Highlights

As Indian expats living in the UAE, we always excitedly plan for our parents’ annual trips to Dubai usually around winter. The planning involves buying air tickets, tourist visas and importantly a decent travel insurance for any medical emergency. Just one year, in 2019, we mistakenly struck off travel insurance from our to-buy list and it cost us heavily – financially and mentally.

We were looking forward to the winter of 2019 excitedly planning the annual visits of my parents and parents-in-law. They were scheduled to visit us for a couple of months. Like every year we carefully planned all details maintaining a record in a specific folder. It included things like air tickets, tourist visas and a decent travel insurance (usually as add-on with the visas at an extra fee) for any medical emergency. We also considered smaller details like proofing the house as much as possible with anti-skid floor mats to prevent any possible accident. However, that year for some reason (not financial) we mistakenly struck off travel insurance from our to-buy list. While my parents decided to get their travel insurance from India, my parents-in-law did not.

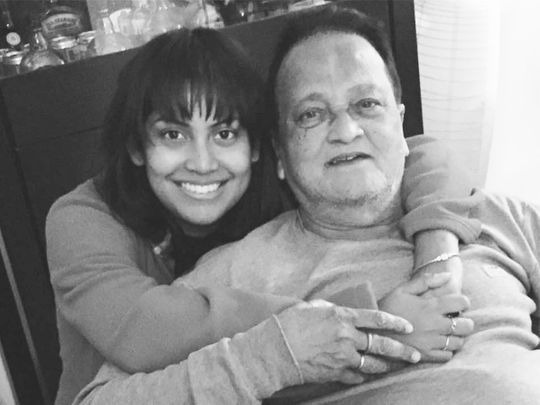

My father-in-law's condition stabilised after suffering from heart failure, but in 15 days we incurred a Dh100,000-plus bill.

Third day into their trip, my father-in-law who has pre-existing medical conditions suffered from congestive cardiac failure and had to be hospitalised. The paramedics and my father who is a doctor himself said there was not enough time to take him to a government hospital, the nearest one at least 45 minutes away. We had to take him to a hospital within 20 minutes distance from our residence leaving private hospital as the only option. His condition stabilised but in 15 days we incurred a Dh100,000-plus bill.

Since many families like us bring their parents to the UAE for visits on tourist visas here are some things to consider as part of their travel plan.

A comprehensive medical insurance is a must

A comprehensive medical insurance tops the list. There is an option to buy travel insurance along with a 90-day tourist visa in the UAE for Dh850 (current price). The most recent 90-day tourist visa and travel insurance that we purchased for my parents in November includes up to $5,500 (Dh20,000+) of accidental and sickness medical reimbursement. In addition, there is up to $2,750 (Dh10,000+) coverage each for accidental death and permanent disablement and repatriation of mortal remains.

A comprehensive medical insurance tops the list while inviting parents to visit you in the UAE. There is an option to buy travel insurance along with a 90-day tourist visa in the UAE for Dh850 (current price).

It might be a good idea to get extra coverage with an additional insurance. For example, in India a comprehensive plan from one of the leading insurance companies offers a coverage of $500,000 (Dh1.8 million) for those aged up to 64 years and $50,000 (roughly Dh184,000) for 75 years at a premium of approximately INR20,000 (around Dh1,000) each. The applicable covers include accident and sickness related medical expenses, accident and disability benefit, baggage delay, trip cancellation, missed connection, flight delay and more.

However, while buying a travel insurance especially from the country of origin its crucial to understand the terms and conditions clearly. In 2018 despite having a decent travel insurance from India we still had to pay upwards of Dh600 for my mother’s eye check-up in a private hospital that was not reimbursed by the insurance company. Also, it’s important to bear in mind that in case of two travel insurance policies, each insurer will only pay their share of the claim.

Create a sheet with a breakup of emergency expenses

After the medical emergency in 2019 we have realised that maintaining an excel sheet with a breakup of probable expenses can save the additional stress of planning finances during a crisis. For those who have parents with pre-existing conditions such a sheet can help in planning finances in advance keeping enough buffer for any unforeseen emergency.

For those who have parents with pre-existing health conditions tracking costs on a sheet can help in planning finances in advance, keeping enough buffer for any unforeseen emergency.

For example, should the need arise factor in the cost of hiring a medically trained caregiver. Here’s a specimen of hourly rates [in 2019] for hiring a nurse from an authorised agency.

We had also checked the cost of flying back the patient in an air ambulance. It was exorbitant and since there was no medical benefits of treating in the home country, we decided to get my father-in-law treated here. However, in some cases if there is a comprehensive medical insurance in the home country the flying back option could be explored.

Even the travel back to the home country must be carefully planned. In case of unwell passengers, a discharge note from the hospital and prior request for things like oxygen have to be made to the airline. In our case, the flight back cost us over Dh20,000 for four tickets due to last-minute booking and specific requirements to prevent further complications. It’s prudent to keep aside some emergency fund for such crises.

Even the travel back to the home country must be carefully planned. In case of unwell passengers, a discharge note from the hospital and prior request for things like oxygen have to be made to the airline.

An important thing to note is during my father-in-law’s 15-day stay at a private hospital after he was slightly stabilised, we tried the option to shift him to a government hospital but realised it’s a difficult proposition unless done in the first place. In 2013 a similar accident had happened when my father-in-law fainted on the road and was immediately rushed to a government hospital. Even after a week of hospital stay and tests including MRI, CT scan and Ultrasound we had to pay roughly Dh3,500. The choice of hospital, thus, makes a huge difference if there is an option.

Factor in other details

Alongside the above details there are a few more things to factor in. In 2018 my mother fell on the eve of their travel and hurt her head requiring stitches. We had to reschedule their flight, paying upwards of Dh1,800 (for two tickets) since less than 12 hours was left from the flight departure. On their arrival, her stitches had to be removed for which we paid roughly Dh1,600 in a private hospital. Although outpatient this fell under procedure. Later an ear infection led to a couple of more hospital visits costing Dh500-plus each time.

When older parents visit it is always advisable to factor in some extra costs for any unforeseen medical needs such as ear infection, tooth extraction etc.

A few things that we learnt from that experience is the prudence to select a flexi option that’s usually slightly more expensive than the regular option while booking flights as it can help save on rescheduling costs, if required. Finally, when older parents visit it is always advisable to factor in some extra costs for any unforeseen medical needs such as ear infection, tooth extraction etc. Without an insurance, each doctor visit in a private hospital can cost roughly Dh600-plus, based on the choice of hospital or clinic.

Living away from home when parents and relatives visit, we look forward to spending happy and refreshing moments with them. Thus, pre-planning certain details as listed above can ensure peace of mind even if there are certain ups and downs.