A digital asset investor who goes by the handle Metakovan and refuses to give his full name, announced that he is the buyer of the a record-breaking $69.3 million digital artwork. Christie's auction house, which hosted the sale, confirmed his statement, also declining to reveal his legal name.

"I think this is going to be a billion-dollar piece," Metakovan says in an interview over Google Hangouts. "I don't know when."

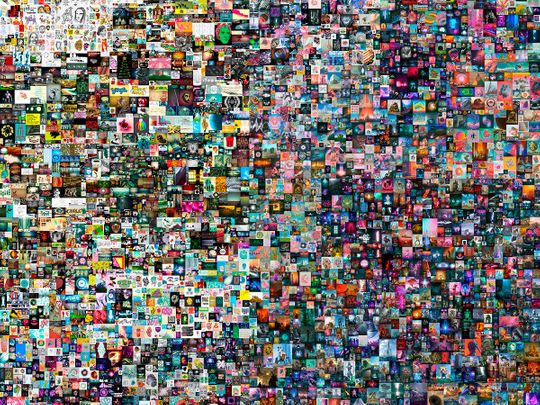

The work in question is a mosaic of 5,000 artworks made by Mike Winkelmann, who goes by the artist name Beeple.

Included in the mosaic are works including an image of Abraham Lincoln spanking a baby Donald Trump, a giant rabbit eating children on a playground, and a muscled Tom Hanks beating up an anthropomorphic representation of the coronavirus. The image file is connected to a non-fungible token (NFT), which was "minted" just last month, and serves as its certificate of authenticity recorded via blockchain technology.

The auction for Everydays: the First 5,000 Days opened for bidding on Feb. 25, and shot from $100 to $1 million in minutes. But it wasn't until the final 10 minutes of the sale on Thursday that the bidding action became particularly intense. The number quickly jumped from $14 million to $30 million. With seconds to spare, Metakovan placed the winning bid.

"It was excruciating actually," says a man who work with Metakovan and goes by the pseudonym Twobadour, and whose unofficial title is "the steward of Metapurse."

"It's an unfamiliar experience bidding on Christie's; it wasn't very gentle on the nerves," he continues. Of his role in the endeavor her says, "I try to look for really significant NFTs. Metakovan is the founder of Metapurse, and he puts his money where my mouth is."

"Twenty-two million visitors tuned in for the final minutes of bidding," says Alex Rotter, Christie's chairman of 20th and 21st century art. "There's a lot of excitement out there, but there's real interest, too. We had over 200 registrants for this auction that were really serious about it."

Metakovan intends to pay using Ethererum, the world's second-biggest digital coin; approximately 42329.453 ETH, according to a Christie's rep. Accepting crytpocurrency is a first the 254-year-old auction house and a major nod to the payment form's legitimacy. A 10:11 a.m. EST on Mar. 11, a short time after the lot hammered, Ether was trading at $1,815 to the dollar.

This isn't the first time that Metakovan has bought works by Beeple. In a January auction of original Beeple's art on the online marketplace Nifty Gateway, Metakovan purchased 20 images for a combined $2.2 million. He later fractionalized them. Currently, those works have a market cap of $163.5 million.In an interview a month before the Christie's auction, Winkelmann spoke of that sale: "One guy in Singapore made a bunch of username accounts named after Greek philosophers"-he tricked everybody and bought all 20 artworks," Winkelmann explained. "He then locked those [artworks] using blockchain into another smart contract, and then fractionalized them." (Winkelmann did not respond to requests for comment about the Christie's sale, though he did tweet something that cannot be reprinted.)

Money in context

Not only is $69 million the most ever paid for a digital artwork, it is the third-most expensive artwork to sell at auction for a work by a living artist, ever, just behind Jeff Koons and David Hockney. Taken out of the context of the art market though, that number is even more impressive.

That amount of money could buy you a collection of legitimate palaces in France, Ireland, and Italy, with about $30 million to spare; it could just get you the highly coveted Gulfstream G700, though let's hope you have enough money for maintenance and air time; or you could leave the money in a conservative index fund and let it appreciate. Left alone for a decade and assuming annual compound interest of 7%, your money would more than double to $135.7 million.

And yet given how wildly NFTs have been appreciating"-another one of Beeple's pieces was bought for $67,000 last October, then flipped four months later for $6.6 million"-the market would appear to also have the potential for outsize returns.

Metakovan, who says that he doesn't own a house, doesn't own a car, and "just tries to be physically light, so that I can pack and move around," hasn't yet sat down to admire the piece. "It is the most expensive purchase I've done," he says.