When 'green' financing turns sustainable

Funds must reach initiatives that actually tick sustainable development targets

The urgency to address climate change has caused investors to put sustainability and Environmental, Social and Governance (ESG) practices at the heart of their business strategy.

Both regulators and government authorities have also began introducing a series of nation-wide sustainability initiatives aimed at reversing the consequences of climate change and have called on institutions to champion these agendas. This increased support has helped to drive a paradigm shift from “green” to “sustainable” to encompass an entirely sustainable agenda.

We are now seeing considerable efforts towards gauging investors’ and institutions’ interest in pursuing sustainable practices and introducing comprehensive sustainable agendas. One method of ensuring that financing activities reflect the full range of sustainable activities is by combining the underlying principles of doing less harm and striving to do better.

For example, the Equator Principles, chaired by Standard Chartered, have been adopted by over 100 international financial institutions and require the implementation of a broad range of environmental and social criteria.

However, some institutions are wary of adopting green finance measures, as they may be subject to additional costs, such as reporting on metrics. Although one solution is to incentivise through pricing, this is not a sustainable, long-term fix. Therefore, financers and investors must look to reap the intangible benefits of these investments.

This may become more relevant as regulators begin to consider scenario analyses around climate risk.

Thwarted intentions

Another suggestion is to advocate for increased cooperation between public and private sector organisations. This would ultimately lead to a knowledge exchange in the implementation of sustainable practices.

Credibility remains the overarching challenge faced by the entire sustainable finance market. Since the inception of the green bond market, there have been several cases of “greenwashing”, where funds designated for green activities have not been used as expected.

The use of frameworks to clearly define what an organisation views as credible sustainable finance activities is an important tool to avoid greenwashing and achieving the SDGs. Detailed methods of reporting and measuring should be used to instil confidence in investors regarding sustainable finance measures, as well as utilising covenants that are specifically related to sustainability.

Enforceable ways

The underlying assurance that funds are being used as intended must also come from quantifiable reporting practices. Likewise, measurements should be made using the most current science-based methodologies, which must be made available where possible to ensure confidence throughout the process.

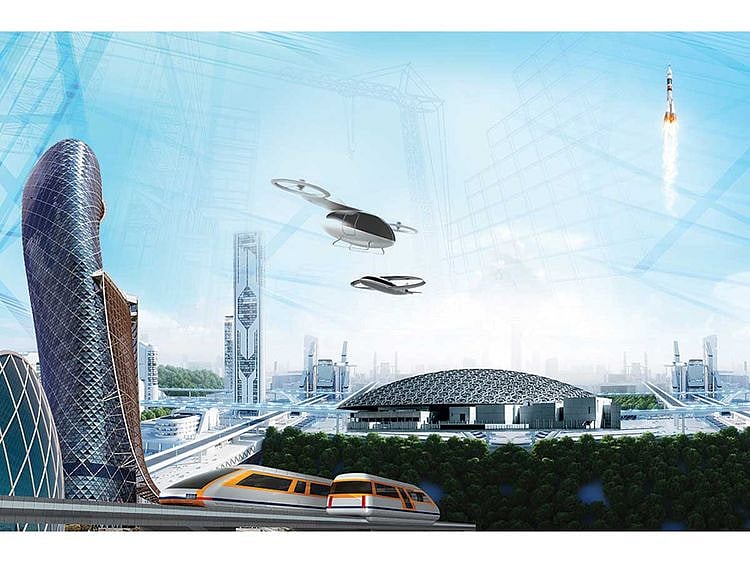

To meet the SDG targets by 2030, it is estimated that emerging markets need an annual investment of $2.5 trillion, with a large portion of this investment focused on the Middle East. The region is home to some of the key sustainable development opportunities, with an estimated annual financing gap of over $100 bn in the Middle East.

For the goals to be met by 2030, investors and banks need to coordinate and connect capital to promote sustainable development.

Serious money backing the goals

Countries in the region have geared up to meet the global SDGs goals and have been championing the fundamentals of sustainable finance. Saudi Arabia last year implemented a $28 billion renewable energy development programme. The programme offers loans for clean energy projects and the manufacturers of renewable energy components.

Additionally, the Saudi Industrial Development Fund’s Mtujadeda was created to help the Kingdom move away from its dependence on oil, towards other diversified energy sources.

Another notable example is the recent roundtable session conducted by Standard Chartered and Abu Dhabi Global Market (ADGM), Abu Dhabi’s International Financial Centre, which brought together over 25 participants from the finance, government, industry and legal sectors to discuss what needs to be done in order to achieve the SDGs in the region, promoting the UAE as sustainable finance hub for the entire region.

Similarly, in July 2018, the Bank was the “Green Loan Coordinator” for the launch of DP World’s market in the Middle East, linking the pricing to the company’s carbon intensity ratio.

Heightened priority

There are several other recent efforts in the UAE and the wider region that have sought to tackle the broad range of SDGs. Etihad Airways, the UAE’s national carrier, for example, took a 100 million euro loan to fund a project linked to the SDGs goals.

The movement towards renewable energy has also been gaining momentum in the Middle East and it is an equally appealing area of focus for financial institutions. Solar energy has continued to grow in the region since Masdar inaugurated what was the world’s largest concentrated solar power (CSP) plant at the time – Shams Solar Power Plant – in 2013.

The plant, which remains one of the world’s biggest CSP projects, has paved the way for additional renewable energy capacity in the UAE, most notably with the recent development of the Mohammed bin Rashid Al Maktoum Solar Park in Dubai and the completion of the Noor Abu Dhabi solar power project, and the country’s climate lends itself well to the technology. Islamic finance is a particularly useful mechanism for the UAE.

Ultimately, the paradigm shift from green to sustainable finance has served as a catalyst to the achievement of the SDGs. However, there lies a significant gap at this point in time – a gap that financial institutions and government authorities together must work to address through the adoption of an entirely sustainable agenda.

- Sunil Kaushal is Regional CEO for Africa and Middle East, Standard Chartered.

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox

Network Links

GN StoreDownload our app

© Al Nisr Publishing LLC 2026. All rights reserved.