Travel sector 2025 forecast: Industry eyes India, China for major gains despite geopolitical “noise”

North America faces signs of a slowdown despite positive global trends, says GHA CEO

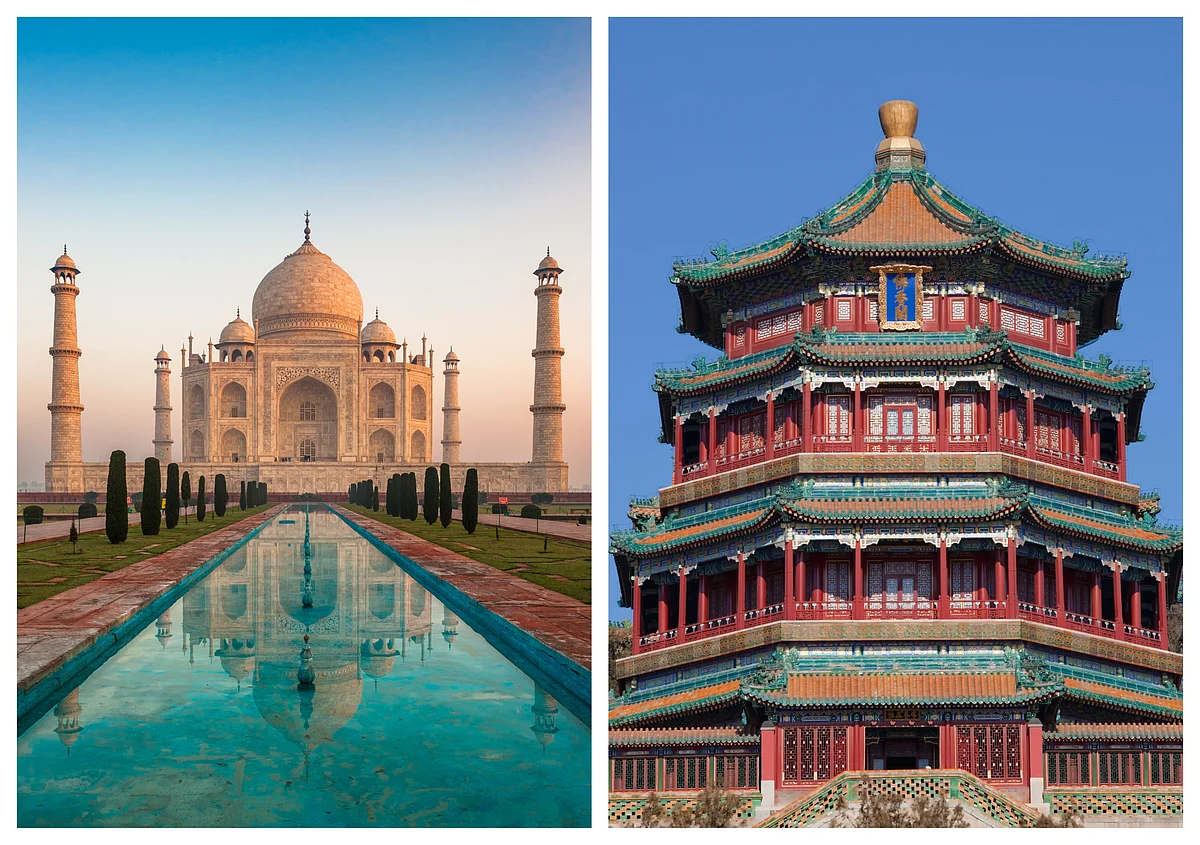

Dubai: The global travel and hospitality sector is set for steady growth in 2025, with India, China, and other emerging markets leading the charge despite geopolitical uncertainties, an industry veteran has said. Chris Hartley, CEO of Dubai-based Global Hotel Alliance (GHA), said that while mature markets like Europe and North America remain stable, future growth will primarily come from Southeast Asia and South America.

"China has taken a long time to recover, but it is now in full recovery mode. We also see a huge upside in India over the next few years," Hartley said. "Emerging markets like Indonesia present strong business potential, particularly in Southeast Asia, but there are also opportunities beyond.”

Countries like Vietnam are rapidly becoming travel hotspots, while South American destinations continue to gain momentum. "If you’re looking for long-term growth, watch the recovery of China, the travel boom from India, and the rise of new destinations across Southeast Asia," Hartley added.

GHA, the world’s largest alliance of hotel brands, operates on an airline alliance model. Hartley’s remarks follow GHA’s announcement that it has onboarded Rotana, one of the UAE’s largest hotel brands, as a member. Hartley said this move gives the 30 million members of the GHA Discovery loyalty program access to 80 new properties across the Middle East, North Africa, Eastern Europe, and Turkey. “With Rotana joining, we will be close to 950 hotels, and we have high hopes to hit 1,000 hotels very soon,” he said.

The group expects to surpass 1,000 hotels by 2026, driven by increasing demand for flexible loyalty programmes. “It is an exciting time for loyalty programmes in general, which are very much at the heart of the growth of the hospitality sector because that's what engages consumers with hospitality brands,” stated Hartley.

North America slows down

While Europe and North America are expected to maintain solid performance, their growth rates are slowing due to economic caution and geopolitical uncertainty. And despite positive global trends, the North American market faces signs of a slowdown.

"By the end of last year, we were already seeing signs of softening demand, with 2025 growth forecasts at just 1 per cent in RevPAR (Revenue Per Available Room)," Hartley explained. With rising operational costs and inflation, such minimal growth translates to a decline in profitability. North America had already entered 2025 cautiously, and geopolitical uncertainty and disruptions linked to the current US administration have only added to the sentiment.

For example, Delta Airlines recently issued a profit warning, citing a slowdown in air travel demand. However, Hartley remains optimistic about international travel, which continues to show resilience.

US travel to UAE stays strong

That said, despite economic concerns in North America, US demand for UAE-bound travel remains steady, said Hartley. “So far, demand from the U.S. has been strong in Q1," Hartley noted. “We don’t track individual traffic numbers, but international demand from the U.S. has remained stable.”

Historically, American travellers favour Europe during the summer, particularly destinations like Greece, Spain, Portugal, and Italy. Demand for the UAE tends to rise later in the year, and Q1 performance has already been strong, particularly in Dubai. Hartley attributes this success to Dubai’s packed event calendar, particularly in February when major events like Gulfood attracted large crowds. "With Ramadan and Eid in March and an active events season in April, we expect momentum to continue," he added.

GHA’s expansion plans

While GHA has a sizeable presence in the UAE, its focus is now on filling gaps in other regions. The alliance recently onboarded Malaysia’s Sama Hotels, Sri Lanka’s Cinnamon Hotels, and brands in Norway and Greece—key markets for international travellers.

Hartley explained that GHA is actively expanding in India and seeking partnerships with local brands to strengthen its presence. Like its recent deal with Adeera Hospitality in Saudi Arabia, GHA anticipates new local brands emerging in India as investment in the sector grows alongside inbound travel.

“Our goal is to reach 100 hotels in India over the next three to five years, up from the current 15. The market’s scale and outbound travel potential—second only to China—present a significant opportunity,” said Hartley.

GHA-branded credit card

GHA has also partnered with MasterCard to launch its first co-branded GHA Discovery credit card in early 2026, following Rotana’s integration. This marks GHA’s entry into the competitive credit card loyalty space.

Hartley said the company is currently in talks with multiple banks and will select a partner in the coming months.

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox

Network Links

GN StoreDownload our app

© Al Nisr Publishing LLC 2026. All rights reserved.