Energy sector deals with risk

Regional companies turn to enterprise risk management solutions

Dubai: Regional energy companies are showing "tremendous interest" in using Enterprise Risk Management (ERM) solutions to face what they deem top risks by way of human resource issues, geopolitical tensions, product development hassles and asset performance issues, a Deloitte and Touche Middle East analyst told Gulf News.

ERM's importance has grown after the financial crisis and the recent BP oil spill in the Gulf of Mexico.

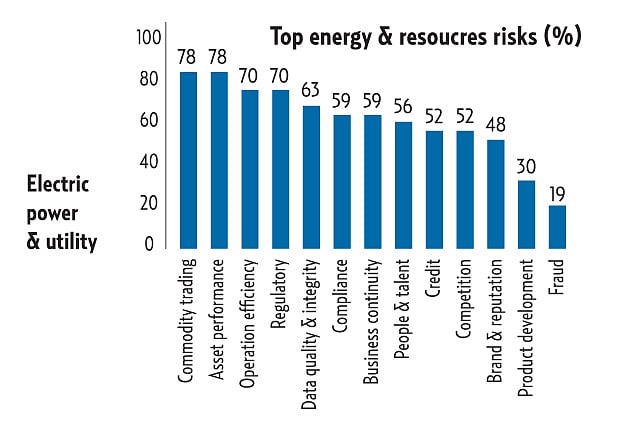

An ERM Benchmark Survey released yesterday by Deloitte, the financial advisory firm, showed that 95 per cent of international energy and resources companies used risk management solutions and expanded ERM scopes towards enterprise-wide management practices.

In comparison, the number of energy companies in the GCC and Middle East using risk information is "much smaller" and there is "tremendous" variety in the maturity of ERM programmes, according to Dr. Patchin Curtis, Leader of the Middle East ERM Centre of Excellence at Deloitte.

One the top risks facing respondents from the Middle East is geopolitical tension, she said. Most of the oil is transported through the strategically critical but narrow Strait of Hormuz. Though some GCC countries have alternative routes, the risk is "significant" for the entire oil-producing Gulf region, she said.

Paucity of talent

Regional energy companies are also facing the risk of shortages in experienced talent, ageing infrastructure, increasing plant capacity, and identifying the right products to develop, she added.

The survey indicated the top reasons driving ERM globally are improving operational performance and complying with strategy.

In the Middle East, the main reasons include meeting initial public offer requirements, regulatory compliance with environmental and safety standards, maintaining a desirable public image, gaining competitive advantage, and operation efficiency, Curtis said. Also important is ensuring business continuity with protection against natural disasters.

Management can use risk information to understand how a blow to one business unit can affect others in a "cascading effect" and to understand the interdependency and interaction between them, she added.

Developing a risk aware culture in the current economic climate is essential, she said.

"With the financial downturn and [the state of] the real estate and financial sectors there's been a real wake up call, so it's easier to bring home to people the point about risks. ERM provides companies with systematic ways to build risk awareness and take concrete actions to manage risks," she said.

Though BP had an ERM programme in place they did not seem to heed the warnings, she said. Having ERM provides a company with risk-analysis for informed decision-making but if it doesn't prevent it from making a wrong turn or ignoring the data. "There are no more excuses for bad decisions."

Leading energy company CEOs in the GCC are starting to use ERM in strategy-making and unrewarded risks such as IT security and financial reporting, but the programme is still in its infancy, she said.

The problem is that most regional companies are using ERM to simply identify and assess risks without taking this a stage forward to monitoring and reporting risk, Curtis noted.

This leads to what she calls "analysis paralysis," or failure to take action based on the identified risks — a rut that many GCC companies are stuck in.

The Deloitte survey covered energy and resources companies in Europe, Middle East, and Africa. Since the Middle Eastern respondents constituted only six per cent of the total respondents there were no statistically significant numbers available for the region, according to Curtis.

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox

Network Links

GN StoreDownload our app

© Al Nisr Publishing LLC 2026. All rights reserved.