Dubai’s developers have sales sell-outs and a skyscraper launch in busy week

Investors queue up for projects with right price points, while ‘Burj Jumeira’ draws wows

Also In This Package

Dubai: The last week of January has been an exceptionally good one for Dubai’s property market.

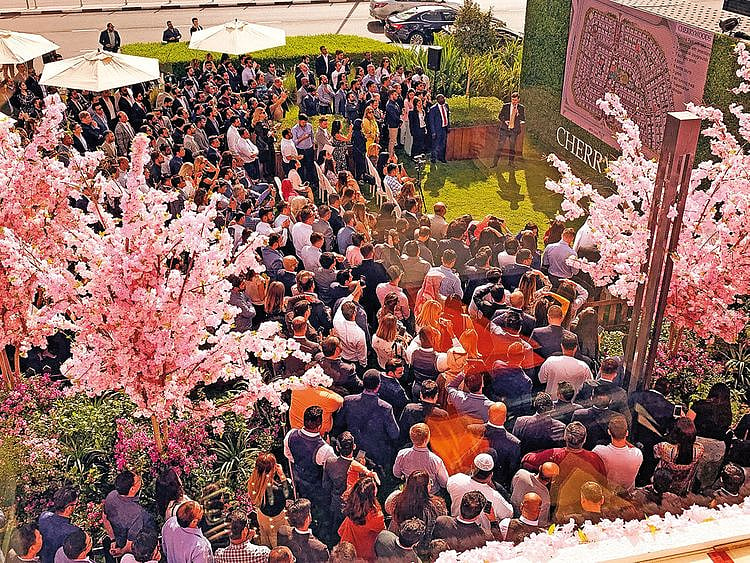

Two government-owned developers — Meraas and wasl Properties — had sizeable crowds queuing up for their latest launches, the Cherrywoods and Gardenia town houses, respectively. And the price points? About Dh1.5 million and over for three- and four-bedroom units.

More important, these were quite sizeable units, of well over 2,000 square feet. In the last two years, developers had been pushing out smaller units and lower per square foot prices to rope in investors.

But demand for Cherrywoods and Gardenia shows that buyers are returning to the “big is good” mantra.

For the Gardenia, wasl Properties actually released a further set of units for a second consecutive day, just to keep up with the demand. The result was that all 257 units, forming part of the wasl Gate community, got sold in less than 48 hours.

Interestingly, the Meraas and wasl projects are located in Dubai’s emerging locations; the Cherrywoods (scheduled for delivery second-half of 2021) on Al Qudra Road and near the Mira community, while the Gardenia takes up spots near the Ibn Battuta.

And it wasn’t all mid-market offerings either during the week — on January 31, Dubai Holding confirmed what it had in mind for a prime spread of land near the city’s established icons Burj Al Arab and Madinat Jumeirah. Taking up that spot would be Dubai’s latest super-tall structure, the Burj Jumeira and which will rise to 550 metres. Around it will be a self-contained development called “Downtown Jumeirah”, with smaller office and residential towers and plenty of retail and entertainment options.

All signs point to Dubai’s leading developers reworking their launch and sales strategy to suit a property market still in correction mode. That they are able to pull in significant demand and sell out launches attests to investor interest being there for projects offering something new … and with the right prices and payment plans (preferably post-handover).

Then come the incentives — estate agents are starting to put out promotions that focus on buyers being allowed 5-year residency visas on buying properties of Dh5 million and more. (Buying property of Dh1 million and higher makes it eligible for owners to have two-year visas.) These are still the initial days for the visa incentives, but the feelers from developers and brokers are already being seen. Once the government signs off, that would be when these campaigns get into fever pitch.

“We expect sentiments will improve on the macro front with further incentives in the offing,” said Sameer Lakhani, Managing Director at the consultancy Global Capital Partners. “By and large, investors had been cautious given the market data that has been playing out for some time.

“Even then, buying at some communities continue to be spurred by the sheer proliferation of payment plans.”

Both Cherrywoods and Gardenia have generous post-handover plans; with the former, the post-handover portion is 50 per cent over five years. At Gardenia, where prices are from Dh1.68 million to Dh2 million, the post-handover portion is 80 per cent. Completion is scheduled for late this year.

In the wider Dubai freehold space, according to Reidin-GCP data for January, 817 sales transactions were registered on ready properties, against 1,159 units last year. On off-plan properties, the first month’s tally was 1,126 units against 1,752 units in January 2017.

“There will be a certain lag of a few weeks between properties actually getting sold and then being registered with the Land Department,” said Lakhani. “February will show whether the off-plan momentum of January can be maintained or not. This is where the roll-out of the Government incentives and the response from investors will be the key.”

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox

Network Links

GN StoreDownload our app

© Al Nisr Publishing LLC 2026. All rights reserved.