- Why a personal loan can be an attractive fund option for a UAE resident

- Understanding profit/interest rates

- Taking a personal loan: When to, and when not to

- Fixed and reducing rates, choosing the best loan for you

- Job loss and loans

- Items to check off before taking a loan and after paying it off

A loan, for many people, only represents debt and an added burden on their finances – which would be true in some cases.

There are various kinds of loans taken for various purposes – to buy a house, a car, for college education, for moving or relocation, for structured debt repayment, etc. In loans that are driven by asset purchases such as a car or a house/property, banks loan a percentage of the purchase price with the asset as security. In student loans, the loan agreement structures repayment based on the graduation of the student.

And then there are personal loans.

A personal loan, one of the fastest growing types of loans around the world, does not have a security backing in an asset. Therefore, the banks call it an ‘unsecured loan’ and amounts are never as high as those one would get for a secured loan. For UAE expats, the maximum amount one can get is either Dh1 million or 20 times of monthly salary, whichever is lower. The maximum loan period is 48 months i.e. 4 years.

4 years

Maximum loan repayment period in the UAE

Why take a personal loan in the UAE

In addition to easing your financial burden or giving you necessary cash flow when you need it, taking a personal loan from the UAE has some definite advantages.

1) Interest/profit rates

Taking a personal loan from your UAE bank for a financial need in your home country can be beneficial because of the lower Sharia-compliant profit rates.

As a note, Sharia-compliant financing need not be always cheap. In most cases, the difference might be only in nomenclature. Profit rate or interest rate, finally what matters is the cost of funds.

For example, for non-resident Indians, interest rates on personal loans taken in India can be as high as 15 per cent, averaging around 10 to 11 per cent per annum (p.a). In the Philippines, an Overseas Filipino Worker (OFW) i.e. an expat may have to pay as much as 25 per cent or more as interest p.a. This is in addition to a common requirement of having a direct relative based in Philippines as co-borrower for the loan.

In the UAE, per annum profit rates are lower and more reasonable owing to the Sharia laws that govern financial operations in the country, including banking and lending. You could get an unsecured loan for a fixed interest rate of 5 per cent or lower in the UAE.

A fixed rate of 5 per cent works to 9.25 per cent on reducing balance basis. Even then the nominal rates are lower compared to emerging markets like in India and the Philippines where currencies tend to depreciate due to weak economic fundamentals. In the UAE, the currency is pegged to the dollar and is backed by strong external balances and current account surpluses. What a borrower in dirham should keep in mind is that, he/she has sufficient future income in dirham or any other strong currency to repay the loan.

In the absence of that, the borrower is taking on himself two types of risks, such as the currency risk and interest rate risk. Currency risk kicks in when his domestic currency weakens and the debt burden becomes big in terms of domestic currency.

5 %

Interest rate for an unsecured loan in the UAE

Interest rate risk can be very real if we are going through a rate hike cycle. Dirham’s rates are directly linked to Fed rates and interbank rates. When these rates go up, the rates offered by local banks go up too. These movements always need not be proportional.

The local rates are a function of factors such as cost of funds to local banks, overall liquidity in the system and the loan demand. So, coming back to our point of economics of borrowing here to pay for an asset in India will depend on factors such as interest rate outlook for the loan period, currency outlook, the potential appreciation of the asset and the inflation outlook. And more than everything, one’s ability to earn in a hard currency during the loan tenure.

The concept of real interest rates, nominal interest rates and inflation should be understood before one takes a hard currency loan to finance an asset or make an investment in a country that is susceptible to exchange rates volatility.

A quick and easy loan need not be always cheap and viable. It all depends on a number of factors as explained above.

2) Ease of repayment

The fact that it is tied to incoming salary can also help you pay off the loan through strict auto-debit facilities. The bank also ties in your salary payment dates to ensure on-time repayment along with a grace period of up to a week for some banks.

3) Consolidation of debt

Many UAE expats take out personal loans to pay off burgeoning credit card or other debts. In fact, banks propose loans in cases where customers look for an easy way to pay off a card. The advantage of this is that a loan could help consolidate debt and pay back the new loan amount in affordable monthly installments without the high penalties levied on card payments.

4) Early repayment

Having a loan is a mental struggle for some people and an early repayment strategy can help put these minds at ease. In most countries, early repayment of loans comes with fees that make it not worth the effort.

However, in the UAE, full early repayment is made easier as the law states that banks cannot charge anything over 1 per cent of the principal loan amount or Dh10,000 (whichever is lower) as prepayment charge. So, if you had a Dh50,000 loan and want to pay off the last pesky Dh10,000 with money you saved up, the UAE bank cannot charge more than Dh100 as fees for early settlement.

1 %

Of principal loan amount will be charged as early repayment fee in the UAE

5) Math can save you

Taking a loan should be economically and mathematically safe for you. The items on your calculation lists should be the following:

- Your existing total debt – compile them in a descending order along with currently active installments on them

- Your salary account bank or another bank – comparing rates, benefits, cons

- Penalty fee on any credit card debt that you have been paying or not, which has added up – call your bank to clarify each card’s outstanding amount

- Your payment dates and bill statement dates for each card and loan

- How much you can afford to pay towards total debt of monthly income after essential expenses in the long term

- Loan tenure

- Any expected returns during the term of the loan

- Service fees (one-time and non-refundable)

- Interest rates (fixed – based on total loan amount, reducing – charged on outstanding amount only)

When to take a personal loan?

“Money is a terrible master but an excellent servant”, P.T. Barnum, considered the ‘Greatest Showman on Earth’, said in another century. This quote holds starkly true even now when considering any loan or new debt.

A personal loan in the UAE could be a great idea when/if:

- You need to pay off a credit card debt that is burgeoning out of control with hefty penalty fees.

- You need emergency money for situations such as marriage, birth of a child, relocation, college education.

- You need a lump sum of money to start off an already financed asset purchase in your home country.

- You have no debt at all but want to save a lump sum in a higher interest savings account/deposit – the difference could be a gain. But, this is debatable when the savings are made in a weak currency. The notional arbitrage gains can get wiped out through exchange rate risk, as explained earlier.

A personal loan is not a great idea when/if:

- You need additional money for lifestyle expenses such as shopping, elective cosmetic procedures or non-essential car maintenance.

- You already have debt that you're struggling to pay off and if the new loan will not help consolidate debt

- You have a better option, like getting an interest-free loan from your company.

- If you plan on taking the loan for risky investment.

Each person's situation for wanting to take a loan may differ extensively.

Money is a terrible master but an excellent servant

Credit score

To approve a personal loan in the UAE, the bank will check the customer’s credit score, income/expenses for at least six months and may ask for a salary transfer letter from the applicant’s employer.

The Al Etihad Credit Bureau (AECB) provides the credit report, which includes the credit score of an individual and centralises financial information across the UAE. It collects financial information of an individual from various sources and generates a report by analysing the details such as existing loans, installments paid, delays in payments (if any), number of cards, any bounced cheques, etc. A good score is anything above 700, while scores can range between 300 to 900.

If you have a low score, not only can the bank refuse your loan application, but it might also be better if you don’t take on further debt.

You can also request an AECB report with credit score online (https://aecb.gov.ae/home) by paying Dh105. You can also get the credit score and credit report separately (fees are Dh32 and Dh84 respectively).

Debt Burden Ratio

This ratio analyses your debt burden in comparison to your regular income. If this ratio is higher than 50 per cent i.e. if more than half of your income goes towards paying for existing debts, banks will hesitate to provide you a loan. Ideally if this is the case, you shouldn’t take on more debt but focus on paying off existing liabilities by consolidation or cutting down on expenses and trying to generate alternate income. In addition to this the Central Bank of UAE has directed banks and other financial institutions to be prudent in setting monthly installment amounts, and that these should stay well below 50 to 60 per cent of monthly salary.

50 %

Maximum debt burden ratio permissible in the UAE

20 times salary

The personal loan amount approved is usually limited to 20 times the salary of the expatriate applicant, with a usual upper limit of Dh1 million. Some banks also offer up to Dh2 million in personal loans for expats.

Fees/security cheques

These loans come with arrangement fees and/or service fees and a minimum salary requirement. Banks also collect a post-dated security cheque for the loan amount at the time of approval.

Salary transfer letter

If you are taking the loan from the bank where your salary is credited, the bank may ask for a letter from your employer to ensure end-of-service benefits will be paid into the same account unless there is a loan clearance letter from the bank.

Choosing the best loan for you

Interest-based payments

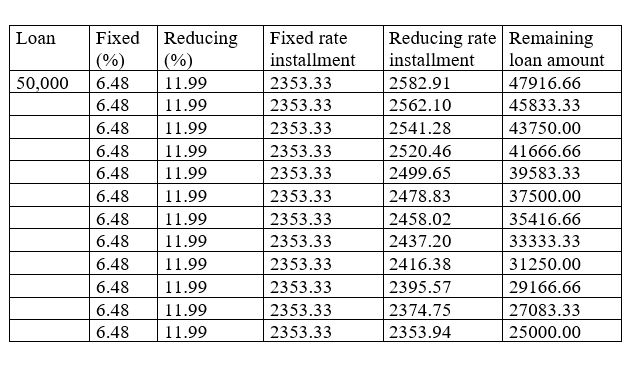

We have made a table to portray how payments would look like for one year if a person earning Dh8,000 wants to borrow Dh50,000 as a personal loan. The complete term here is 24 months i.e. 2 years. The rates, fixed rate at 6.48 per cent and reducing rate at 11.99 per cent per annum, are representative of average bank rates available in the UAE.

As one can see from this table, both interest rates have pros and cons.

In fixed interest, the rate of interest is low and the payable amounts are consistent until the end of the term. In reducing rate interest, the rate is higher and so are the initial installments but the amounts go down as time passes because the interest is charged only on your outstanding loan amount.

If one was to choose the full 48 months to complete payments, the monthly installments could go down to around Dh1,400 per month.

Fixed or reducing interest rate for personal loans?

The interest paid in a fixed rate scheme may seem more affordable at first glance but is not economically feasible if the loan term is longer as the interest paid will be very high at the end of the term even when your loan amount falls. However, if your loan term is short, around 1 to 2 years, fixed rate may be better since the rate is lower.

Also compare your bank’s rates with those of UAE’s Islamic banks. They follow Sharia laws in terms of profit rates, so rates might be lower.

Answers you need

Are the payments affordable given your current debt-income structure? Compute the total interest amount paid over the entire loan period for both interest rates and compare them to see where you can save money. Is there a better option – maybe your company can loan you interest-free funds?

Your own bank vs. a new bank

When we say your own bank, we mean the bank into which salary gets credited each month – the loan taken this way is called a salary-transfer loan. Taking a loan from this same bank has definite advantages such as better interest rates, easier processing, automated payments, etc. In addition to this, if your company is ‘listed’ with the bank, it can help ease restrictions on getting the loan. Listed companies, for banks, are credible and stable from a financial point of view, which can aid in loan processing for employees as well.

However, taking a loan from another new bank could be beneficial if they offer better benefits like discounts, better payback opportunities, points, etc. But the interest rates are almost always higher. Some banks approve loans only if salary transfer is done.

For instance, Emirates NBD has non-salary transfer loans available but the factors differ. Interest rates start at 14.99 per cent on reducing basis while minimum salary amount is Dh10,000. In the same bank, salary transfer loans feature reducing rate interest rates starting at 5.49 per cent and minimum salary requirement is Dh5,000.

Insurance coverage

Many loans come with inbuilt life insurance coverage in case of the unfortunate death of the customer, which covers the loan amount.

Some loans come with coverage in case of unemployment as well. If there is such coverage, there will be a charge applicable as a percentage of the loan amount. For example, Emirates Islamic charges 0.75 per cent of the finance amount as Takaful (Islamic insurance) fees.

Loan arrangement fees

Banks usually charge a non-refundable amount at the time of loan application as arrangement fees or processing fees. This is either charged as a percentage on your applied loan amount or as a fixed amount and may be clubbed with your total loan amount, which accrues interest. Sometimes the fee is interest-free and treated separately from the loan amount.

Dh 2500

Maximum loan arrangement fee that banks can charge

These charges are usually around 1 per cent of the loan amount and go up to 2.5 per cent. The amount cannot go over Dh2,500 for one loan.

Other fees

There are also other fees to be mindful of. Late payment of your due installment can cost you money so can using the facility to defer or postpone a payment. According to the Central Bank of UAE, all charges should be made available to the customer, so you have to read all the terms and conditions and ensure you know of every fee applicable to the loan

What if I lose my job?

As expatriates, losing one’s job can shift everything. A stable income is crucial in making those payments. However, your employment and your loan tenure are not related, unless the monthly installments are not paid for either three consecutive months or six non-consecutive months. In addition to this, some banks provide what is called a ‘credit shield’ – a partial insurance in case of inability to pay the outstanding amount.

Before taking the loan

Deferring payments

Some banks offer limited free deferral or postponement of monthly installment payments as part of their loan package while others charge a fee and a limit on such deferrals. Ask in detail about these before signing the loan document. If you happen to lose your job, you can defer payments this way for a couple of months so you get some breathing space while you find a new job.

Credit shield

Some banks charge a monthly amount as credit shield to cover payments in case of involuntary loss of employment, mostly for credit cards. However, this coverage varies from bank to bank and product to product. Before you sign the loan document or take a new credit card, ask about the credit shield (if any) and discuss the terms and conditions in detail. If possible, take the details to a legal advisor to understand protection as many situations may not be covered even while you pay the necessary fee.

If you were made redundant due to no fault of yours, this shield should ideally help you through hard times. However, knowing the exact conditions is key in making sure this shield is useful exactly when you need it.

During loan term

While you are in your loan term, save small amounts as possible as emergency cover for your loan installments. For example, if your monthly installment for a loan is Dh2,000, try and save Dh500 each month separately as emergency funds to cover loan installments. This would mean that every four months, you get enough to pay off one month’s installment in case something unexpected happens. If you lose your job at the end of the first year, by this calculation, you should have at least three months’ of installments stashed away.

Made redundant, then what?

According to the Central Bank of UAE, a bank’s loan and a customer’s employment status are not related unless the installment payments have been missed. Regardless of whether you are employed or not, the loan installments must be paid.

So if you lose your job but manage to pay your installment with saved money or benefits, your bank cannot question employment status. However, if your installments haven’t been paid for three consecutive months or six non-consecutive months, the bank can take action to collect funds.

If you feel you won’t be able to pay an installment, ask what the charge for a deferment would be and activate that instead till you collect funds for the next payment. This would count as a one-time bank-given facility and not non-payment.

So even before you come to a junction of job loss, constantly work towards being able to pay the monthly installments at all times.

I paid off my loan, now what?

It is not enough that you paid off your loan – there is a lot to do to end your loan relationship with the bank. Everything you did to secure your unsecured loan needs to be reverted back to you. For example, the security cheque given to the bank (which covers up to 120 per cent of the loan amount) needs to be cancelled and returned back to you.

If you initially provided a salary transfer letter from the employer to pay end-of-service benefits to the bank, get a bank clearance letter as soon as your loan is paid off. This can cost you around Dh60 but this is worth it when it comes to getting a clean credit report and ensuring no further problems arise after you pay off the loan.

For example, a small fee that accrues over time and adds up despite the fact that you have paid off your loan can affect your credit score. The terminology used can also affect your credit report – for example, the term ‘Write Off’ is used when the bank is either unable to get the loan paid back or when there is a mutual agreement between the bank and customer. No matter how small this ‘written-off’ amount is, it affects your credibility for future loans, credit cards etc.

Getting everything in writing and constantly checking your bank accounts can help you stay ahead of any discrepancies. A month or two after your loan is paid off, get a credit report for yourself to make sure there are no loose ends in your credit history.