Visa’s crypto chief aims to leverage $2 trillion 'stablecoin' era

Can stablecoins offer faster and cheaper alternatives to traditional platforms?

For decades, Visa Inc. has stood at the center of global payments, with its network facilitating trillions of dollars in commerce each year.

Now, as stablecoins rocket into the spotlight touting faster and cheaper alternatives to traditional platforms, the company faces a pivotal test: ensuring they enhance — not erode — its core business.

Enter Cuy Sheffield, Visa’s head of crypto.

Over the past year, Sheffield’s team has expanded the company’s stablecoin settlement business, partnered with a major bank on issuing its own tokens and inked deals with fintech firms globally.

Visa stablecoin?

Visa has been discussing stablecoin strategies with banking partners and hasn’t ruled out the possibility of launching a stablecoin of its own in the future, according to people familiar with the matter.

“This is just another mechanism for value exchange,” Sheffield said of stablecoins broadly, in an interview from Visa’s offices in San Francisco. “I see it massively expanding our addressable market.”

Pegged to the US dollar

Many analysts agree that this new form of money — cryptocurrencies typically pegged to stable assets like the US dollar — may represent an opportunity for Visa rather than an imminent threat.

While stablecoin payments are theoretically cheaper than card fees, they still require services like fraud detection, dispute resolution and compliance checks, as well as connections to existing bank-payment systems and fiat currency conversion.

Instead of betting solely on a future where money flows are rewired completely, Visa is positioning as a "bridge", using existing infrastructure to help bring stablecoins into the mainstream by for merchants and consumers.

Big opportunity

“They are going after the land grab of empowering every possible stablecoin platform with a payment capability,” said Richard Crone, chief executive officer of payments consultant Crone Consulting LLC.

“This is a really big opportunity.”

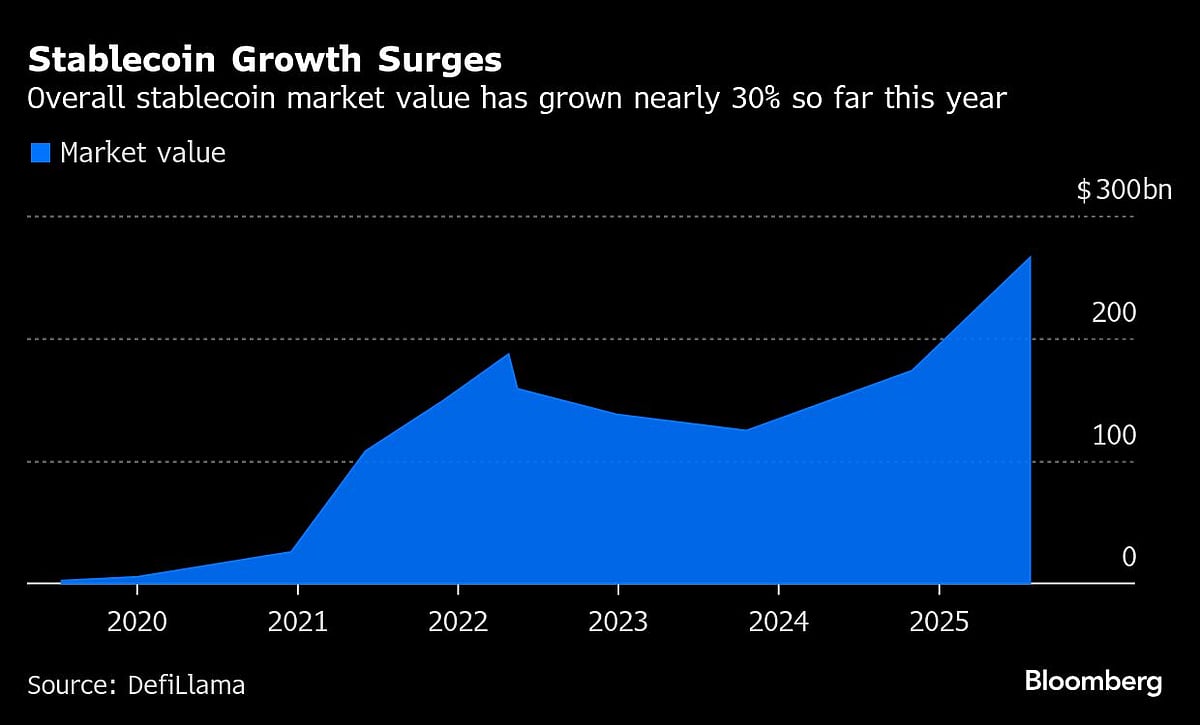

The stablecoin market has grown 62% over the past year to reach nearly $269 billion, according to tracker DeFiLlama, and could expand to as much as $2 trillion within the next three years, according to Standard Chartered Bank.

Still, they facilitate only about $30 billion of transactions daily, less than 1% of global money flows, according to a recent report by McKinsey & Co.

“I don’t think it’s as disruptive as people think it’s going to be,” said Matt Higginson, who leads McKinsey’s blockchain initiatives globally, referring to card networks.

Better payment network

“They are looking at this and asking ‘Is there a way of enlarging our market share to essentially create a better payment network than exists today.’”

Visa remains a powerful incumbent, even as it faces some structural headwinds, including regulatory pressure to reduce swipe fees.

Its stock rose 30% over the past year, with revenue growing 14% to $10.2 billion in the third quarter.

In the longer term, however, the impact from stablecoins is more uncertain.

Competition

As regulators introduce clearer rules and giants like PayPal Holdings Inc. and Stripe Inc. — both of which work with Visa on stablecoins — expand their stablecoin businesses, competition is expected to intensify.

Particularly in the US, where the Genius Act could further accelerate financial institutions’ activity in the space.

While Visa may play a key role in early adoption, stablecoins ultimately let users send money without intermediaries — including card networks.

“In the very long run, stablecoins may replace the future opportunities of the legacy Visa business and eventually supplant network operators,” said Lex Sokolin, managing partner at Generative Ventures.

“But Visa can disrupt itself.”

Combining two worlds

That’s what Sheffield’s work could achieve.

The 34-year-old joined Visa in 2015 after the card network acquired promotions platform TrialPay, a startup he got a job at right out of college.

He was living in San Francisco, working on Visa’s offers and loyalty team during the day and going to crypto meet-ups at night.

“It was so clear the future would be the combination of the two,” Sheffield said. “I said: ‘I want to spend the next decade of my career making the intersection happen.’”

Much of his work now focuses on stablecoins and some of it is centered around the so-called Visa Tokenized Asset Platform. Launched in 2024, the system enables financial institutions to issue and manage tokens on blockchain networks.

Notable clients include Spanish bank BBVA, which is using the platform to create tokens on Ethereum, with live pilots expected this year. Visa is in talks with other global banks on stablecoin work, Sheffield said.

Visa declined to disclose the financial terms of these commercial relationships.

Sheffield’s team also oversees Visa’s stablecoin settlement services, which it has been rapidly expanding in recent years. The service allows clients to fulfill their VisaNet obligations in stablecoins, which means settlement can happen as often as seven days a week.

Earlier this year, Visa partnered with Rain, a US-based fintech that issues credit cards backed by stablecoins. “Visa has taken a very aggressive approach to stablecoins,” said Farooq Malik, Rain’s CEO. “Other networks have been a little more hesitant.”

Today, Sheffield reports to Rubail Birwadker, Visa’s global head of growth products and strategic partnerships, who reports to Chief Product and Strategy Officer Jack Forestell, who sits on the company’s executive committee.

Stablecoins remain a small but growing part of Visa’s business. Its seven-day-a-week stablecoin settlement recently surpassed $200 million in cumulative volume.

That’s tiny compared to the $16 trillion in payments and cash volume Visa processed last year.

New markets

In emerging economies, where access to cards and traditional banking is limited, analysts are bullish about Visa’s opportunity to grow.

In June, Visa inked a deal with Yellow Card, a stablecoin payments company that operates globally, including many African countries. They’ll explore stablecoin use in treasury operations, liquidity management, and crossborder transfers.

“Stablecoins natively could become the default for international payments outside of the US, which is why Visa is investing heavily and working with companies like ourselves,” Yellow Card’s CEO Chris Maurice said in an interview.

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox

Network Links

GN StoreDownload our app

© Al Nisr Publishing LLC 2026. All rights reserved.