Dubai: The credit profiles of GCC banks are set to weaken due to the coronavirus pandemic and lower oil prices despite unprecedented economic stimulus packages worth hundreds of billions of dollars, according to Fitch Ratings.

All six GCC governments were quick to announce stimulus packages to mitigate the economic impact of the pandemic. The UAE announced $77 billion (Dh282 billion), Saudi Arabia $56.5 billion, Qatar $20.6 billion in addition to government entities having been directed to increase investments in the domestic stock market by $2.75 billion, Oman $20.8 billion Bahrain $11.4 billion and Kuwait $16.5 billion.

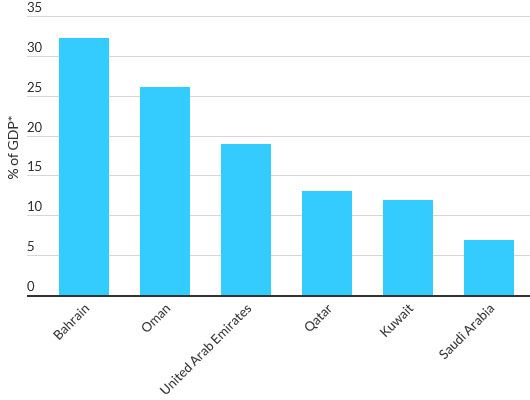

In all, the region’s governments announced a total of more than $200 billion. The vast majority of the stimulus is through monetary and macro-prudential measures. This is over 25 per cent of GDP for Bahrain and Oman, over 15 per cent for the UAE, over 10 per cent for Qatar and Kuwait and 7 per cent for Saudi Arabia.

“GCC countries announced monetary, fiscal and macro-prudential stimulus measures dwarfing any previously seen in the region. These are equivalent to significant proportions of GDP and could be increased if the crisis deepens,” said Fitch said in a report.

Weakenng asset quality

To be able to provide assistance to cushion the impact of the coronavirus, most central banks in the region have relaxed capital and liquidity requirements, and scaled back other lending restrictions. Fitch analysts view these measures as rating-negative as it could lead to weaker underwriting standards and higher risk appetite, and could ultimately result in weaker asset quality.

The rating agency said interest rate cuts and financial aid, such as temporary loan repayment relief, should help the sectors hit hardest by the economic impact of the pandemic, particularly SMEs and the private sector. However, analysts expect the banks’ asset quality to deteriorate as not all borrowers will be able to weather the impact of the sharp economic contraction unscathed.

“We believe the most visible negative outcome of these measures will be pressure on banks’ profitability. While asset quality will weaken, the true extent of loan performance deterioration will be masked by loan deferral programmes and regulatory permission for banks to apply large flexibility in impairment recognition under IFRS 9,” said Redmond Ramsadale, an analyst at Fitch.

Liquidity and capital buffers

If economic disruptions caused by the coronavirus and lower oil prices remain in place into the medium term, asset-quality problems and lower profitability are likely to put downward pressure on currently adequate capital buffers. Liquidity could also come under pressure if GCC sovereigns and government-related entities (GREs) withdraw deposits from the banking system to support themselves, although we do not expect this in the short term.

Fitch analysts believe that profitability will be the first credit metric to visibly weaken. If economic disruption from the pandemic and lower oil prices continues into the medium term, deteriorating asset quality will become more visible and banks’ capital buffers will start to shrink. Liquidity could also come under pressure if GCC sovereigns and government-related entities withdraw deposits from the banking system to support themselves, although we do not expect this in the near term.

Peg to remain intact

Fitch said despite the immense economic pressures from oil prices and COVID-19 outbreak, they believe that currency pegs to the US dollar are likely to remain in place due to strong external buffers. Although these are small in Bahrain, likely to be supported by Saudi if necessary. “Oman remains the most exposed due to large external financing requirements compared with its foreign-exchange reserves, but we still expect the peg to be protected,” Fitch said.

“Most rated GCC banks have relatively strong profitability and a conservative approach to calculating and setting aside loan-loss provisions,” said S&P Global Ratings credit analyst Mohamed Damak.

S&P analysts anticipate banks’ profitability will deteriorate in 2020, because of the dual shock of COVID-19 and the decline in oil prices. This is because financing growth will remain limited, with banks focusing more on preserving their asset-quality indicators than generating new business. Interest margin is also expected to decline, given the reduction in interest rates.

“Overall, we estimate that rated GCC banks could absorb up to a $36 billion shock before starting to deplete their capital base,” Damak.

Some banks have already proactively refinanced some instruments approaching their first call date in 2020, benefiting from the then-supportive market conditions.

“As we see the COVID-19 pandemic and the drop in oil price as a profitability event rather than a capital event, we do not foresee that banks will systematically skip the payment of coupons on their hybrid instruments or write down the principal amount,” stressed Damak.