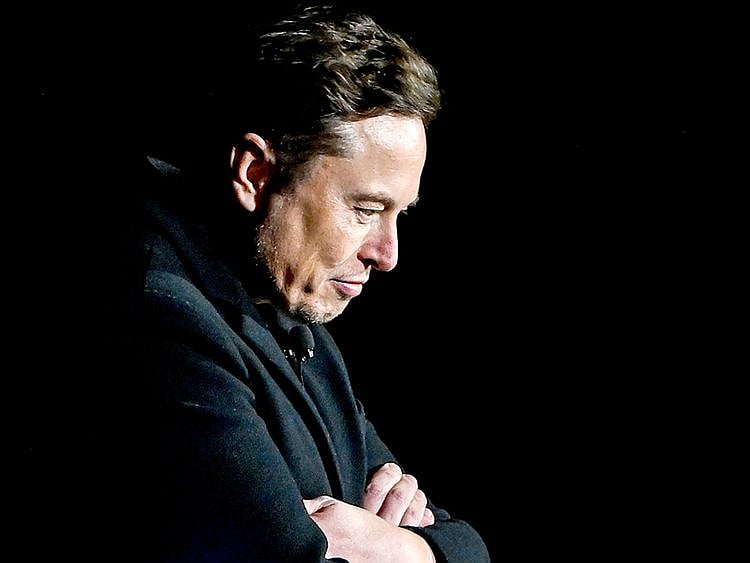

Billion dollar pay: Musk under fire for $55 billion compensation package to run Tesla Inc.

Musk draws minimum wage as a salary, his real compensation is tied to stock

Elon Musk told a Delaware judge he had no role in setting up his $55 billion pay deal to run Tesla Inc. in 2018 and that he was focused instead on solving the complex problem of creating a sustainable electric-vehicle company.

"I do not have any understanding of the internal processes by which this compensation structure was obtained," Musk said during the third day of trial over a lawsuit by a Tesla investor who claims his compensation was excessive and should be returned to the company.

Musk, the world's richest person, said he never discussed his compensation with board members or dictate the terms of the deal.

End up owning 10%

However, court filings in the case show the entrepreneur was asked in a text by his friend Ira Ehrenpreis, a Tesla board member, on April 8, 2017, about how to structure his future compensation. Musk replied that he should end up "owning 10 percent of the company" in a performance plan built around a progression of targets that would each grant him 1 per cent of Tesla's outstanding shares, filings show. As Musk later mused to one of his co-founders in an email, he was "planning on something really crazy, but also high risk."

Delaware Chancery Judge Kathaleen St. J. McCormick is hearing evidence in the case and will decide whether Musk should be forced to return stock-options awarded under the pay package to Tesla.

Part-Time CEO

Richard Tornetta - who owns nine shares of Tesla - claims in his lawsuit that the board failed to exercise independence from Musk as it drew up a new pay package in 2018 for its chief executive officer. Tornetta said the board lavished the world's largest compensation plan on a part-time leader who also runs other companies he founded, including his Space Exploration Technologies Corp., an aeronautical start-up, and The Boring Co., a tunneling business.

And just last month, Musk acquired Twitter Inc. for $44 billion after abandoning a four-month legal fight to get out of the deal. Since taking control of the social-media platform, he's slashed its workforce, changed policies and been confronted with an advertising slump that prompted him to say bankruptcy was a possibility if the company didn't start generating more cash.

Not influenced by ties to Musk

But Tesla directors have defended the pay agreement despite his other business interests. They claim they weren't influenced by their ties to Musk and said the payout motivated the mercurial billionaire to bring his A-game to spur Tesla's growth.

During his court testimony, Musk said he was a reluctant chief executive for Tesla in 2017 and was spending almost 100 per cent of his time on ramping up production of the company's Model 3 mass-market vehicle.

"The probability of survival was extremely low," Musk said, adding that hedge funds had "good reason" to make Tesla the most-shorted US stock ever.

The case is Tornetta v. Musk, 2018-0408, Delaware Chancery Court (Wilmington).

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox

Network Links

GN StoreDownload our app

© Al Nisr Publishing LLC 2026. All rights reserved.