robust fundamentals and could be persuaded to deposit their dollars in India at attractive rates," he added. So will the currency decline in the weeks to come? Research indicates that the currency will drop, given that the US dollar is seen strengthening in the weeks to come.

Pakistani rupee value to weaken, hold remittance

In Pakistan, the buying rate of the US dollar was currently 235.63 Pakistani rupee (64.15 versus UAE dirham).

According to research, the Pakistani rupee value is expected to depreciate the most to 70.27 in the coming weeka against the UAE dirham, from the current levels.

The Pakistani rupee (PKR) maintained its upward trend against the US dollar for the third trading session in the interbank market on Tuesday. In the early trading session, the local unit appreciated Rs3.02 against the greenback and was trading at Rs234 in the interbank market, The News reported.

During the last three trading sessions, the dollar has depreciated by Rs5.71 PKR against the local unit. Due to the recent decline in the value of the greenback, Pakistan's total debt was reduced by Rs740 billion.

The rupee came close to reaching a record low of 240 against the dollar but was unable to do so after several positive cues.

Philippine Peso to drop more by month-end, remit later

According to research, the value of the Philippine peso is expected to drop to 16.92 against the UAE dirham over the coming weeks, from the current 16 – making it ideal to send money now than later.

The Philippine peso slid to a record low against the US dollar for the fourth straight day, closing at 58.50 pesos on Friday, according to data from the Bankers Association of the Philippines.

The new record breached the 58.49 pesos recorded on Thursday, the tenth time the Philippine currency fell to an all-time low, depreciating by over 13 percent.

The peso weakened following the US Federal Reserve's sharp interest rate increase overnight, which caused the US dollars to rally.

Some analysts have expressed their concerns about a continuing depreciation of the peso due to the "aggressive" monetary policy by the US Fed.

- with inputs from Agencies

_resources1_16a4a1613d8_small.jpg)