Why do oil prices go up and down? How do they hit your wallet?

It’s been a wild ride for crude: from collapse in April 2020 to more than $100/barrel

Highlights

- As oil is a finite resource, the price of oil can see massive fluctuations due to supply and demand changes.

- Geopolitics has traditionally been a factor in the price of oil. So does speculation by oil futures traders.

- An increase in oil prices affects households' purchasing power directly through higher prices for oil-based energy products.

Dubai: If you’re not an oil analyst, the oil market may seem like a lot to keep up with. And understanding why oil prices go up and down may seem a tad far-fetched to you. So let’s break it down.

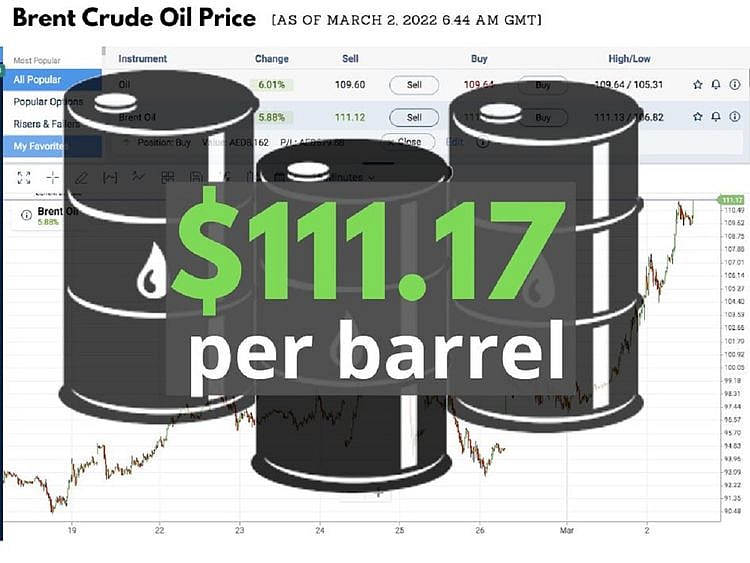

Oil was about $100 a barrel for most of last week. On Wednesday, March 2, 2022, Brent crude spiked to more than $111/barrel on geopolitical uncertainty arising from the Ukraine-Russia crisis.

What has caused this price rise and why are oil prices so volatile?

Less than two years ago, in April 2020, oil prices collapsed — with the West Texas Intermediate (WTI) nosediving to (negative) -$37 and Brent down to $26. We all know by now that crude oil is a highly volatile commodity, with Brent rising to $103 on Tuesday (March 1, 2022).

As with any commodity priced on the market, the laws of supply and demand cause oil prices to change. When supply exceeds demand, prices fall; the inverse is also true when demand outpaces supply.

Oil supply and demand: A breakdown

When it comes to oil, supply and demand has to do with how much oil is available. Oil supply has historically been determined by countries that form part of OPEC (Organisation of the Petroleum Exporting Countries), an intergovernmental organisation of 13 countries.

Demand, on the other hand, is determined by how much need there is for oil at a given time. That need is for things like heat, electricity and transportation, driven by everything from gasoline for cars and airline travel to electrical generation.

The more economic growth a region sees, the more demand there will be for oil.

What else drives oil prices up or down?

Since supply is determined by the big oil-producing countries, tension with one of those nations can cause major problems. So if there’s war or conflict in an oil-producing region, crude inventories could seem threatened, and that could ultimately alter the price of oil.

Geopolitics has traditionally been a factor in the oil price. Particularly when situations in oil-rich regions of the world would flare up and there would be conflict, you would generally see a little bit of an uptick in the price of oil as a result.

One estimate, made by Moody’s Analytics, states that the Ukraine-Russia tensions have already added another $10 per barrel to global oil prices.

Brent, the market for North Sea oil (a benchmark for the prices of other crude oils), jumped to $103.30 at 1.20 GMT on Tuesday (March 1, 2022), from $96.25 on February 23, 2022.

West Texas Intermediate (WTI) rose to $100.08 at 1.20pm GMT on Tuesday from $91.22 as of 10.12 GMT on February 23, 2022. Analysts say supply uncertainty could continue to give an upward pressure to oil prices in the near term.

“Energy prices have moved higher with oil prices now more seriously threatening $100 per barrel after a few days of drifting lower on apparent positive diplomatic developments,” stated Edward Bell, Senior Director, Market Economics, Emirates NBD, in a research note.

“We would expect oil and energy markets to price in much more supply insecurity," said Bell.

This is just by virtue of the risk of supply being disrupted, or of means of transportation being disrupted, such as a canal or pipeline or workers going on protest, things like that. For example, during the Gulf War of 1991, oil production fell, which caused prices to rise.

And in 2003, oil prices soared after the US invaded Iraq, a Middle Eastern nation which produces a lot of oil. So with instability in the region, people weren’t immediately sure what would happen to the supply.

One more factor that drives up oil prices

However, unlike most products, oil prices are not determined entirely by supply, demand, and market sentiment toward the physical product.

Rather, supply, demand, and sentiment toward oil futures contracts, which are traded heavily by market speculators, play a dominant role in price determination.

What are oil futures and what role do speculators play?

Oil futures are contracts in which buyers and sellers of oil coordinate and agree to deliver specific amounts of physical crude oil on a given date in the future. Speculators are the main participants in any futures market, which are individuals or firms that accept risk in order to make a profit. Speculators can achieve these profits by buying low and selling high. So there are essentially three broad factors that traders look at when developing bids that influence oil prices. These are the current supply, future supply, and expected demand. In general, oil futures contracts represent the purchase and sale of 1,000 barrels of oil. When the contract is purchased, it specifies the delivery of these barrels of oil at a pre-agreed date (up to nine years away) — or expiration date — for a predetermined price.

How do people make money as oil prices rise?

As oil is a finite resource, its price can see massive fluctuations due to supply-and-demand changes. This volatility makes it extremely popular among traders.

When you buy and sell oil with the aim of making a profit, it is known as oil trading. This can be done by buying the physical commodity, or speculating on its price. Fluctuations in oil prices can send shockwaves throughout the global economy.

IMPACT ON YOUR POCKET

Rising oil prices have a knock-on effect on your pocket — in terms of price of everyday items a household needs: • FUEL When oil prices spike, you can expect fuel prices to spike as well, and that affects the costs faced by the vast majority of households and businesses. When fuel prices increase, a larger share of households’ budgets is likely to be spent on it, which leaves less to spend on other goods and services. The same goes for businesses whose goods must be shipped from place to place or that use fuel as a major input (such as the airline industry). Higher oil prices tend to make production more expensive for businesses, just as they make it more expensive for households to do the things they normally do. • OIL-BASED PRODUCTS Oil price increases are generally thought to be inflationary. A price rise directly affects the prices of goods made with petroleum products. Increases in oil prices can depress the supply of other goods because they increase the costs of producing them. An increase in oil prices affects households' purchasing power directly through higher prices for oil-based energy products (e.g. petrol, heating oil). The other two-thirds comes from oil being used in the production of non-energy goods. • AGRICULTURAL COMMODITIES Higher energy-related production costs would generally also lower agricultural output, raise prices of agricultural products, and reduce farm income, regardless of the reason for the energy price increase. • HOW DO THESE TRANSLATE TO CONSUMERS? Studies have shown that oil prices do have an, albeit nominal, effect on the food sector. Some of these are fairly obvious. When higher oil prices result in higher prices for gasoline and diesel fuel, it costs more to get products from farms to final consumers.

How are people affected by oil price rise?

Studies show that crude oil and petrol prices are highly “correlated”, or linked. BMO Capital economists estimate that every $10 rise in the cost of a barrel of oil triggers a 0.4% rise in inflation — the general increase in prices (and fall in the purchasing value of money).

BRENT VS WTI VS OTHERS

Oil futures trade on many exchanges. Brent (or North Sea Brent Crude), a blend of “sweet crude oil” used as a benchmark for the prices of other crude oils, is the most popular one. West Texas Intermediate (WTI), a light, sweet crude oil sourced primarily from inland Texas, serves as another global oil benchmark. Other blends include Louisiana Light, Bonny Light, OPEC Basket, Canadian Crude, DME Oman, Mexican Basket, Indian Basket, Dubai. Many oil producers such as Saudi Arabia, UAE, Qatar, Iraq, Mexico, Malaysia and Nigeria also have their own blends.

How will the Iran deal affect oil prices?

European and Russian diplomats have broadly hinted that negotiations over Iran's nuclear programme are reaching the final stages. If a deal is made (over whether the landmark nuclear agreement can be revived) global energy markets hope to get some relief.

Many traders expect that if sanctions are lifted, Iran will be able to boost daily exports by about 1 million barrels — within just a matter of months and 1.3 million bpd by the year's end.

$147 CRUDE OIL PRICE PEAK

Today's international crude prices are still a way off the all-time peak of more than $147 hit in July 2008. In 2008, it took less than five months to soar from roughly current levels to the record, the world saw fast economic growth, tight supplies and a lack of spare capacity to provide a cushion against geopolitical shocks. Some analysists predict the possibility that a price rise will lead to more production of the shale oil lying under the southern US.

This, along with a rise of around 2.8 million bpd from Canada, Brazil, Iraq, Venezuela and the US, could push prices below $65 a barrel, according to some industry analysts. Iran has the world's No. 2 natural gas and No. 4 oil reserves.

If a deal is reached, it could provide relief to oil markets. Still, one variable traders track is the recovery in demand (as the pandemic recedes) and supply constraints among major producers, which could keep an upward pressure on oil prices in the near term.

A decision is likely this week.

What an oil trader eyes when seeking to make profits as oil prices soar

Oil trading is interesting because it is quite predictable until it is not. As a trader, I keep a close eye on the monthly OPEC reports and the weekly crude inventory reports from the US energy regulator — the US Energy Information Administration (EIA). If the data points towards higher supply, prices fall and same goes the other way round. Unlike other commodities, oil is particularly sensitive to geopolitical factors, especially when oil producing nations are involved. The current Russia-Ukraine crisis has taken oil over $90 a barrel and this is barely two years after the commodity hit a record low at the onset of the pandemic in 2020. Any signs of escalation or de-escalation in the conflict will be moving oil prices in the coming few weeks. However, there could be new supply coming into the market once Western Powers sign the Iran nuclear agreement or JCPOA (Joint Comprehensive Plan of Action). The deal will allow Iran, which is currently facing harsh US sanctions, to once again export its crude oil to markets in Asia. The move is also expected to keep oil from reaching $100 a barrel - a price that will be deemed too high by major oil consumers like China, US and India.” (By John Benny, Staff Reporter)

3 methods an oil trader uses to make profits

There are three methods an oil trader uses to make profits amid higher oil prices:

• Futures

One way professional investors commonly make a profit in the commodities market, without having to own any actual oil, is through oil ‘futures’.

Oil futures are traded on exchanges and reflect the demand for different types of oil. Oil futures are a common method of buying and selling oil, and they enable you to trade rising and falling prices.

• Spot price

Another way you can trade oil is on the oil ‘spot’ price. Oil spot prices represent the cost of buying or selling oil immediately, or ‘on the spot’ – instead of at a set date in the future.

While futures prices reflect how much the markets believe oil will be worth when the future expires, spot prices show how much it is worth right now.

• Options

An oil option is similar to a futures contract but there’s no obligation to trade if you don’t want to. They give you the right to buy or sell an amount of oil at a set price on a set expiry date, but you wouldn’t be obliged to exercise your option.

There are two types of options: ‘calls’ and ‘puts’. If you thought the market price of oil was going to rise, you might buy a ‘call’ option. If you thought it was going to fall, you’d buy a ‘put’. Alternatively, you could speculate on the price of oil-linked ETFs and company stocks to get an indirect exposure.|

If tensions continue, and oil prices continue to spike, what would be likely knock-on effect on Europe?

Russia supplies about 40% of the EU’s natural gas imports. Most of the rest comes from Norway and Algeria. Russia sends gas to Europe through several main pipelines - such as the Nord Stream, the Yamal-Europe and the Brotherhood.

The gas is collected in regional storage hubs, and then distributed across the continent. European gas prices have risen by more than 10% since Monday, as tensions over Ukraine escalate. Also, the approval of the Nord Stream 2 pipeline to Germany has been halted because of Russia's actions in Ukraine.

Following the decision, the Deputy Chair of the Security Council of Russia, Dmitry Medvedev tweeted that European gas prices would go up.

In the short term, analysts expect oil prices to continue seeing a level of support from the Russia-Ukraine crisis, as some Western countries promise to impose more sanctions if Russia launches a full invasion of its neighbour.

What’s the impact of higher oil prices on Asia and the rest of the world?

Non–oil producing developing countries and East Asia — with its significant dependence on exports — tend to me most likely to be adversely affected by rising oil prices.

The Institute of Energy Economics Japan (IEEJ), in a 2012 study, estimates that every $10/barrel rise in oil prices results in a -0.7% impact on the GDP of China, India and South Korea; -0.4% on ASEAN; -0.3% on Australia and New Zealand and Japan, and 0.2% on the US and the European Union.

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox

Network Links

GN StoreDownload our app

© Al Nisr Publishing LLC 2026. All rights reserved.