Dubai: Wouldn’t it be great if your car insurance, car repairs, roadside assistance, and fees were all included in one convenient monthly payment? Car subscriptions are widely debated as an alternative to leasing one, but only if costs are overlooked. Let’s delve deeper..

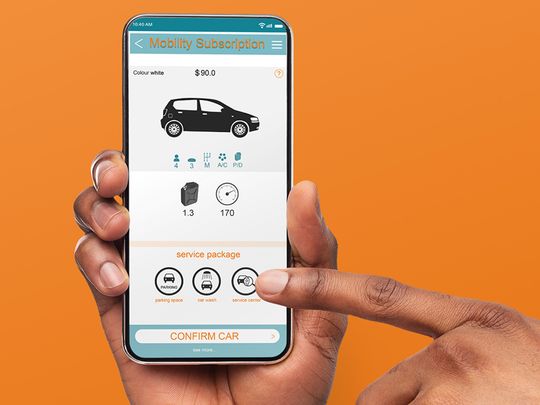

Car subscription services are an increasingly popular alternative to leasing now, providing the use of a car for an all-inclusive monthly fee, which usually covers insurance, maintenance and roadside assistance. But are the costs that come with it make it a financially prudent choice?

“Car subscriptions are fitting right in at a time when a younger generation of users prefer 'on-demand' mobility than buy a car,” said Jacob Koshy, a Dubai-based automotive analyst specialising in retail pricing.

“Globally, research shows that the car subscription category could end up representing 40 per cent of all new car sales and grow into a $40 billion (Dh147 billion) market of its own. And the numbers are only set to rise even further!”

UAE car subscriptions are tracking global trends

Digital platforms offering monthly car subscriptions and dealerships in the UAE have been working together to latch on to a trend picking up some serious momentum in the coming year, said Ibrahim Riba, a senior salesman at an Abu Dhabi-based car dealership that lately branched into subscriptions.

“By offering car subscriptions to a digital savvy generation, the providers who offer the service are trying to overtake the traditional car rental market – as well as offer another option to residents who have been using ride-hailing services via apps,” Riba added.

In some key markets of Europe and different pockets of the car rental and leasing industry worldwide, carmakers have directly gotten into the car subscription business as individual ownership rates come down significantly.

But at the end of the day, isn’t renting a car and subscribing for one serve the same purpose, as far as the user is concerned? Not necessarily. The main difference between a car subscription and traditional rental is the duration.

Car rental firms try to lock customers to the same car for longer periods. With a subscription, you can swap your car every 30 days. Also, the car you subscribe to is the exact vehicle you will receive. So you not only choose a model, but also the colour, trim (version or model) and other specs.

Stand to benefit from car subscription services?

“If you do choose to go the car subscription route, you would primarily stand to benefit from the fact that such subscription services is the all-inclusive monthly payment that consolidates the usual costs of owning or leasing a car. This eases the stress of budgeting your costs,” added Koshy.

“Some subscription services offer all-inclusive packages so you can consolidate all of your auto-related expenses in one place. You still have to cover the cost of fuel and pay a Dh500-Dh1,000 deductible if you’re ever involved in an accident, but that monthly price you pay is all inclusive.”

As the convenience comes at a price, you pay as much as Dh1,900 per month for a luxury car or as little as Dh400 per month for a small, low-cost car. Additionally, most subscriptions come with the convenience of vehicle delivery and pickup, so you never have to leave your home to swap vehicles.

“A notable perk of some higher-end car subscription services is the ability to swap vehicles on an unlimited basis, giving you the freedom to choose the car you want and the length of time you want to drive it,” added Riba. So subscriptions help drivers who get easily bored with the car they drive.

“Also, this doesn’t account for the fee to join a program, which is typically a few hundred dirhams at least. Additionally, many of the more affordable programs have monthly mileage restrictions that you must abide by and don’t give you the freedom to change cars on a whim.”

Key takeaways

Here are Koshy’s top takeaways to what should affect your bottom line as to whether or not you should opt for a car subscription service:

• Car subscriptions are primarily suitable for select groups of people, like those who want to change cars more frequently, those who need a car in a hurry, and those who will only be in a particular location for a brief period of time.

• As with car ownership, the nicer and newer the car is, the more expensive it’ll be to borrow it through a subscription program. As tempting as it might be, don’t get carried away with upgrading to newer cars all the time, as this can drive up your lifestyle costs.

• So, is a car subscription really a preferable alternative to taking out loans for a depreciating asset like a car? While the answer depends on how often you drive, what type of car you want, and whether you value convenience over affordability, here’s your verdict.

Verdict: Is it financially prudent to join a car subscription service?

If you have the necessary disposable income and as Koshy puts it, “the heart of an enthusiast”, a subscription service can make sense. Even Riba agrees. “You can continuously upgrade to the latest models or swap vehicles as you please.

“But if affordability and practicability are vital to you, you’re better off leasing a vehicle because it’s highly likely that you’ll pay a significant amount less with a lease. In other words, leasing a car would be much more affordable than subscribing to a car service when factoring in long-term costs.”

_resources1_16a4a1613d8_small.jpg)