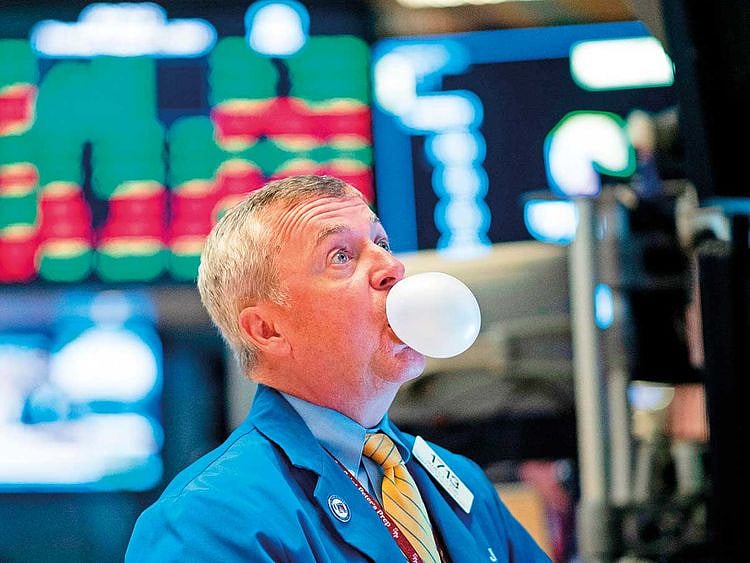

UAE bourses join global sell-off as Fed turns a hawk

The US Fed cut its Fed fund rates by 25 basis points, calling it a mid-cycle adjustment

Dubai: UAE indices witnessed a sell-off joining the world peers as US Federal Reserve chief hinted that they are not starting with a rate cutting cycle, surprising traders who were expecting a dovish tone.

The US central bank cut its Fed fund rates by 25 basis points, calling it a mid-cycle adjustment, surprising many of the analysts who were expecting a wider cut in Fed funds rate. This hawkish tone resulted in the dollar touching its highest level in two years, and a 1 per cent decline in gold.

Surprise move

The Fed’s hawkish tone resulted in the dollar touching its highest level in two years, and a 1 per cent decline in gold.

“Though yesterday’s 25 basis points rate cut was largely in line with expectations, market participants perceived Fed Chair Jerome Powell’s press conference as less dovish than expected. Powell said that the Fed’s first rate cut since 2008 was designed to insure against downside risks rather than mark the start of a long cycle of policy easing. Consequently, equity markets fell in response to likelihood of fewer rate cuts ahead than expected earlier,” Anita Yadav, Senior Director — Head of Fixed Income Research at Emirates NBD, told Gulf News.

The Dubai Financial Market general index closed 0.62 per cent lower at 2,900.39, reversing from its strong trend. The index has gained more than 9 per cent after it breached the 50-day moving average. The Abu Dhabi Securities Exchange general index ended 1.65 per cent lower at 5,230.22. The MSCI Emerging Market Index was 0.95 per cent lower at 1,027.18.

Futures on the Dow Jones Industrial Average futures bounced back after witnessing sharp decline. Dow futures was up 0.02 per cent to be at 26,860. The S&P 500 index fell more than 1 per cent to 2,980.38, its sharpest daily fall since May 31.

On Thursday, stocks wobbled after the rate cut, and witnessed sharp declines after the Fed chief Powell indicated a slower approach to the rate cuts.

“The trick now is for the Fed to stick to their guns. You could make the case that the US economic data warranted a cut to interest rates at this point, especially considering risks to the outlook,” James McCann, Aberdeen Standard Investments’ Senior Economist said.

As far as the impact on the local bond is concerned, Yadav does not see any incremental benefits to bond prices due to rate cuts.

“Falling US rates are good for dollar denominated bonds as lower benchmark yields generally equates to higher bond prices, assuming that credit spreads remain unchanged. However, expectation of circa three rate cuts this year is already priced-in,” she said.

Analysts say yield differential between developed and emerging economies may result in carry trade into emerging markets, where yields are higher.

“EM securities have been well bid in recent weeks as investors hunt for yield and this trend is expected to continue for some more time, at least until corporate defaults begin to emerge on the back of slower global growth,” Yadav said.

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox

Network Links

GN StoreDownload our app

© Al Nisr Publishing LLC 2026. All rights reserved.