Dubai: Saudi banks witnessed an improvement in profitability in the third quarter of 2020 largely driven by higher lending and lower loan loss provisions. However, profitability will come under pressure in 2021.

The combined impact of COVID-19 and oil prices softened profitability and asset quality since the first quarter, according to rating agency Fitch. This has put pressure on asset quality and profitability, and undermined banks’ standalone credit strength.

“We expect corporate default rates to increase as a result of the pandemic and lower economic activity, although some recovery has been observed since the April lockdown,” said Redmond Ramsdale, an analyst at Fitch.

Strong loan growth

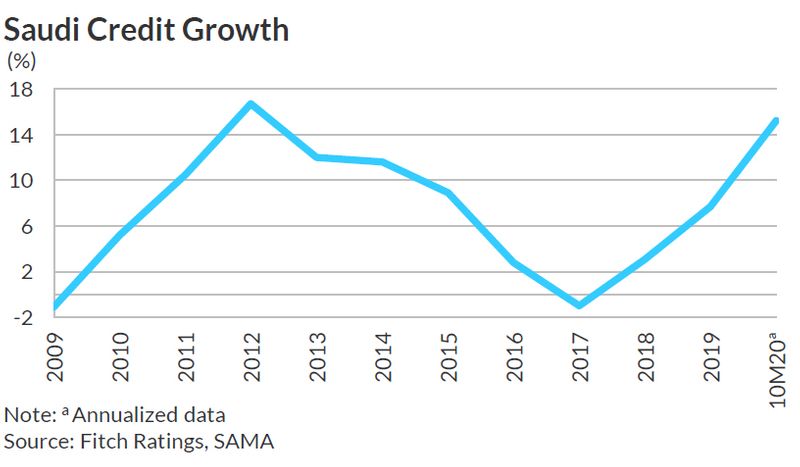

Saudi banks experienced strong loan growth of about 12.7 per cent in the first 10 months of 2020. According to a recent analysis by Alvarez & Marsal (A&M) Saudi Arabia’s Top 10 banks reported an increase in loans and advances, which grew at a faster pace in the third quarter compared to the second. This growth was primarily driven by increased credit uptake in consumer and credit card segment.

“The near-term outlook for Saudi banks looks bearish,” said Asad Ahmed, A&M Managing Director and Head of Middle East Financial Services. “The government’s announcement to cut budget spending by 7.5 per cent in 2021 could have a spillover effect in other sections of economy.”

Late reporting

Fitch analysts see delayed recognition of impairments, a tempering of growth and increasing government fiscal consolidation measures as key risks.

The sector’s asset-quality metrics were stable in the first nine months, supported by government forbearance measures and high credit growth. This will likely be undermined by more corporate defaults but also delayed asset-quality problem recognition from the first quarter of 2021 as government support measures expire. Banks have been building provisions since first quarter 2020 in anticipation of weaker asset quality.

Fitch expects credit quality issues will be less severe at retail-focused banks as almost all financing is to public-sector employees and salary-assigned (repayments are deducted directly from the borrower’s salary). However, this safety net will largely depend on there being no lay-offs in the public sector or an escalation in austerity measures.

Margin pressure

Net interest margin (NIM) of Saudi banks continued to decline substantially, reaching 3.02 per cent in the third quarter, the lowest in several quarters.

Cut in interest rates by the Saudi Central Bank (SAMA) has put pressure on margins, in particular for banks with high proportions of non-interest bearing deposits. Low trade volumes and economic activity also undermine fee income generation.

Capital buffers and liquidity

The sector remains well-capitalised, with an average common equity Tier 1 ratio of 17.8 per cent at end of third quarter. This is among the highest globally and is despite high credit growth and loan impairment charges. The sector’s liquidity has been supported by large government deposits since the first quarter.

Sovereign support

Despite changing the outlook of leading banks to negative, Fitch said Saudi Arabia has the ability to support the sector, given its still large, albeit decreasing, external reserves. It also reflects a track record of support for its banks, irrespective of their size, franchise, funding structure and level of government ownership.