Mumbai: The Adani Group will probably drop plans to sell about $500 million of bonds abroad, the Economic Times reported, citing two people with knowledge of the matter that it didn’t name.

The group will look into other ways to refinance the first tranche of $4.5 billion of debt it used to buy ACC and Ambuja Cements Ltd., according to the report. The options include using internal accruals, it said.

Adani raised the debt last year via 14 global lenders, led by Standard Chartered Plc, Deutsche Bank AG and Barclays Plc, the Economic Times said.

An email sent to the Adani Group seeking comment wasn’t immediately answered, according to the report.

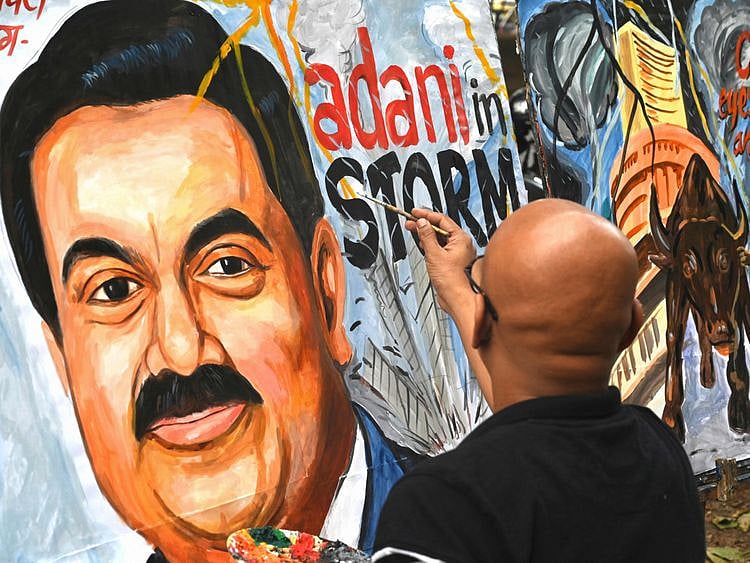

The Adani Group has been thrown into turmoil after after fraud allegations by US short-seller Hindenburg Research.

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox

Network Links

GN StoreDownload our app

© Al Nisr Publishing LLC 2026. All rights reserved.