Dubai’s government-owned developers must now focus on rentals

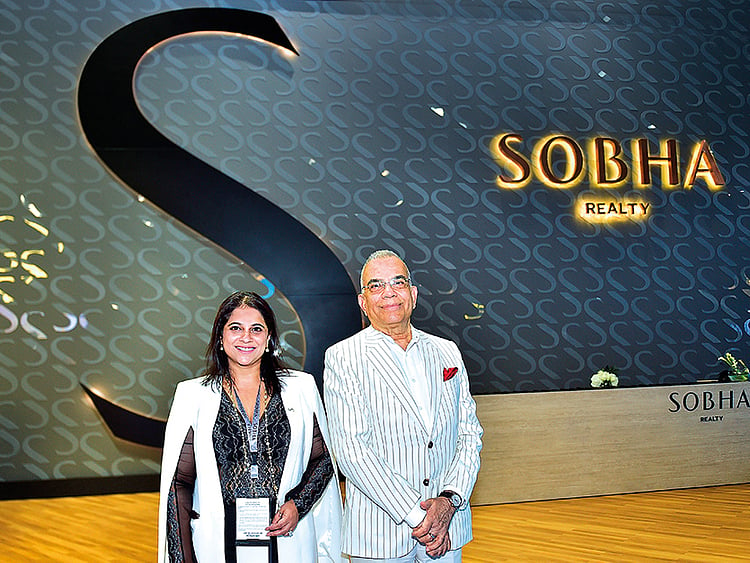

Private players must be given space to compete in freehold space, says Sobha chief

Dubai: There is one way to drastically reduce the risk of oversupply in Dubai’s property market — get government-owned developers to stop selling freehold.

“Instead, these developers should only focus on building assets that are then leased out,” said P.N.C. Menon, Chairman of Sobha Realty. “They should not be in the game of selling, and this way they don’t compete in the same space as private developers.

“In any market, private enterprises need some space to thrive. Government developers can build the hotels, malls, leisure and investment destinations. And even residential and office assets as long as these remain in the leasehold space.”

Menon’s comments assume significance in the context of Dubai setting up a high-powered committee to oversee its real estate sector and come up with ways to address some of the legacy problems. One of this, and a view taken up at the very top of Dubai Government, is to provide privately owned businesses sufficient room to grow.

Dubai’s government-owned developers, or those in which it has a significant stake such as Emaar, have led the way in generating freehold sales this year. In comparison, private names have held back on new launches and instead focused more on completing existing projects.

Compensate in other ways

Menon says the Dubai government can still generate income even while its development companies focus on rental income than on freehold sales. “If it means a certain percentage of tax on the private developers, it would still be welcomed by most,” he added. “But in the real estate space, it’s next to impossible for government-owned and private developers to compete on a level playing field.

“It’s not too late, and those developers will still be creating beautiful assets for the country.”

The Sobha chief — in the midst of building up its $4 billion (Dh14.68 billion) Hartland project at MBR City — said his suggestions should only apply to 100 per cent government-owned operators. “Emaar has a 30 per cent stake held by the government, but it functions more as a private company,” he added.

Access to funds

Where private developers are facing an issue is in tapping finance from banks for their projects. More so, as Rera (Real Estate Regulatory Authority) has tightened the norms on how and when developers can dip into their escrow funds (collected from off-plan sales).

“It’s always best for the market when banks do take on some amount of risk to ensure there is some amount of liquidity,” said Menon. “The present situation is not fantastic, but still manageable.

“The ideal way for developers, however, will be to bring in fresh equity into the business. If they can’t do it on their own, they can do so by selling stakes and tapping outside investors. If you have a good brand, today there is always money.”

Bring down debt

Sobha is working on ways to bring down its debt burden. “Ideally, we want it to be at the 1:1 or 1:1.1 level,” the chairman said. “Only way to survive is have strong equity, whatever be the size of the developer. Right now, we are at the 1:1.5 level. We need to work it down and reach the ideal level by 2022-23.”

This year, the company expects to close out with Dh2 billion in sales, boosted by demand for a twin-tower it launched at Hartland. More than 750 units out of 800 have found a buyer.

“It was the first time we experimented with smaller apartment sizes, with 700 square feet being the largest,” said Menon. “It will be by 2023 that we will have finished doing everything at Hartland.”

Off to Shaikh Zayed Road

Outside of the Hartland in MBR City, Sobha has finally decided to make a move on a plot it acquired on Shaikh Zayed Road more than 10 years ago.

“It’s in the Tecom area and will be a Dh1 billion project,” said P.N.C. Menon. “Plan is to launch a tower — mostly residential but also to have our corporate offices — in the first quarter 2020.

“The market is such we cannot get too adventurous with launches and pricing. But this is one project we will go ahead with next year.”

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox

Network Links

GN StoreDownload our app

© Al Nisr Publishing LLC 2026. All rights reserved.