Inclusive growth reshapes India

Investment, manufacturing, innovation, and inclusivity to drive growth in 2025 and beyond

India’s economy is poised for sustained growth in 2025, with projections indicating a GDP rise of 6 to 8 per cent. This optimism is rooted in a solid foundation of strategic investments, manufacturing expansion, innovation, and inclusive growth, as outlined by Union Minister Ashwini Vaishnaw at an event last month.

Fitch Ratings states India’s steady economic growth and easing input prices will boost corporate profitability and support rating headroom in the financial year ending March 2026 (FY26), despite elevated capital expenditures.

“We forecast growth of 6.5 per cent in FY26 [fiscal year from April 2025 to March 2026], remaining largely steady from our forecast of 6.4 per cent in the current FY25. The economy has been in a relative soft patch in the past two quarters, but we do not expect this to translate into a prolonged slump in the economy,” says Jeremy Zook, Director, Sovereign Ratings – APAC, Fitch Ratings.

Growth in investments

India has seen a dramatic rise in capital expenditure, growing from Rs350 billion (Dh14.87 billion) a decade ago to Rs1.1 trillion in 2024-25. This surge is boosting productivity and creating jobs across various sectors.

The country’s infrastructure development has contributed significantly to this growth. India has doubled its airport capacity and added over 31,000 km of railway lines, surpassing Germany’s entire network. The National Highway network has grown by 60 per cent in the last decade, from 91,287 km in 2014 to 146,195 km.

Industry experts say public-private partnerships (PPPs) have played a key role in this progress.

“Investment will be a key growth driver over the coming year, underpinned by the government’s ongoing capex drive and an acceleration in private investment,” says Zook.

While consumption is likely to moderate slightly over the coming year, he points out that it will remain resilient, noting that India’s government has significantly increased infrastructure spending, a key driver of investment growth.

“Public capex is expected to reach about 3.4 per cent of GDP in FY25, up from 1.6 per cent of GDP in FY20. It’s likely that public capex is at its peak in the current fiscal year and will moderate gradually as the government balances its capex push with fiscal consolidation,” Zook explains.

On the private investment side, Fitch says real estate investments have surged in recent years, with a healthy outlook. However, manufacturing investment, which is critical to a robust medium-term outlook, has yet to experience durable acceleration, though there are signs of growth.

“Our baseline is that private investment will pick up in 2025 and beyond, as improved bank and corporate balance sheets since 2020 should support a positive investment cycle. This will drive medium-term GDP growth of around 6.2 per cent,” Zook says.

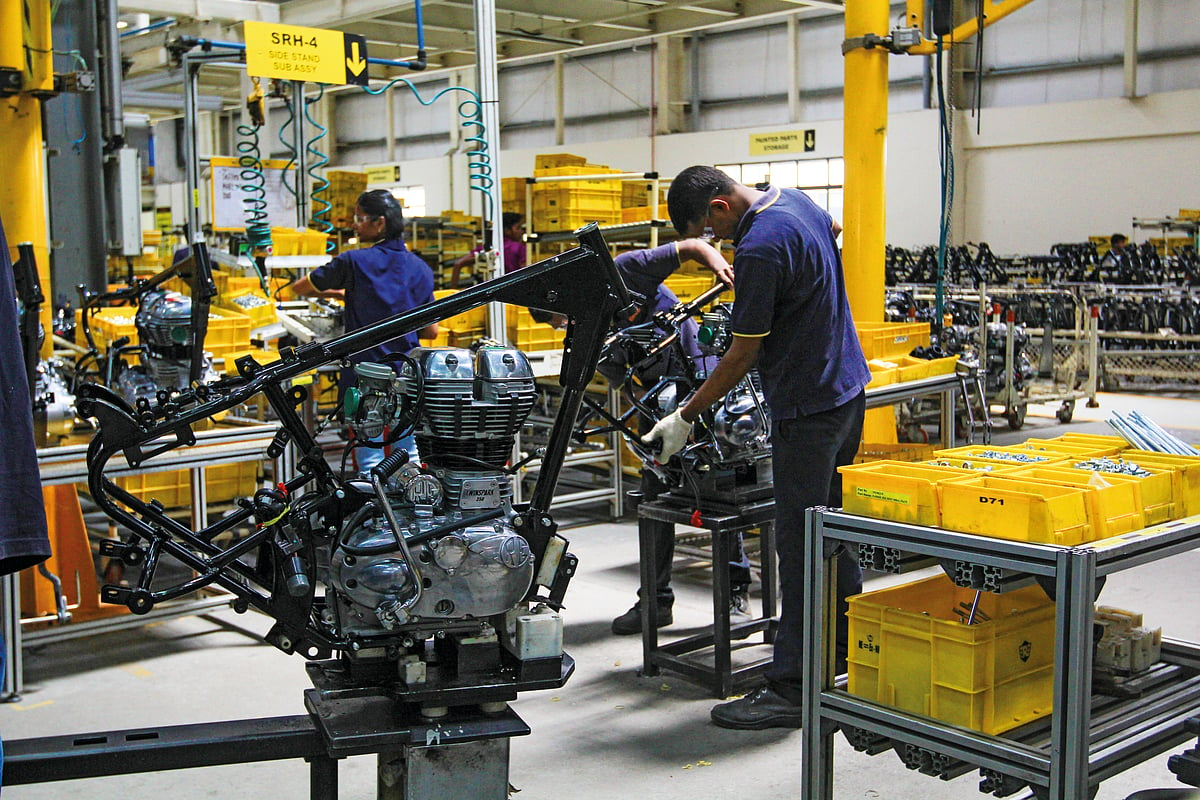

Manufacturing and innovation

India’s manufacturing sector is evolving, with initiatives like Make in India and the Production-Linked Incentive (PLI) schemes driving growth.

As of 2024, investments in electric vehicles (EVs) and battery storage have surpassed Rs4.25 trillion.

The FAME-II scheme, supporting EV adoption, has seen over 1.6 million vehicles on the roads, with nearly 11,000 public charging stations established.

Vikas Marwah, CEO of Lumax Auto Technologies, emphasises his company’s alignment with India’s Make in India initiative by investing in localised production, reducing import dependency, and fostering employment across seven states where the company has manufacturing facilities.

“Our focus on green mobility drives innovation in EV-compatible technologies while building robust supply chains and supporting MSMEs,” he says.

The company has integrated cutting-edge technology into its operations, including robotics, automation, and Industry 4.0 practices.

“Smart manufacturing initiatives, including real-time production monitoring and predictive maintenance, boost productivity and optimise costs,” Marwah adds.

Lumax, a leading manufacturer of automotive components, is also focusing on the development of lightweight, energy-efficient solutions, solidifying its role as a key player in India’s transforming automotive sector.

Zook notes that expanding the manufacturing sector will play a key role in sustaining strong medium-term growth, improving India’s global competitiveness, and providing ample employment opportunities for the growing job-seeking population.

Candytoy Corporate (CTC), one of the largest candy toy producers globally, reflects this approach, operating six manufacturing units in Indore, Delhi, and Hyderabad, along with 11 contract manufacturers.

“Our investment strategies align with Make in India. We supply to 40 countries and are chosen for our quality and price competitiveness,” says Gaurav Mirchandani, Director.

Meanwhile, experts highlight that India’s growth is also driven by clean energy and decarbonisation.

According to Anirudh Bhuwalka, CEO of Blue Energy Motors, who highlights the role of companies like his in advancing LNG-powered vehicles.

“Government policies and incentives aimed at reducing carbon emissions, coupled with rising awareness among businesses to adopt greener supply chain practices, are further catalysing the transition,” he says.

“These advancements not only align with India’s commitment to global climate goals but also position the country as a leader in sustainable growth,” Bhuwalka adds.

Bhuwalka further emphasises that Blue Energy Motors’ investment strategies align with India’s broader vision, particularly Make in India. The company focuses on localising advanced technologies for LNG-powered trucks, which supports both industrial growth and sustainability goals.

“We are creating an ecosystem that involves collaborations with suppliers, fostering creativity, and creating jobs. Our investments in cleaner, more efficient transportation solutions align with the government’s sustainability and security priorities,” Bhuwalka says.

Regulatory reforms

India has significantly improved its business environment through simplified laws and reforms, eliminating over 1,500 outdated regulations to streamline the regulatory process.

Marwah credits regulatory reforms, such as the Goods and Services Tax (GST) and digital tax filing systems, for creating a more business-friendly environment.

“This has reduced delays, minimised costs, and improved cash flow management. Similarly, the consolidation of labour laws has enabled greater flexibility in workforce management,” he says.

Bhuwalka highlights that his company has capitalised on regulatory reforms that have simplified business operations, particularly in areas like vehicle registration and incentives for clean technologies.

“These changes have allowed Blue Energy Motors to focus more on innovation and expanding its footprint rather than navigating bureaucratic hurdles,” he says., adding, “The improved regulatory landscape inspires confidence, and we’re committed to leading the shift towards sustainable logistics in India.”

Mirchandani of CTC notes that since January 2021, the government of India has banned the import, manufacturing, storage, and sale of non-BIS (Bureau of Indian Standards) compliant toys through the issuance of the Quality Control Order (QCO).

“It provides all-round support to the domestic toy industry by promoting Made in India. This has helped us immensely,” he adds.

Zook notes that India’s regulatory improvements could attract more FDI, particularly from companies diversifying their supply chains amid the China+1 strategy. However, he warns that global economic uncertainty could temper FDI growth in 2025.

Inclusive growth

India’s inclusive growth strategy has redefined its socio-economic landscape. Policies like Mudra Yojana, which offers credit to micro-enterprises, have furthered these goals, while platforms like BHIM-UPI have democratised financial services, boosting entrepreneurship and consumer confidence.

Lumax is committed to fostering inclusive growth by promoting equitable opportunities within its workforce and contributing to India’s economic development. “We are actively promoting workplace diversity by ensuring fair representation across genders, geographies, and socio-economic backgrounds,” says Marwah.

Companies like CTC also champion inclusivity, with over 80 per cent of its 2,000 workers being women. “We plan to open more manufacturing units within Indore and across India, keeping in line with the government’s Make in India initiatives,” Mirchandani says.

These efforts mirror broader government initiatives that focus on education, financial inclusion, and job creation for marginalised communities.

India’s outlook for 2025 reflects a comprehensive strategy integrating investments, sustainable manufacturing, inclusive growth, and regulatory reforms. With a vision for a Viksit Bharat, a developed economy, by 2047, India is steadily advancing towards its goal of equitable prosperity and global leadership.

Network Links

GN StoreDownload our app

© Al Nisr Publishing LLC 2026. All rights reserved.