Philippines: Massive cash withdrawals, brazen kickbacks shock central bank chief

Authorities move to curb massive cash withdrawals, prevent money laundering

Manila: Amid exposés of kickbacks from midnight budget insertions and ghost projects, the Philippine central bank chief voiced shock over huge cash withdrawals that vanished into the shadows of corruption.

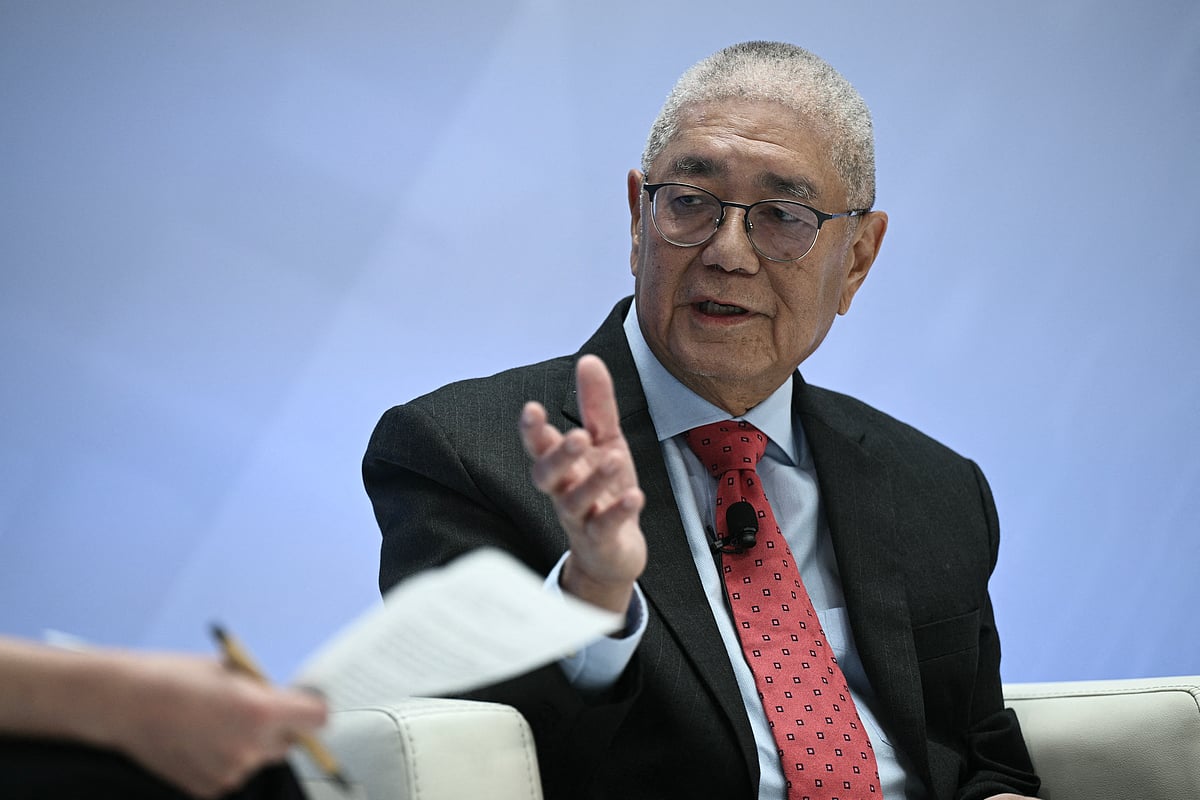

Bangko Sentral ng Pilipinas (BSP) Governor Eli Remolona openly expressed his dismay at the scale of the plunder, describing it as “as much of a shock” to the central bank as to the general public.

Brazen kickbacks scheme

Damning reports of cash-filled suitcases being transported out of local banks to project "proponents" (lawmakers) laid bare the brazen sophistication and audacity of the scheme.

An on-going Senate probe revealed that the budget insertions scam has infected more legislators than initially reported, thus making the ₱10-billion pork barrel scam which hogged headlines 2013 look like child's play.

700+ bank accounts frozen

The BSP chief also highlighted the gravity of the situation, revealing that the Anti-Money Laundering Council (AMLC) has already frozen more than 700 bank accounts linked to the scandal.

The BSP's swift response aims to stem the flow of illicit funds but also underscores the extensive network of transactions facilitating corruption on an unprecedented scale.

Despite the unsettling revelations, Remolona total local media that the Philippine banking system remains fundamentally strong and resilient.

A central figure in the reported plunder, Congressman Zaldy Co of AKO Bicol party-list, former head of the House Appropriations Committee, denied his involvement in the scam.

Co, part of the so-called "small committee" where the midnight budget insertions take place, has reportedly gone into hiding in Europe following medical treatment in the US.

A final warning issued by the new House leadership threatened Co with dismissal, forcing Co to promise to fly back to the country to face allegations against him.

More curbs on cash transactions

In light of the scandal, regulatory authorities are now intensifying controls, especially tightening the rules around massive cash withdrawals.

These enhanced measures seek to curb illicit financial flows, prevent money laundering, and restore integrity to the country’s financial institutions.

Kickbacks

The budget insertions scam in the Philippines has unmasked a deeply entrenched system of illicit kickbacks involving hundreds of billions of pesos, estimated at $19 billion, effectively exposing a new incarnation of pork barrel system.

The Philippine Supreme Court banned pork barrel in 2013.

Historically, pork barrel funds — allocated discretionary items in the national budget — were meant to finance local projects but became synonymous with corruption and patronage politics.

Their abolition was hailed as a major victory against graft.

What shocked the BSP and the public alike is the astonishing ease with which multimillion-peso cash withdrawals are made from the banking system.

Meanwhile, former senator Grace Poe admitted that all senators in the 19th Congress had submitted "amendments" or "insertions" in the proposed national budget.

Poe has cited the need to introduce key legislative changes in the budget process should be introduced amid the ICI probe.

More protests are planned in in Manila and the provinces against government corruption.

Amid calls for repentance, and "we're-all-guilty" admission made Senator Alan Peter Cayetano, the public seeks full-on cleansing.

President Ferdinand "Bongbong" Marcos Jr, known as BBM, has expressed his own outrage at the scale of corruption, vowing that there will be no holy cows. He has publicly supported the protests.

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox

Network Links

GN StoreDownload our app

© Al Nisr Publishing LLC 2026. All rights reserved.