China approves $1.3 billion loan rollover for Pakistan: Finance minister

Country has already received $700m loan from Beijing to help boost its forex reserves

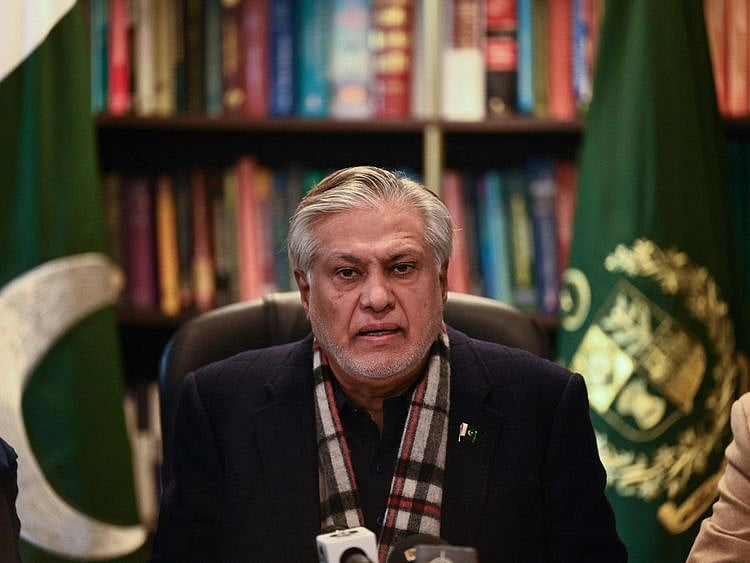

ISLAMABAD| Industrial and Commercial Bank of China Ltd on Friday approved a rollover of a $1.3 billion loan for cash-strapped Pakistan, which will help shore up its depleting foreign exchange reserves, Finance Minister Ishaq Dar said.

The facility will be disbursed in three instalments. The first one of $500 million has been received by Pakistan’s central bank, Dar said in a tweet.

“It will increase forex reserves,” he said.

The money, which Dar said has been repaid by Pakistan to the ICBC in recent months, is crucial for the South Asian economy, which is facing a balance of payment crisis, with its central bank foreign exchange reserves dropping to levels barely able to cover three weeks of imports.

Pakistan has already received a $700 million loan from China to help boost its forex reserves.

Dar said the total $2 billion is in effect Pakistan borrowing back the debt repayments it has paid to Beijing for previously agreed loans.

He said Pakistan will need $5 billion external financing to close its financing gap this fiscal year, which ends in June.

More external financing will be coming to Pakistan only after Islamabad signs a deal with the International Monetary Fund (IMF), which the minister said should be done by next week.

The lender has been negotiating the deal with Pakistan since early last month to clear its ninth review, which if approved by its board will issue over $1 billion tranche of $6.5 billion bailout agreed in 2019.

“We will, God willing, take this country out of this quagmire,” Dar said, dismissing concerns of a default risk.

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox

Network Links

GN StoreDownload our app

© Al Nisr Publishing LLC 2025. All rights reserved.