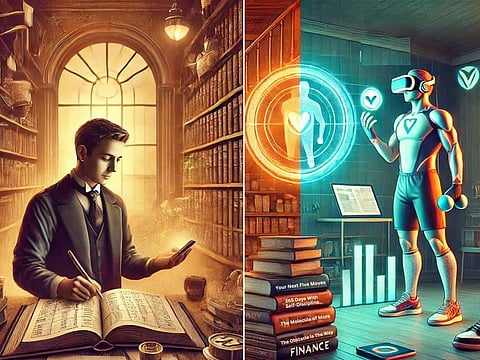

Old habit vs new habit in 2025: Simple rule that builds empires

It’s not just about money — it's paying attention, and changing certain habits

Money is not just about money itself. It's about the body and the mind, too.

What if the secret to wealth wasn’t earning more? What if it is doing something radically counterintuitive with what you already have?

The year 2025 could be a good time to start, if you hadn't done it already.

The world’s richest people live by one golden rule: Pay yourself first. Sounds simple, doesn’t it?

Yet, most people struggle to grasp its true power. And it's not really about money; it's about paying attention.

The vicious cycle of “what’s left”

Here’s the devastating truth: Most people approach money backward.

They pay their bills, buy their groceries, and cover every expense — and then, they look at what’s left to save.

Spoiler: there’s almost never anything left.

This is why so many live paycheck to paycheck, trapped in a relentless cycle of stress and survival.

Think, and act, differently

The wealthy don’t leave savings to chance. Instead, they treat saving as sacred. Before they pay a single bill, before they even think about spending, they pay themselves first.

The first “expense” on their list is their future self.

The power of automation

Now, here’s the real game-changer: They automate it.

No reliance on willpower, no second-guessing, no “I’ll do it later.”

The moment their paycheck lands, money flows automatically into savings and investments. It’s invisible, effortless, relentless. In other words – systematic.

And here’s the magic:

The shift that changes everything

This isn’t just about saving — it’s about thinking like an investor, not a consumer. This is the secret sauce of the wealthy.

Every amount becomes a soldier in your wealth army, working tirelessly for one of three missions:

Pay yourself first: A step-by-step guide

Ready to join the ranks of the financially free? Here’s your roadmap:

Divide and conquer: Your accounts for wealth

To make this work, you need a system. Different accounts serve different goals:

Emergency fund: For unexpected expenses (3–6 months of living costs).

Investment account: For long-term growth (stocks, ETFs, or mutual funds).

Retirement fund: For your future self.

Each account plays a vital role in building a fortress of financial security.

The inevitable path to wealth

Here’s the best part: Once you set this up, it’s automatic.

You don’t have to think about it. Your wealth grows while you sleep.

As your income increases, resist lifestyle inflation (avoid increasing expenses proportionally), you raise your savings rate, which helps you accelerate financial progress.

Paying yourself first transforms your financial future from fragile to unshakable. It’s not about making more — it’s about keeping and growing what you make.

This is how financial freedom is built. And it starts with one simple habit: Pay yourself first.

Adopt a long-term perspective

Celebrate milestones: Acknowledge and reward yourself for reaching savings goals (by saving more!). Positive reinforcement makes the habit more sustainable.

When you focus on the rewards of financial security and freedom rather than short-term gratification, it reinforces the pay-yourself-first habit.

By paying yourself first, you create a financial foundation that supports your goals, reduces stress, and builds wealth over time.

The wealthy know something profound: Savings aren’t an expense. They’re an investment in yourself.

When you pay yourself first, you’re not just saving — you’re buying shares in your own success.

This approach needs (demands) a change of heart and mind — and habits. It requires discipline. But the rewards are life-changing.

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox