Why diamonds are an investor's best friend

Forget gold with its fluctuating price – diamonds are an investor’s best friend, reports Nick Harding

Before the 1960s, marriage customs in Japan had changed little for centuries. They followed Shinto beliefs and weddings were arranged by parents. There was little romance or courtship and engagement rings were not part of the tradition.

Then something altered the Japanese psyche. Advertisers highjacked love in the land of the rising sun and in a carefully planned campaign executed by advertising agency J. Walter Thompson – which had been employed by diamond conglomerate De Beers – framed the nature of romance to a generation of Japanese baby boomers.

The campaign was backed by glossy posters of westernised Japanese couples. The women wore diamond rings and the underlying message was one of progress. Diamonds represented the romance of modernity. It was hugely successful. Before it began in 1967, hardly any Japanese women wore diamond engagement rings but by 1981 around 60 per cent were sporting ‘rocks’. Tradition had been overturned and diamonds were associated with a deep romantic sentimentality. By their association with engagement and marriage, they became an emotional investment.

The Japanese project was carried out after a similar decades-long campaign in America, launched in the late 1930s when diamond prices began to slide. They had failed to rise after the Depression and in Europe, where war was imminent, the market was flat.

De Beers employed New York advertising agency N W Ayer to create a new image for the precious stone.

N W Ayer executives proposed a campaign, which strengthened the link between diamonds, romance, luxury and long-term attachment. Movie stars were given diamonds to wear and stories about high-profile engagements that always stressed the size and price of the gem in the ring were published in stylish magazines.

Advertisements drew comparisons between diamonds and works of art. In just three years this repositioning of the diamond had a marked success. Sales of larger stones increased by 55 per cent. The public had not only been sold gems; they had been sold an idea. N W Ayer said that the campaign had required “the conception of a new form of advertising, which has been widely imitated ever since.

“There was no direct sale to be made. There was no brand name to be impressed on the public mind. There was simply an idea – the eternal emotional value surrounding the diamond”.

The catchphrase ‘A Diamond is Forever’ was coined, and remains in the global consciousness today. It was one of the most astute marketing campaigns of modern history.

‘An emotional investment’

Today, very few diamonds are purchased with the intention of re-selling them. The majority of high-grade polished diamonds are locked up in pieces of jewellery their owners have huge emotional bonds with. With limited resale, diamond prices stay high.

Anan Fakhreddin, CEO of Damas, can vouch for that. “Diamonds are a symbol of status, love and affluence. They have emotional, luxurious and sentimental appeal. Also, diamond jewellery always maintains its high value, so naturally they are hugely appealing to high-net-worth individuals,’’ says Anan.

“The aspect of an ‘emotional investment’ is the reason beautiful jewellery is often passed down through generations.’’

Until the end of the 19th century, diamonds were rare. Each year just a few kilograms were scooped from riverbeds in remote places.

That changed in 1870 when diamonds were discovered in South Africa and mining companies began operations, which exploited lucrative deposits and extracted diamonds from the ground by the tonne.

But the market became flooded and as the value of diamonds relied almost exclusively on their scarcity, prices dropped. Financiers who funded the mining operations realised their investments were threatened and merged to control the trade. De Beers was born and for over a century deftly controlled the price of its commodity. Today the firm is owned by Anglo American and is no longer the biggest player in the market – that accolade belongs to mining giant Alrosa.

Diamonds have never lost their appeal. They continue to be bought in the mature markets of America and Europe and also in the emerging Gulf markets and those of China and India.

Dubai-based John Paul Joy Alukkas, executive director of Joyalukkas Group says, “We are seeing rapid growth in the sale of diamond jewellery compared to gold over the past few years. This could be because gold prices keep fluctuating and hence consumers are a bit wary to buy gold jewellery when gold prices shoot up.

“Also, consumers are attracted to the choice and design options available in diamond jewellery. Even during key Indian festivals we are now seeing a big growth in diamond jewellery sales, which earlier was not the case.’’

‘A universal commodity’

Abdul Salam K P, group executive director of Malabar Gold, agrees. “Diamonds will only gain value over time. One of the reasons for this is because it is a universal commodity. Diamonds can be bought and sold all over the world and the market value of diamonds does not really change from one place to another. Their value will only continue to rise, therefore, you could always hold on to your collection for years before selling it to the highest bidder,’’ he says.

Experts believe the trend in purchasing diamond jewellery will continue, and mining company Rio Tinto Group, the third-biggest producer of rough diamonds in the world, predicts that by 2025 China will surpass the USA as the world’s biggest buyer of diamonds.

In a presentation released to the Australian stock exchange recently Rio Tinto forecast a rise in prices for diamonds over the next decade as demand from China and India continues to soar. Due to a lack of major new discoveries, supply is not expected to increase significantly.

The UAE is set to benefit from any increase in the gem trade. Many wholesalers moved their operations from the historic diamond trading hub of Antwerp to Dubai towards the end of the last decade. In 2007 the number of diamond wholesalers that were part of the Dubai Diamond Exchange went up from the previous year. With prices projected to rise even further, investors are viewing the commodity as a safe bet. Precious metals like gold and silver have often proved safe havens for investment during recessions, and as storm clouds of economic uncertainty continue to roll over Europe and the US, several diamond hedge funds are now being launched.

New York company, IndexIQ, is proposing a diamond-backed exchange-traded fund while Harry Winston, the largest publicly traded diamond company, is also collaborating with a Swiss asset manager on a $250 million (Dh918 million) fund to buy diamonds using money from hedge funds.

Peter Laib, chairman of Diamond Asset Advisors, the Swiss group collaborating with Harry Winston, recently told the Financial Times in London, “After the subprime disaster and with economic uncertainty, investors are looking for low-volatility investments. Diamonds are less volatile, as they’re resistant to speculation by the financial community, so there are no derivatives or tradeable products and no short selling is possible.”

Peter forecasts a 12 per cent annual return on the fund. His optimism is backed by figures that show, on average, polished cut diamonds have increased in price 100 per cent since 2004.

Price rises have varied depending on quality, but half-carat diamonds have risen by 49 per cent since 2001, one-carat diamonds have risen by 88.9 per cent in the same period, and three-carat diamonds have gone up by 238 per cent.

Despite the growing interest in diamond investment funds, Lynette Gould, who is a spokesperson for De Beers, explains that people still predominantly buy them for their sentimental value and she expects consumers to continue doing so in the near future.

“Like many luxury products, diamonds have an intrinsic value. For us, this value is made up of both an emotional and financial investment,” she says.

“Overwhelmingly, consumers who purchase diamonds tell us that it is primarily an emotional purchase, bought to celebrate and commemorate significant milestones in their lives.

“There have been few, if any, dedicated funds launched anywhere for these purposes. Mostly, individuals will buy and build their own collections much like you would a piece of art.”

Anan of Damas is convinced that the artistic appeal of a piece of diamond jewellery increases its value. “The artistic value allows the pieces to sell at premium prices later at auctions or similar events – another reason diamonds make very good investment options,’’ he says.

Bang for your buck

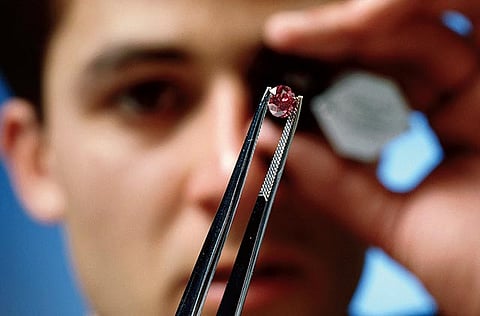

For those looking to buy a diamond purely as an investment, Lynette says rarity and quality are key attributes to consider. Coloured diamonds, or fancies as they are known, are highly sought after and those above two carats are tipped to offer the best returns.

The highest returns seen in the investment market have come from pinks, yellows, blues and greens, and some have even doubled in price in just a few years.

Demand is dictated by the state of the consumer market. Prices are affected by economic booms and by recessions. While prices dropped in 2001 and 2008, rough and polished diamond prices increased again in 2010 and 2011.

Because diamonds are a luxury item, demand is expected to parallel GDP growth. Slower GDP growth around the world, which is now the expectation for the next couple years, particularly in the US and Europe, is a problem for the diamond industry. Lynette says that De Beers expects only modest levels of growth in the diamond jewellery market for the rest of the year with the USA, China, the Arabian Gulf and Japan expected to contribute the bulk of the growth.

“Diamonds remain the ultimate gift of love and, when carefully chosen, can be a smart investment choice. It’s wonderful to have something that has emotional meaning for you, is beautiful to wear and own, but is also a good long-term investment. There are few things in the world that provide all these benefits,” Lynette says.

Traditionally, investors looking at diamonds have faced one main hurdle. It is hard to put a price on a diamond. While commodities like oil and gold have set prices, no two diamonds are the same, so there is no single universal measure for the value of a diamond. Dealers rely instead on the Rapaport Diamond Report, the primary source of diamond price and market information. They also rely on the Rapaport Network, which is the first and world’s largest electronic diamond trading network that currently provides daily diamond listings of 930,000 diamonds worth over $6.2 billion. It has over 7,000 members in 80 countries.

Kevin McElroy from US-based Wyatt Investment Research predicts, “The real coup yet to come into the diamond market is the artificial manufacturers.

“These diamonds are like real mined diamonds in every way except that they’re completely flawless and, soon, will be much, much cheaper to produce.” Some analysts believe these will one day affect prices.

In September Russian officials announced a secret diamond field buried under a Siberian asteroid crater so vast it could supply the global diamond market for the next 3,000 years. Officials have known about the site, which is said to contain ‘trillions of carats’, for several decades, but they kept it secret to protect the profitability of other Russian mines.

But there’s a catch. The diamonds at this site are ‘impact diamonds’, which are used mainly in industry and are lower quality than jewellery-grade gems. They are unlikely to ever grace the fingers of brides-to-be.