India RBI head warns crypto could spur next financial crisis

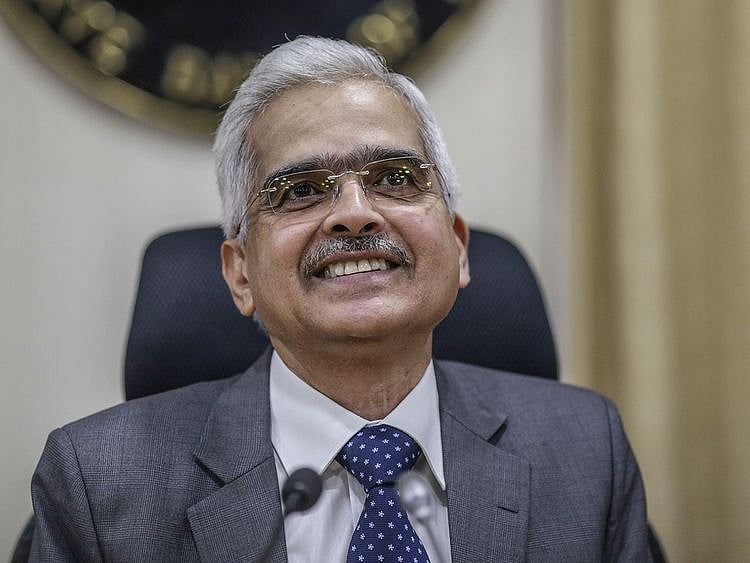

Shaktikanta Das calls crypto a '100% speculative activity'

Reserve Bank of India Governor Shaktikanta Das warned that failing to regulate cryptocurrencies could ignite the next financial crisis and urged the adoption of a new e-Rupee for digital banking needs.

"Cryptocurrency has certain huge inherent risks for our macroeconomic and financial stability," Das said at an event on Wednesday in Mumbai, pointing to the implosion of FTX as an example. "If cryptos grow, mark my words, the next financial crisis will come."

Das said a main concern for the RBI is that cryptocurrencies don't have any underlying value. "It is a 100 per cent speculative activity," he added.

Das's comments come in light of the global cryptocurrency meltdown that led to billions of dollars being wiped out. India's central bank has refused to recognize private cryptocurrencies and repeatedly issued warnings against trading in them.

Globally, more central banks will embrace digital currencies as they shun private cryptocurrencies, Das said. India's central bank tested its own digital currency for retail usage earlier this month.

Speaking at the Business Standard BFSI Insight Summit, Das said it's in everyone's interest to cool high prices in the economy, and that the government and central bank are "serious about controlling inflation." He said monetary policy isn't driven by politics or upcoming national elections, which are scheduled for 2024. Instead, the RBI is "only looking at inflation and growth."

In the monetary policy review earlier this month, the central bank increased the key rate 35 basis points, the smallest bump in months. Since May, the RBI has raised its policy rate by 225 points to bring stubbornly high inflation within a target band of 2-6 per cent.

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox

Network Links

GN StoreDownload our app

© Al Nisr Publishing LLC 2026. All rights reserved.