A Biden presidency will not settle the oil markets

But his push for renewables could give some welcome lift to oil prices

The oil markets dealt with the dramatic developments in the US election in a subdued manner, tuning out all the bickering and trading of accusations that accompanied the choice of a new president.

Even more so as the election results will be validated by the courts - a remarkable development not seen in 20 years. Yes, this repeats the scenario from the 2000 election but in a more aggressive manner.

Undoubtedly, the US elections are systemically important due to the economic, political, environmental and security implications across the world. However, what is really important is the effect on oil markets, which are the main source of income for Gulf economies.

Can be discounted

The political and security implications, no matter how they are portrayed in the media, will continue to be decided by the various arms of the US government and legislatures. If there is a disparity in policies between one administration and another, it remains relative.

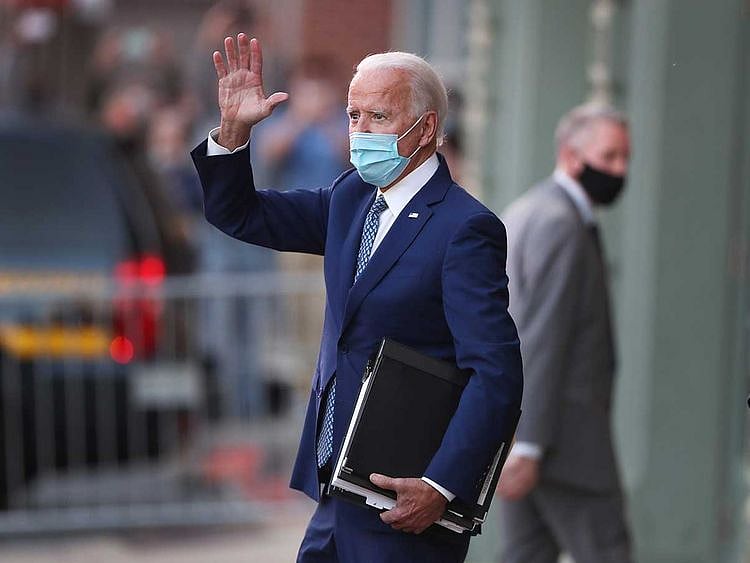

This simply means a misunderstanding of the institutional state. Prince Turki Al Faisal, an informed observer of US affairs, said those who expect Joe Biden to be different from Donald Trump will be very disappointed - and he is absolutely right.

The best example is by gauging the impact on the oil markets. Let’s assume that the election resulted in a win for President Trump. In this imagined scenario, there will be repercussions on oil prices in the short- and long-term.

First, Trump’s oil policy is based on increasing US oil and gas production to the limits, which is already the case, and turned the US into one of the biggest energy players. This policy contributed to the oil price collapse, before the Saudi-Russian deal with US support rebalanced the markets.

In the long run, the Trump administration has limited the development of alternative energy sources, noting that the life span of shale oil and gas, which has mainly contributed to the rise in US production, is relatively short. This policy helps maintain oil’s position in the global energy balance, an outcome favourable for producing countries.

Pivot to renewables

As for Biden, in the near term, the President-elect will significantly limit shale oil and gas production due to environmental reasons and commitment to the Paris Climate Accord, which he has decided to rejoin after the end of the Trump administration’s term.

This will lead to a symmetry of supply and demand, particularly after the end of the pandemic, which could lead to prices to $60 a barrel. And this is exactly what producing countries aspire to.

In the long run, Biden’s oil policy will cause extreme harm to oil producing countries, given that he intends to pump massive investments to develop alternative energy sources. This will create complications for the energy markets and accelerate the end of the era of semi-absolute oil dominance.

Based on the above, both presidencies have positive and negative aspects that reflect on the oil markets. They are based mainly on protecting US interests, but they differ in the way of their fulfilment.

This is the reality in the approaches of the Republican and Democratic parties, which may differ in the handling of policy matters, but united in the ultimate goal that of safeguarding the interests of their own country and bereft of emotional choices.

Other countries need to set certain short-term and long-term parameters to deal with US administrations on economic, political and strategic aspects - and taking into account the disparity in their approaches.

- Mohammed Al Asoomi is specialist in energy and Gulf economic affairs.

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox

Network Links

GN StoreDownload our app

© Al Nisr Publishing LLC 2026. All rights reserved.