Singapore gets a boost in the electric car making drive

Home appliances brand Dyson picks island city as its location for new venture

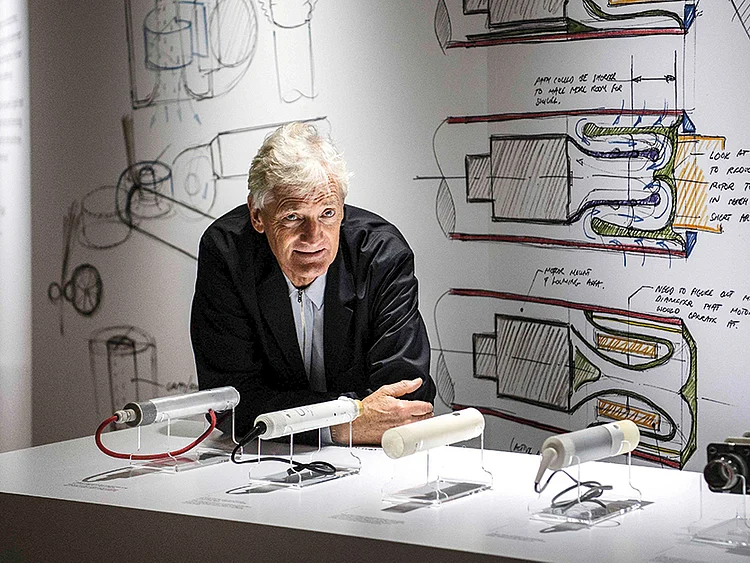

Singapore: When James Dyson, the billionaire British inventor of the bagless vacuum cleaner, unveiled a plan to build an electric car plant in Singapore, it raised a few eyebrows.

Not only does the land-starved city state have some of the highest average salaries in the world, but it has been nearly 40 years since Ford closed its factory in Singapore, effectively ending car production on the island. “It is a bit of a surprise because of the cost base and no other car manufacturing plant being here,” said Shantanu Majumdar, regional director at consultancy JD Power.

Dyson said the decision was based on supply chains, access to markets and the availability of expertise, which offset the cost factor. But what other factors could have influenced the decision?

Why not head straight to the biggest electric vehicle market in the world, China, like rival Tesla? Here’s a look at some of the less obvious pros and cons:

1. High costs vs generous incentives compared with other global cities

Aside from its skilled engineers and scientists, for a high-tech firm like Dyson, Singapore offers generous incentive schemes. Some schemes include tax breaks for five years, which can be extended, and grants that can cover up to 30 per cent of the cost of projects to improve business efficiency.

To shore up productivity in its manufacturing sector, which makes up less than a quarter of its output, Singapore has focused efforts on attracting high-end manufacturers and those who adopt automated production processes.

2. Small market vs China gateway

Dyson may have decided to make electric cars in Singapore, but few are likely to be driven there or anywhere in Southeast Asia for that matter. The number of privately owned electric vehicles in Singapore is in single digits, and Tesla CEO Elon Musk has criticised Singapore for not being supportive of electric vehicles.

Singapore is one of the world’s most expensive places to own a car because the government strictly controls the vehicle population by charging owners a variable rate for the right to own and use a vehicle for a limited number of years.

In the broader Southeast Asia, only 142 electric vehicles are forecast to be sold this year, data from consultant LMC Automotive shows.

By contrast, sales in China are forecast to almost reach 700,000 vehicles this year, more than double the combined sales from the US and Europe.

But with one of the world’s busiest ports on its doorstep, Dyson can roll a car off the production line in Singapore and within the hour it can be on its way to China or other sizeable electric vehicle markets like South Korea or Japan.

Dyson products — which also include bladeless fans, air purifiers and hair dryers — are becoming a premium brand in China and other Asian markets. Asia accounted for more than 70 per cent of its growth last year, the firm said.

3. Familiarity vs New Frontier

Dyson’s history with Singapore probably also played a role. It already employs 1,100 people in Singapore, making 21 million digital electric motors a year. It also has manufacturing hubs in Malaysia — connected to Singapore via two road bridges — and the Philippines.

“This is obviously a surprise but since Singapore is at the heart of Southeast Asia, Dyson would be best placed to source many components from neighbouring countries and, locally, assemble and manufacture the high-tech car here,” said a corporate banker who deals with multinational firms in the region.

Another option for Dyson could have been to follow rival Tesla to the biggest market, China.

By the time Dyson’s first car is ready in 2021, Tesla may already be selling locally produced cars in China after it signed a deal with the Shanghai government for an 860,000 square metre plot to build its first overseas Gigafactory.

But China is becoming a crowded market for making electric vehicles and the government is reining in subsidies.

Meanwhile, Singapore does have an extensive free trade agreement with China, which lists various car types and car parts in its tariff-reduction schedule. However, Singapore’s Ministry of Trade and Industry said electric vehicles were not covered under the existing arrangement.

That means Dyson’s vehicles would be subject to 15 per cent import tariffs in China, imposed on all autos shipped from countries other than the US.

JD Power’s Majumdar said intellectual property would be another consideration for Dyson. “Intellectual protections are very strong in Singapore. It is definitely an advantage. When you are in China ... you may not be so comfortable on that part.”

— Reuters

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox

Network Links

GN StoreDownload our app

© Al Nisr Publishing LLC 2026. All rights reserved.