Dubai: Is it possible to fly on fats, used cooking oils, municipal solid waste and grease?

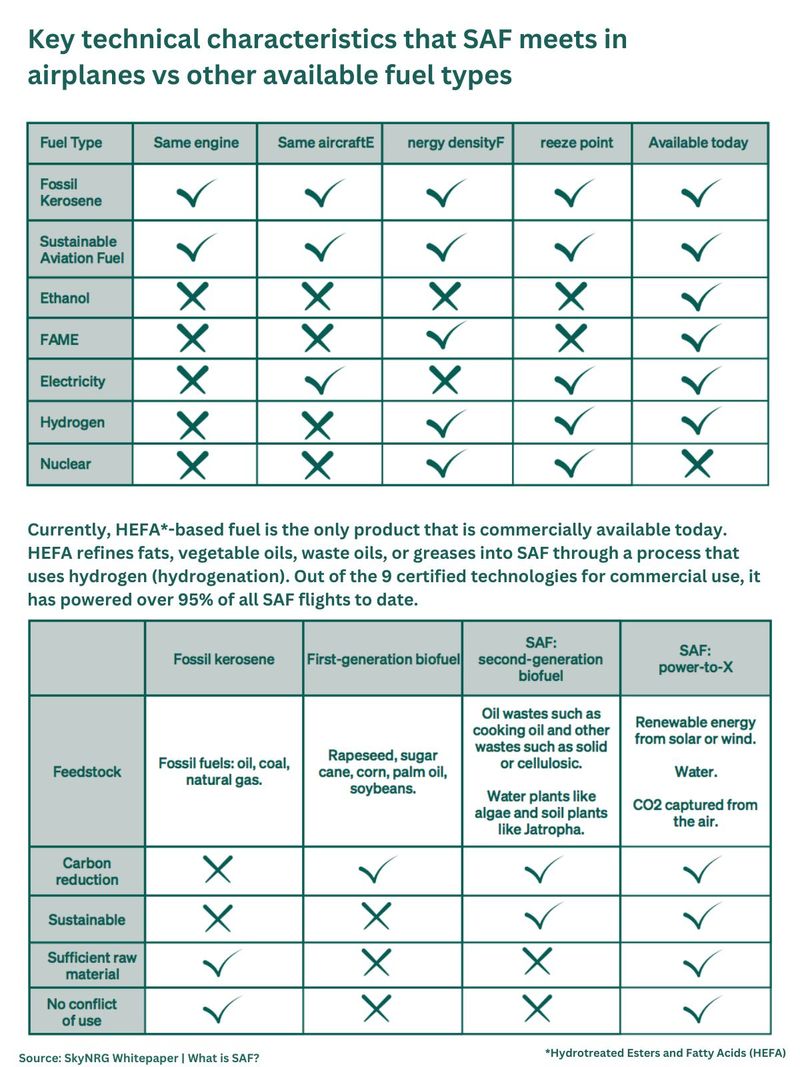

It turns out such “feedstock” — including “biodiesel”, vegetable oil and other “bio-fuels” — have become part of the sustainable aviation fuel (SAF) ecosystem, now fast becoming a global standard.

As the aviation industry charts a course toward sustainability, the trend encompasses advancements in aircraft technology, engine efficiency — as well as groundbreaking initiatives in waste management.

Crucial policies are being established or in progress for the sector. There are a number of drivers for this:

- New legislation concerning SAF in the EU, the US, and the UK is set to boost both the demand and supply of SAF.

- The introduction of “blending mandates” and production goals is anticipated to catalyse a surge in SAF demand and supply.

- Leading this charge is the commitment by the International Civil Aviation Organisation (ICAO) to achieve net-zero operations in global commercial aviation by 2050.

What is sustainable aviation fuel?

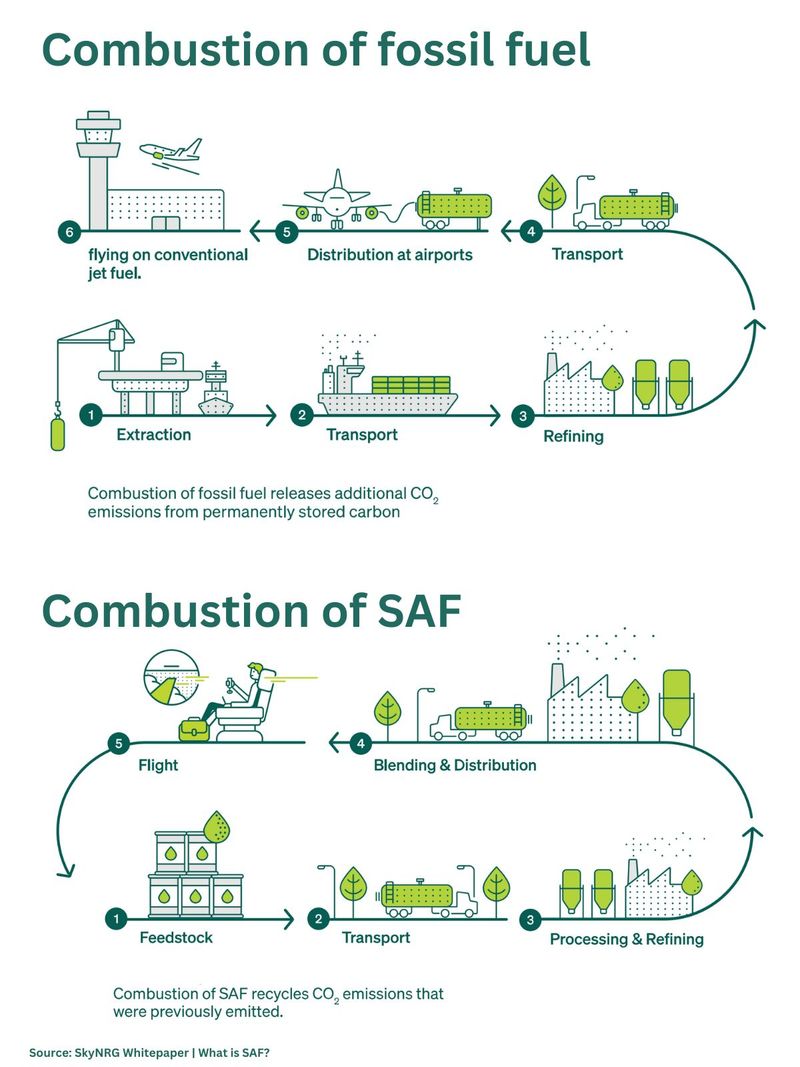

SAF is a "biofuel" used to power aircraft. It is increasingly recognised as the primary solution for significantly reducing aviation emissions.

SAF can be produced from non-petroleum-based renewable/sustainable “feedstocks” including — but not limited to — the food and yard waste portion of municipal solid waste, woody biomass, fats/greases/oils, and other feedstocks.

Why is this important? SAF holds significant potential to reduce carbon emissions of air travel by up to 80 percent over the fuel’s life cycle compared to using conventional jet fuel.

In general, SAF has similar properties as conventional jet fuel, but with a smaller carbon footprint.

Depending on the feedstock and technologies used to produce it, SAF can reduce life cycle greenhouse gas (GHG) emissions dramatically compared to conventional jet fuel.

80 %

Percentage of reduction in carbon emissions over the fuel’s life cycle vs using conventional fossil-based jet fuel.How is SAF produced?

The creation of SAF involves a meticulous production process. Initially, diverse feedstocks ranging from used cooking oil to algae and plant waste are collected.

One key factor in the rise of SAF: Landmark legislations in three key regions — the EU, the US and the UK. Such moves are expected to create a huge market. SkyNRG, a SAF supplier to dozens of airlines, reckons SAF will reach a projected minimum of 12.8 million tons (4.5 billion gallons) by the year 2030.

• Fischer-Tropsch process:

Typically, in the standard implementation, carbon monoxide and hydrogen—the feedstocks for Fischer-Tropsch (FT)—are generated through gasification of coal, natural gas, or biomass.

This gasification process plays a crucial role in both coal liquefaction and gas-to-liquids technologies, facilitating the production of liquid hydrocarbons.

• Hydroprocessing

These techniques transform biomass, natural gas, or hydrogen-treated feedstocks into aviation-grade fuel.

The choice of feedstocks and production methods significantly influences SAF's carbon reduction profile.

The diversity in feedstocks and production methods enables varying levels of emissions reductions.

Certain SAFs have demonstrated remarkable effectiveness in reducing emissions.

“SAF is increasingly accepted as the most effective measure to significantly reduce aviation emissions,” says Maarten van Dijk, Chief Development Officer of SkyNRG, which supplies SAF to 40 airlines.

Advantages of SAF

SAF is widely seen as a commercially proven, sustainable “drop-in” alternative to fossil jet fuel. This simply means: SAF requires no modifications to infrastructure or aircraft engines, making it ready to use today.

When compared to other alternative energy sources for today’s aircraft, sustainable aviation fuel carries other key advantages.

Even when pitting it up against the likes of hydrogen or electricity, it proves to be the best option to decarbonise aviation today.

What does the aviation industry need now?

Among others, Van Dijk suggests solid partnerships to deliver on the momentum and realise the dramatic increase in production capacity needed to reach “net zero”.

A paper titled “Sustainable Aviation Fuel Market Outlook”, comes with updates on EU laws, advancement of UK mandate discussions and tax credits in the US being implemented.

The white paper, prepared by SkyNRG, predicts that the mandates set for 2030 in European markets are likely to be achieved — though it came with significant qualifiers.

How many SAF refineries are needed?

In order to meet the mandates established for 2050 in Europe, the report suggests the necessity of deploying over 150 sustainable aviation fuel (SAF) refineries.

150

Number of sustainable aviation fuel (SAF) refineries needed to meet EU mandates by 2050.This ambitious venture presents a significant environmental, social, and governance (ESG) investment opportunity, estimated at a staggering €250 billion ($266.9 billion).

In the context of the United States, the report emphasises the need for additional announcements to meet aspirational goals.

The potential sources for such announcements are anticipated to include facilities utilising corn ethanol and various waste materials such as agricultural waste, waste biogas, or household waste.

Challenges: Price of SAF

120 m

tonnage of SAF refining capacity (42 billion gallons) estimated in the US and Europe by 2050, equivalent to $600b in investments (Source: SkyNRG)The report underscores the importance of freeing up feedstock from other sources — like renewable diesel or “biodiesel”, or by increasing domestic vegetable oil production.

• Modern engines of the latest generation are engineered to efficiently operate with a proportion of SAF, aligning with the industry's commitment to greener practices.

• A milestone in SAF adoption unfolded with the Airbus A321XLR achieving a breakthrough — a test flight powered by 100% SAF.

• Under the Volcan project, the A321XLR D-AVZO, equipped with CFM LEAP-1A engines, marked a historic moment, joined by a modified Falcon 20 jet scrutinising exhaust emissions within close proximity.

• In October 2023, Boeing, NASA, and United Airlines initiated tests on a Boeing 737-10 dedicated to United, conducting flights fueled entirely by SAF.

• Accompanying this venture was NASA's DC-8 Airborne Science Lab, emphasizing collaborative efforts to explore sustainable alternatives in aviation.

To achieve a SAF production capacity of 27 billion gallons (77 million tonnes) – equivalent to the jet fuel demand in 2019 – the United States would have to establish approximately 250 SAF refineries by the year 2050.

This undertaking represents a cumulative investment opportunity amounting to an impressive $400 billion.

The report also raises concerns about potential increases in SAF prices due to heightened pressure on feedstock, particularly if jet fuel demand aligns with forecasts by the International Air Transport Association (IATA), intensifying the competition for resources.

Key takeaways from the report include recognising that blending mandates and production goals worldwide have the potential to trigger at least 12.8 Mt (4.5 Bgal) of supply by 2030.

By 2050, Europe and the US could have around 120 Mt (42 Bgal) of SAF capacity installed.

SAF UPDATES:

• Today, many airlines operate their aircraft on SAF blended with conventional fuel as most plane engines do not allow using 100% of SAFs. Currently, the widespread production and the use of SAFs is also limited by cost and requires significant investment.

• International producer Neste began supplying SAF to San Francisco International Airport in 2020, and 2021 saw the introduction of SAF at Telluride Regional Airport and Aspen/Pitkin County Airport, both in Colorado. In 2021 and 2022, SAF expanded to additional airports in California.

• Neste MY SAF is currently being used by many leading commercial airlines, including Air France-KLM, Lufthansa, Delta and American Airlines, and cargo carriers such as DP-DHL, Amazon Prime Air and UPS.

• The first Emirates flights operating with sustainable aviation fuel (SAF) provided by Shell Aviation have taken off from Dubai International Airport (DXB). Emirates' flight EK 412 bound for Sydney on 24 October was among the first to operate with SAF.

• Cebu Pacific has signed a memorandum of understanding (MOU) with Neste to explore the supply and purchase of sustainable aviation fuel in Asia Pacific. “Carbon emissions are a pressing concern in the aviation industry. To this end, Cebu Pacific has laid out initiatives to address our emissions footprint, with a primary focus on integrating SAF in its operations. This will consequently minimise the environmental impact generated from our flights,” said Alex Reyes, chief strategy officer of Cebu Pacific.