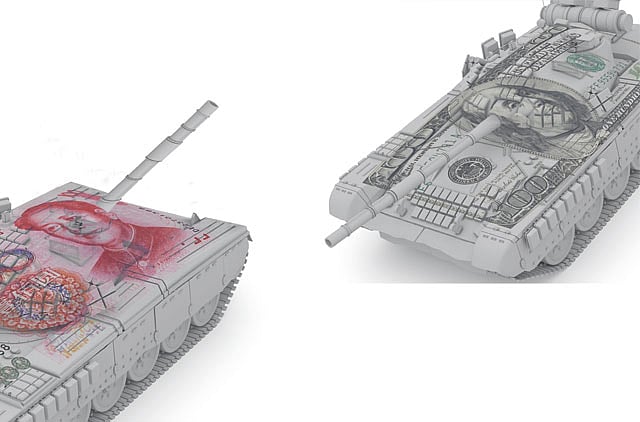

In early October, China's Premier Wen Jiabao addressed European leaders in Brussels. Ominous talk of currency wars dominated the proceedings. And why not? After all, America — and a growing coalition of forces — has mounted a massive attack on China. And the American-led coalition's weapon of choice is the yuan-US dollar exchange rate.

According to America's war "plan," a maxi appreciation of the yuan against the greenback will generate economic instability in China. This will rein in the hegemon.

Premier Wen had good reasons to be worried and to warn the assembled in Brussels that a maxi yuan appreciation would destabilise China and be "a disaster for the world."

The rhetoric coming from Washington fails to mention weapons and war plans. Instead, the airwaves are filled with a never-ending stream of nonsense about how a maxi yuan appreciation is designed to help the Chinese and to make the world safe from global imbalances. Not surprisingly, Washington's line bears no relation to the facts — not even the relationship which is implied by an ordinary lie.

This isn't the first time America has used currency as a secret weapon to destabilise China. In the early 1930s, China was still on the silver standard and the United States was not. Accordingly, the Chinese yuan-US dollar exchange rate was determined by the US dollar price of silver.

During his first term, President Franklin D. Roosevelt delivered on his Chinese currency stabilisation "plan." It was wrapped in the guise of doing something to help US silver producers and, of course, the Chinese.

Silver impact

Using the authority granted by the Thomas Amendment of 1933 and the Silver Purchase Act of 1934, the Roosevelt Administration bought silver. This, in addition to bullish rumours about US silver policies, helped push the price of silver up by 128 per cent (calculated as an annual average) in the 1932-35 period.

Bizarre arguments contributed mightily to the agitation for high silver prices. One centered on the fact that China was on the silver standard. Silver interests asserted that higher silver prices — which would bring with them an appreciation of the yuan against the US dollar — would benefit the Chinese by increasing their purchasing power.

As a special committee of the US Senate reported in 1932: "silver is the measure of their wealth and purchasing power; it serves as a reserve, their bank account. This is wealth that enables such peoples to purchase our exports."

Things didn't work as Washington advertised. It worked as "planned," however. As the dollar price of silver shot up, the yuan appreciated against the dollar. In consequence, China was thrown into the jaws of the Great Depression. In the 1932-34 period, China's gross domestic product fell by 26 per cent and wholesale prices in the capital city, Nanjing, fell by 20 per cent.

In an attempt to secure relief from the economic hardships imposed by US silver policies, China sought modifications in the US Treasury's silver-purchase programme. But its pleas fell on deaf ears. After many evasive replies, the Roosevelt Administration finally indicated on October 12, 1934 that it was merely carrying out a policy mandated by the US Congress. Realising that all hope was lost, China was forced to effectively abandon the silver standard on October 14, 1934, though an official statement was postponed until November 3, 1935. This spelled the beginning of the end for Chiang Kai-shek's Nationalist government.

America's "plan" worked like a charm — Chinese monetary chaos ensued. This gave the communists an opening that they exploited — one that contributed mightily to their overthrow of the Nationalists.

Ironically, now the shoe is on the other foot. As was the case in the 1930s, Washington does not have a war plan, or even the idea of a plan, nor do I believe it knows the meaning of the word "plan." That said, if Beijing caves into Washington's current demands for a yuan appreciation, the result is totally predictable. A Chinese upheaval and a world disaster will ensue.

Exchange rate regimes

Fortunately, Premier Wen has studied the data. Since China embraced Deng Xiaoping's reforms on December 22, 1978, China has experimented with different exchange rate regimes.

Until 1994, the yuan was in an ever-depreciating phase against the US dollar.

Relative volatile readings for China's GDP growth and inflation rate were encountered during this phase (see the accompanying chart and table). After the maxi yuan depreciation of 1994 and until 2005, exchange-rate fixity was the order of the day, with little movement in the yuan/dollar rate.

In consequence, the volatility of China's GDP and inflation rate declined, and with the renminbi firmly anchored to the U.S. dollar, China's inflation rates began to shadow those in America.

Then, China entered a gradual yuan appreciation phase (when the yuan/dollar rate declined in the 2005-08 period).

Without a firm dollar anchor, China's inflation rate picked up, relative to the US inflation rate. And, yes, the volatility of China's GDP picked up and China's average inflation rate rose, too.

In addition to letting the data "talk," Premier Wen must be also listening to the echoes of Karl Schiller, German Finance Minister between 1966 and 1972, who pithily said: "Stability is not everything, but without stability, everything is nothing."

Let's hope he keeps listening.

Steve H. Hanke is a Professor of Applied Economics at The Johns Hopkins University in Baltimore and a Senior Fellow at the Cato Institute in Washington, DC.

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox

Network Links

GN StoreDownload our app

© Al Nisr Publishing LLC 2026. All rights reserved.