Dubai: My credit card was completely paid off in January 2019. “I will never use this again!” I told myself. Thinking that I was finally free, I made a firm decision not to use my credit card again. That resolve only lasted a few months.

How my debt built up again

I started using my card again. First I had to travel, so I decide to pay it with my card, to then pay it off immediately after! Then it was time to pay for all of my RTA fines. Then came the time to pay for my car insurance and then I took another trip. Then I had to renew my gym membership, followed by another trip. Every month, I would pay money towards my card but the amount I owed just never dropped. On the contrary, I felt like it was increasing.

By December 2019, I had amassed a debt of Dh13,700.

Important details

- The credit card has a Dh22,000 limit. That was the first bad idea. The limit was so high. This gives you the chance to spend more than your means.

- My card also had a Dh550 penalty if the full outstanding amount of each cycle was not paid before the due date. That was an important fact that I did not know – I was under the assumption that a minimum payment meant no penalty.

When the bank offered me that credit card, they mentioned low interest rates, no yearly fee and points that I could use to pay off basic expenses such as my phone bill, Salik bill and more. The penalty fee on the card’s monthly payments was something the bank did not explicitly tell me. However, I would have realised this much earlier if I had checked my statements with a hawk eye.

So, every month in addition to what I owed, my bank charged me an extra Dh550. Even if I paid back Dh2,000 or Dh3,000 a month to try and knock the debt down and without using the card, the amount just kept increasing.

When I called my bank to ask for help

“This is my current situation. I need you to tell me what to do.”

Different people at my bank had several suggestions that would help me pay off my card debt.

1. Take a loan

Multiple customer service representatives at my bank recommended that I take a personal loan to pay off the Dh13,700.

Being a personal loan, the payback term offered was 12 months at a specified profit rate. I would also have to pay a Dh1,100 service fee to the bank that I could choose to pay ahead of the loan. If I paid this in the beginning in full, my monthly payments would be Dh1,193.33 for a year (including profit rate).

If I chose to pay the service fee (Dh1,100) across 12 months instead, at Dh91.66 per month, my monthly payments would be Dh1,284.9 (including profit rate and service fee).

The benefit: I could pay off the entire outstanding amount and not have to worry about getting anymore late payment fees.

The disadvantage: I would be stuck paying off another debt for 12 months plus my total payback on the loan would be Dh14,319.96, which is an additional Dh619.96 (as profit to the bank) along with the Dh1,100 service fee for the loan.

2. Just pay it off with your own plan

Another customer service rep told me that I could pay off my outstanding amount in 6 months, if I simply divided the Dh13,700 by 6 months. This comes up to Dh2,283, but he said to also make sure to add the late fee of Dh550 every month, so my monthly payment would have to be Dh2,833 a month.

The nerve of this guy. Trying to convince me to pay off my credit card, while also giving the bank a ridiculous fee of Dh550 a month. Instead of paying off Dh13,700 I owed, I would have ended up paying Dh17,000 – an additional Dh3,300 over 6 months. I wish I could have called him back and given him a piece of my mind.

3. Installment offers

Many banks have offer based 0 per cent installment payment plans that you can use to pay off your credit card. I asked a few times, but my bank did not have an ongoing offer.

4. Cash on card

This option was not recommended by anyone from the bank. Since my card had a limit of Dh22,000 and I had already used Dh13,700, I had available balance of Dh8,300. The bank said they could give me a cash on card facility to take the rest of my credit card balance as a cash transfer into my current account.

On this facility, I would have to pay back in monthly installments with a fixed fee of Dh39. I could also pay off this small card loan in full without incurring any early cancellation charges.

Here is what I did

Taking up option 4, I transferred the available balance Dh8,300 to my current account. I had Dh2,000 saved up the previous month and now, all I had to do was wait for my salary to come in on December 28.

I used the card’s cash of Dh8,300, added in Dh5,400 from my salary and savings to pay off the entire credit card debt of Dh13,700 in one go. This outstanding balance that accumulated and built up over months of minimum payments and fees was obliterated once and for all.

I still have to pay off Dh8,300 that I took from my credit card balance but other than Dh39 in fixed fees each month, I pay only what I owe in small fixed monthly installments and no penalty fees.

The benefit of cash on card

The money I used to pay off my credit card is 0 per cent interest rate plan, but there was a monthly fee of Dh39. I decided on a six month plan, so that I could be completely debt free by July 2020. My monthly cost is Dh1422, i.e. Dh1,383 + Dh39 (the service fee). I also called my bank and activated a standing instruction to withdraw the Dh1422 by my due date every month until July.

I have not used my credit card since December 2019 and am paying my outstanding amount without any interest or late fees, thanks to this payment plan.

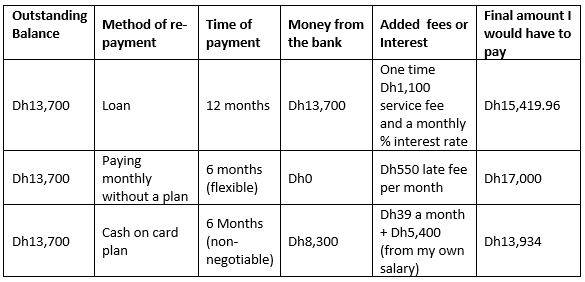

Comparison table

Winner: Cash on card

I am now on my third month paying off the cash on card amount with just Dh4,200 left, to be completely debt-free.

I was a winner with cash on card plan because I used Dh5,400 from my pocket to repay part of my debt. It works only if you have the resources to cover that gap.

In most cases, cash on card comes with a one-time fee in addition to the monthly charges. If you get money from card without any charge that is a good deal. I need to make sure that my total repayment was only Dh8,300+Dh234 adding up to a monthly installment of Dh1422.33 for a 6-month repayment plan. Always double check, never presume.