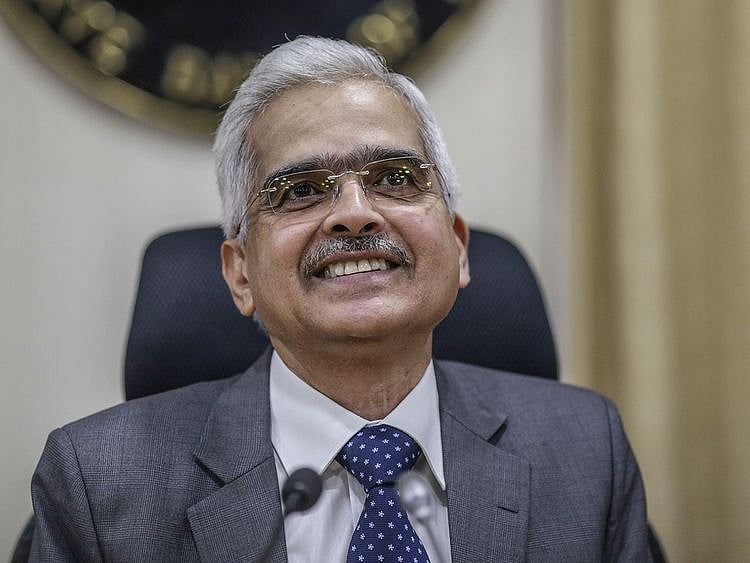

Indian inflation expected to cool from October, says RBI Governor

The governor’s outlook may spur expectations of revisions in coming policy updates

New Delhi: Inflation in India is expected to cool from October, minimizing the need for aggressive central bank action, Governor Shaktikanta Das said.

“Our current assessment is that inflation may ease gradually in the second-half of 2022-23, precluding the chances of a hard landing,” the Reserve Bank of India governor said at an economic conclave in New Delhi on Saturday.

Central banks worldwide are grappling with worse-than-anticipated inflation driven by supply-chain disruptions, surging commodity prices, and fall-out from the Russian attack on Ukraine. In India, the pace of price gains has stayed above the RBI’s 6 per cent upper tolerance level since the start of the year, forcing it to raise rates by 90 basis points in the last two months.

“Our endeavor has been to ensure a soft landing,” Das said. The supply outlook appears favorable, with several high-frequency indicators pointing to a resilience of the recovery in the April-June quarter of 2022-23, he added.

In June, the bank said inflation was expected to average 6.7 per cent in the year to March, and while prices will start to cool from the second-half, starting in October, the mandate could be met only in the January-March quarter. Downside risks to inflation are materializing with a cooling of commodity prices, and the RBI’s inflation forecast may get revised down, said Rahul Bajoria, India economist of Barclays. Bajoria expects inflation at 6.5 per cent for the fiscal year ending March, against the RBI’s current 6.7 per cent projection.

The impact of global factors on domestic inflation has increased over the past three years due to the pandemic and the war in Ukraine, the governor said. Over this period, India has seen a “more protracted and sizable role of global factors in proportions not witnessed in decades,” he said. These have “an even more conspicuous effect on net commodity-importing countries like India.”

There should be a greater recognition of global factors in local inflation dynamics and economic developments, Das said. That calls for enhanced coordination among countries, and the RBI would remain flexible and transparent, he said.

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox

Network Links

GN StoreDownload our app

© Al Nisr Publishing LLC 2026. All rights reserved.