Dubai: The IPO season is back in the UAE with Investcorp Capital set to float on the ADX. Part of the Bahrain headquartered fund manager Investcorp - one of the legacy names in the Gulf's financial sector - the IPO will see 643 million ordinary shares being issued with a nominal value of $0.5 (or Dh1.84) each.

This represents around 29.34 per cent of the company's issued share capital post-IPO. These are the dates investors should be looking at:

The final offer price per offer share will be determined after the bookbuilding process carried out during the second tranche.

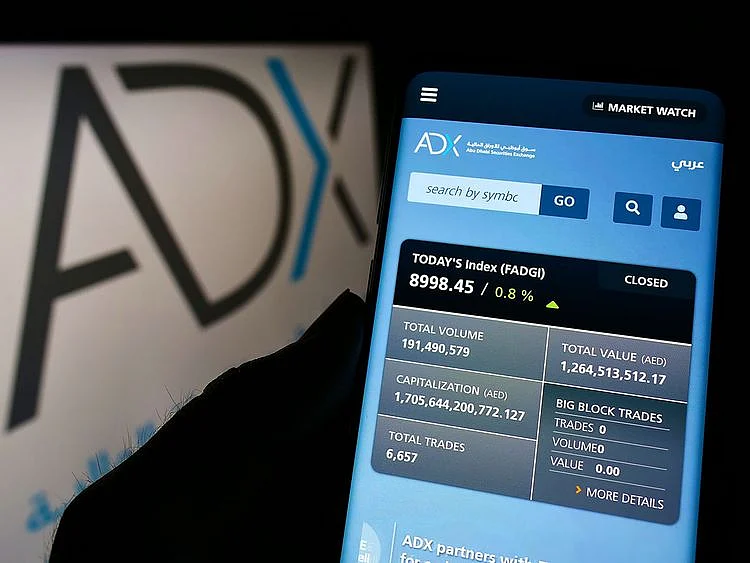

The ADX is down 8 per cent year-to-date, much of which after how events panned out since the start of the Israel-Hamas conflict on October 7. ADX had seen some major listings in the early half of the year, with ADNOC Gas and Drilling leading the way, as have the Group 42 affiliated AI entities Bayanat and presight.

Also Read

Saudi Arabian water treatment firm Miahona considers IPOPIF-backed medical procurement firm Nupco plans Saudi IPOThat Investcorp Capital had listing plans for the UAE had been talked about in the industry circles for some time. Plus, given the situation unfolding in the region, the IPO will give an insight into investor sentiments, analysts say.

Also, Investcorp has the legacy to bank on - and that's something Investcorp Capital will be tapping into. The parent entity has assets under management of around $50 billion.

8% dividend

For the financial year ending June 2024, Investcorp Capital expects to pay semi-annual cash dividends of at least 8 per cent based on the total Net Asset Exposure of $1.235 billion (Dh4.536 billion) as at July 1, 2023. And increased by the primary proceeds raised from the IPO. The semi-annual dividend payments are expected in February and October of each year.

“For more than 40 years, Investcorp has been a leading name in alternative asset management," said Timothy Mattar, CEO of Investcorp Capital. And help it be 'at the forefront of some of the most innovative and successful deals across corporate investments, global credit, real estate, strategic capital, insurance asset management, infrastructure and absolute return investments.

"Today’s ITF (intention to float) announcement, and Investcorp Capital’s subsequent listing on the ADX, will build on the established track record of Investcorp and give investors an opportunity to take advantage of this presence and access to a portfolio of high-quality private market investments that are expected to deliver consistent, risk-adjusted returns.

5 IPO's so far in UAE - and Investcorp Capital makes it 6

Across ADX and DFM, there have been five listings year-to-date, with ADNOC Gas' being the biggest by some distance. The others on ADX are ADNOC Drilling, Bayanat and presight. On DFM, Al Ansari Financial Services made a splash with its float.

Signing up as 'cornerstone investor'

There is already a 'cornerstone investor' agreement with IVC Strategic Investment Company, by which it will put up around $250 million to the IPO.

"Investcorp Capital marks the return of IPOs to the UAE capital markets - which has seen $3.95 billion raised this year - and all of which have been high levels of investor demand," said Sameer Lakhani, Managing Director of Global Capital Partners.

"Whilst the offer is catered for more institutional investors, it allows access to a premier investment management company with regional and international private and public markets."

Investcorp Capital plans

The company's investment landscape spans real estate (spanning continents), global credit markets and a third prong, which it defines as 'strategic capital' opportunities. (The latter opportunities involve acquiring 'minority interests in established mid-sized alternative asset managers and high quality firms with potential for growth'.

"With the support of our four decades of alternative asset management expertise that have allowed Investcorp to grow to approximately $50 billion AUM (including assets managed by third-parties) and our global presence, Investcorp Capital is well-positioned to provide a unique investment opportunity and attractive risk adjusted returns," said Mohammed Alardhi, Executive Chairman of Investcorp Group.

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox

Network Links

GN StoreDownload our app

© Al Nisr Publishing LLC 2025. All rights reserved.