Huawei to double output of AI chip as Nvidia wavers in China

Huawei aims to win customers in the world’s biggest chip market amid supply chain snags

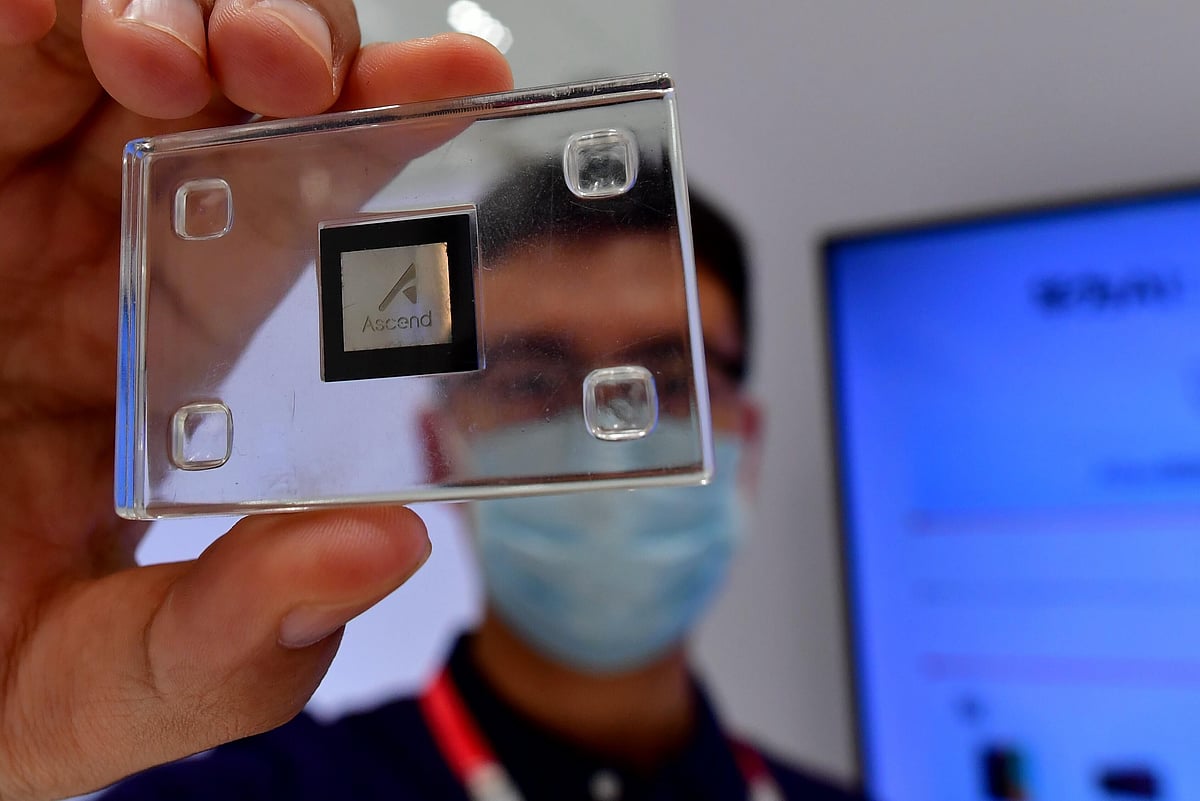

Huawei Technologies Co. is preparing to sharply ramp up production of its most advanced artificial intelligence chips over the next year, aiming to win customers in the world’s biggest semiconductor market while Nvidia Corp. struggles with geopolitical headwinds.

The Chinese company plans to make about 600,000 of its marquee 910C Ascend chips next year, roughly double this year’s level, people familiar with the matter said, asking for anonymity to discuss private information. Huawei had struggled to get those products out the door for much of 2025 because of US sanctions.

Overall, the Shenzhen-based company will raise output for its Ascend product line in 2026 to as many as 1.6 million dies, the people said, describing the basic silicon components that house chip circuitry.

If Huawei can hit those targets, it would represent a technical breakthrough for a company regarded as China’s best hope of weaning itself off the foreign chips that power the world’s No. 2 economy.

It suggests Huawei and main partner Semiconductor Manufacturing International Corp. have found a way to relieve some of the bottlenecks that’ve hindered not just its AI business, but also Beijing’s self-reliance objectives.

The projections for 2025 and 2026 include dies that Huawei has in inventory, as well as internal estimates of yields or the rate of failure during production, the people said.

Shares in SMIC and rival chipmaker Hua Hong Semiconductor Ltd. gained more than 4% in Hong Kong Tuesday, while the broader market stayed largely unchanged.

Chinese companies from Alibaba Group Holding Ltd. to DeepSeek need millions of AI chips to develop and operate AI services. Nvidia alone was estimated to have sold a million H20 chips in 2024.

What Bloomberg Economics says

Huawei’s reported plan to double AI-chip output over the next year suggests China is making real progress in working around US export controls.

Yet the plan also exposes the limitations imposed by US controls: Node development remains stuck at 7 nanometers, and Huawei will continue to rely on stockpiles of foreign high-bandwidth memory amid a lack of domestic production.

From Beijing’s perspective, Huawei’s production expansion represents another move in an ongoing back-and-forth with the West over semiconductor access and self-sufficiency. The priority remains accelerating indigenization of critical technologies while steadily pushing back against Western controls, as per Bloomberg analyst Michael Deng.

In September, Huawei took the unusual step of publicly unveiling its three-year vision for eroding Nvidia’s dominance.

That was a break in tradition for the company, which has thus far preferred to keep its plans and capabilities secret.

Rotating Chairman Eric Xu introduced an array of Ascend chips — the 950, 960 and 970 — slated for rollout in phases up till 2028.

They’re the natural evolution of the years-old 910 series, which remains Huawei’s cash cow for now, the people said. Company representatives didn’t respond to an email seeking comment for this article.

Accelerator developer

Huawei leads a wave of Chinese chip firms racing to develop accelerators while Nvidia remains mostly shut out of the market by government controls. Beijing has blocked or discouraged Chinese use because of security concerns.

Nvidia co-founder Jensen Huang has sought to reassure the Chinese of his products’ safety, but it’s not clear when — or if — that will happen. The company said on its most recent earnings call it didn’t record any sales of the H20 — a model tailored for China — in the last quarter.

While there have been reports that Chinese companies are trying to triple their overall semiconductor production next year, that target is unrealistic, the people said.

One issue is that production yields, or the percentage of chips that are usable once they come off the assembly line, are underwhelming, they said.

Shortfall

Huawei’s current top-of-the-line AI processor boxes two dies into one chipset — a feat of advanced packaging that in theory makes the product more powerful.

But the process is challenging, and partly explains a persistent supply shortage that’s allowed rivals like Cambricon Technologies Corp. to make up the shortfall, the people said.

But Huawei was able to meaningfully improve output over the summer, the people added. Over the past year, signs have emerged of Chinese firms including Shanghai Micro Electronics Equipment Group Co. making major strides in gear technology.

Huawei now plans to introduce a chip to follow the 910C — originally dubbed the 910D by the industry — in late 2026, the people said.

Radical design

The company is targeting 100,000 units of the new chipset, which comes with a more radical design that squeezes four dies into one chipset, they added. Huawei said this month it’s targeting a late-2026 release for a chip it calls the 950DT.

In total, Huawei will distribute roughly 1.6 million dies across two types of chips next year, versus up to 1 million dies in 2025, the people said.

Huawei told customers earlier this year it’s ready to sell 200,000 Ascend 910Cs by year’s end in addition to about 100,000 units reserved for its own cloud computing unit and potentially some state-linked projects, the people said.

For now, Huawei’s AI chips lag Nvidia’s in single-chip performance. The upcoming Ascend 950 can only offer 6% the performance of Nvidia’s next-generation VR200 superchip, Bernstein estimates.

Inferencing chips

Up until now, Huawei’s major customers including Alibaba and Tencent Holdings Ltd. have largely used its best semiconductors only for inferencing, or running AI models after they are trained.

With help from SMIC, Huawei is able to produce dies using aging 7-nanometer technology. The dies for the 910 product line are made with an enhanced version of SMIC’s 7nm technique. In comparison, Nvidia’s latest Blackwell-architecture GPUs are produced at 4nm nodes by Taiwan Semiconductor Manufacturing Co. — roughly two generations ahead.

As a wild card, Huawei is exploring a revamped next-generation Ascend chip beyond the announced models, slated for an even more-enhanced 7nm SMIC line. The new chip could be powerful enough to train AI algorithms for major clients, not just operate them, according to a person with direct knowledge.

What Bloomberg Intelligence Says

The doubling of production of Huawei’s marque AI accelerator chip in 2026 could help ease the semiconductor bottleneck at Alibaba, Tencent and Baidu. An unconfirmed report from Bloomberg News stated that Huawei plans to approximately double production of its 910C Ascend chip next year to 600,000 units. The plan casts further doubt on Nvidia’s route to market in China, which is doubling down on its goal to achieve technological self-sufficiency.

- Robert Lea and Jasmine Lyu, analysts

But technical challenges in manufacturing could push the commercialisation of that product to 2027 or later, the person said. Huawei plans to roll out a chip it calls the 960 around that timeframe and another it’s christened the 970 in 2028, the company said in its public presentation earlier this month.

This month, Xu presented a range of solutions to that technology ceiling: brute force, networking, and policy support. One technique he outlined lets Huawei link as many as 15,488 of its Ascend-branded AI chips using self-developed UnifiedBus interconnect protocol, a new technology also formally unveiled the same day.

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox

Network Links

GN StoreDownload our app

© Al Nisr Publishing LLC 2026. All rights reserved.