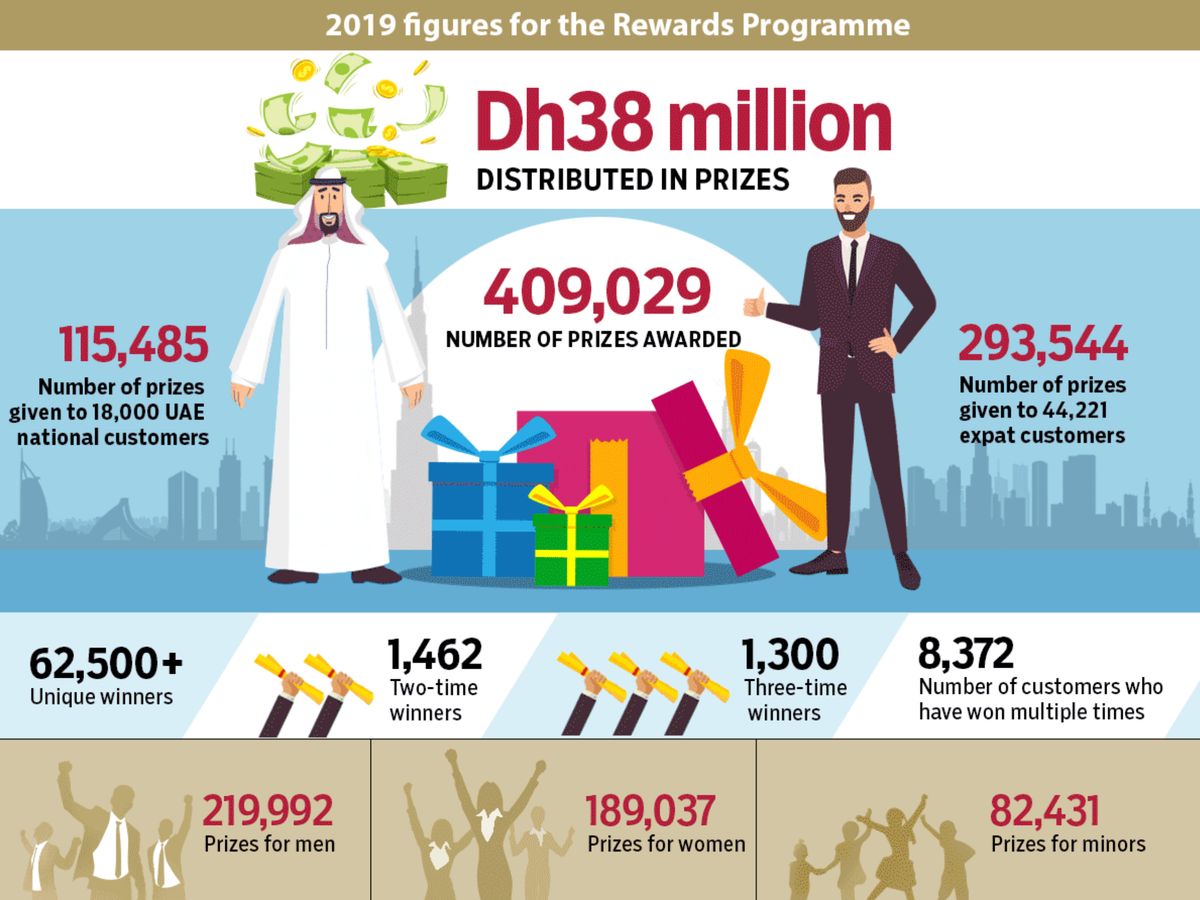

National Bonds is ending the year on a high note, having brought a smile to more than 62,500 UAE residents through its Rewards Programme. Some of them have won cash prizes not just once but twice and more, taking the total number of rewards distributed by the corporation to 409,029 in 2019.

Indian expatriate Roschelle D’Costa and her family are among those who got lucky twice this year. A HR business partner at a pharmaceutical company, Roschelle couldn’t believe she had won Dh10,000 in the December draw hot on the heels of her daughter’s prize. “As a family, we have been investing in National Bonds for the past five years, and a couple of months back our four-year-old daughter, Kiara had won Dh10,000,” she says.

Earlier this year, her husband, Kenneth, who had an investment plan with National Bonds, moved his portfolio to Roschelle and their daughter believing them to be luckier with the draws. Providence proved him right.

“We must have won a total of Dh25,000 to date,” says Roschelle. “And we are hopeful we will win the big prize 1 million dirham someday.”

So is Najoua Yahyaoui, a Moroccan flight attendant with Flydubai, who has been saving with National Bonds since 2014. This December brought her a lot more than the Dh50 she’s been winning on and off - bonds worth Dh10,000. But she has other things on her mind.

“I am actually waiting for the million,” she says.

Prizes galore

The million she is referring to is part of the two mega prizes that National Bonds gives away at the beginning of every quarter - Dh1 million each in draws for UAE nationals and expatriates. In October Amira Kashwani and Yasar Abu Hejleh joined six other winners to make up the eight National Bonds millionaires for the year.

But it’s not just the mega prizes that make the corporation’s Reward Programme so popular. Every month, there are a host of prizes up for grabs, the highlight being the two draws of Dh100,000 each, again one allocated for UAE nationals and one for expats. British expat A.R. and UAE national G.H., who is a minor, won the mega prizes for this month.

This year we have distributed Dh38 million in prizes to our customers, higher than the previous years. We are pleased that people are realizing the importance of savings and working towards that.

Exclusive rewards

What sets National Bonds apart are exclusive rewards for categories such as women, minors and regular savers, making sure that everyone stands a fair chance to win. Special attention is given to women as they deserve the extra attention be it as housewives or career-driven women. Moreover, saving for children's future becomes more rewarding for parents with National Bonds having dedicated prizes for them. There are two exclusive draws of Dh10,000 each for women, two for Dh10,000 each for minors, 15 exclusive draws of Dh10,000 each for regular savers (people who have a monthly saving plan with National Bonds) and 40,000 draws of Dh50 each, divided among various categories, every month.

Naturally, the cash rewards add up to a huge number over the 12 months.

“This year we have distributed Dh38 million in prizes to our customers, higher than the previous years,” says Mohammed Qasim Al Ali, Chief Executive Officer of National Bonds. “As per our latest Savings Index, 92 per cent of UAE residents surveyed planned to start savings in 2019, up from 73.5 per cent last year. We are pleased that people are realizing the importance of savings and working towards that. Our Rewards Programme gives an excellent incentive for people to make savings a habit, which would help secure their future and provide a safety net in case of emergencies.”

Stress on savings

Mohammad Samarah, Assistant Engineer with Al Ain Distribution Company, insists his purpose behind investing in National Bonds was to save money. “I wasn’t looking to win prizes,” says the Jordanian expatriate.

Winning Dh10,000 this December was of course welcome, but having spent money like water in the past, Samarah had realized the significance of putting away some for a rainy day.

Roschelle couldn’t agree more. “Saving is more of a necessity and if you are habituated towards keeping some money aside, it becomes a routine.”

It’s all the more important for expatriates, she explains, as without adequate savings, they will have no means to support themselves when they return to their home countries.

That’s why Roschelle and her husband started looking for saving plans. In their research, National Bonds stood out for being safe with promising returns. “It has structured plans that help you make a start. Sometimes making the first investment is what sets the whole process in motion.”

For Najoua, it was the fact that her account was wiped clean by the end of every month that triggered a bit of soul-searching. Eventually, when her loan closed, she decided to start a monthly saving plan with National Bonds.

“It’s a good solution for me,” she says. Putting money away in bonds means it stays there, she adds, as withdrawal is a long process. “If it was in my account, I would have spent it.

“It’s safe. And it’s there when you need it.”

Over the past five years, Najoua has dipped into her savings twice to meet emergencies.

More than the cash rewards it’s this financial freedom and the ability to realize your dreams with your savings that draw people to National Bonds. “Saving in National Bonds has allowed me to purchase a flat in Dubai,” says Samarah with pride. “I intend to renew my monthly plan next year and increase the allocation from my salary.”