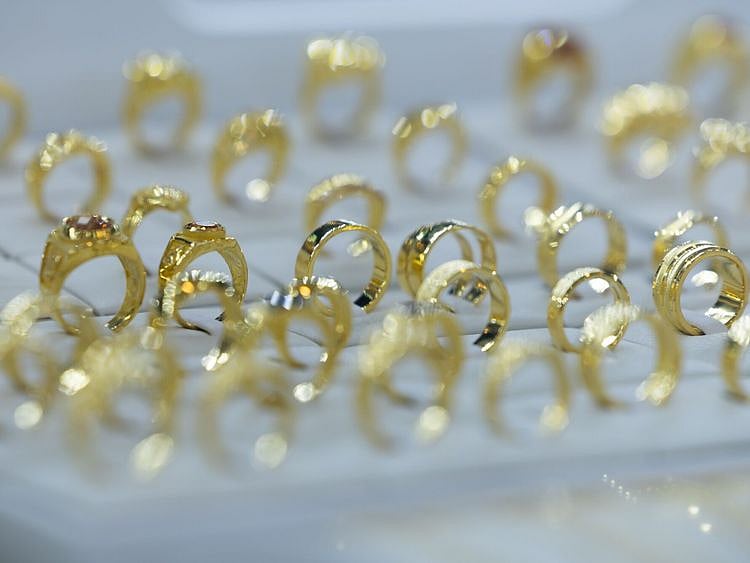

Gold hits 3-month peak as investors take cover from Middle East risks

Markets are expecting the Fed to keep rates on hold at its policy meeting next month

Dubai: Gold climbed to a three-month peak on Friday, en route to a second straight weekly rise, as fears of a further escalation in the Middle East conflict bolstered safe-haven demand.

Spot gold was up 0.4 per cent at $1,980.80 per ounce by 1143 GMT, after hitting its highest since July 20. US gold futures added 0.6 per cent to $1,992.50.

“There’s an enormous amount of uncertainty around Israel and Gaza at the minute, and two days can feel like a very long time under the circumstances. So (there are) safe-haven flows and risk aversion going into the weekend; I don’t think that would be a surprise to anyone,” said Craig Erlam, senior markets analyst at OANDA.

Israel levelled a northern Gaza district on Friday and ordered the evacuation of the biggest Israeli town near the Lebanese border, as it made clear that a command to invade Gaza was expected soon.

Gold has risen 2.5 per cent this week, and added nearly $150 since the onset of the conflict.

Gold was also supported “as fears of another Fed rate hike in 2023 subside,” Fitch Solutions said in a note, forecasting prices to average $1,950 an ounce this year.

Higher interest rates raise the opportunity cost of holding gold.

Markets are widely expecting the Fed to keep rates on hold at its policy meeting next month, according to the CME FedWatch tool.

Spot gold is expected to extend gains into a range of $1,998-$2,010 per ounce, as it has broken a resistance at $1,972, according to Reuters technical analyst Wang Tao.

Spot silver rose 0.4 per cent to $23.13 per ounce, platinum gained 0.8 per cent to $897.45. Both were set for their second consecutive weekly rise.

Palladium lost 0.7 per cent to $1,106.21, as it headed for its fourth straight weekly decline.

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox

Network Links

GN StoreDownload our app

© Al Nisr Publishing LLC 2025. All rights reserved.