Rising oil could trigger food price spiral

An expected increase in crude oil prices over the next four months will drive up the prices of gasoline and basic food, economic analysts say

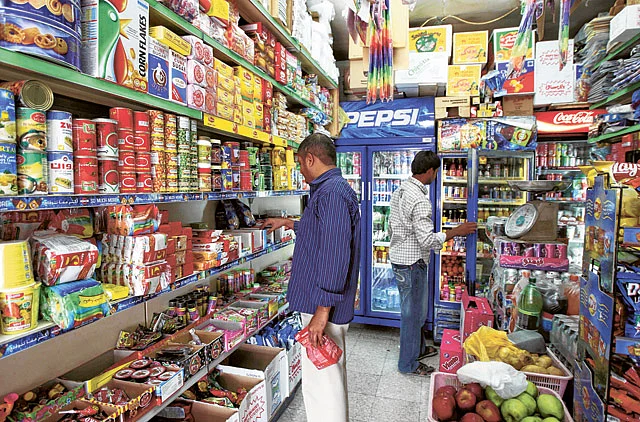

Dubai: An expected increase in crude oil prices over the next four months will drive up the prices of gasoline and basic foods but the continuing drop in rents should ease the burden on consumers' wallets, economic analysts say.

The retail price of gasoline is expected to rise by 10 per cent to 15 per cent within the next three to four months as crude oil is anticipated to reach $110 (Dh404) to $120 per barrel, said Sajith Kumar, chief executive and director at JRG International Brokerage DMCC. Current prices are around $90 a barrel, he said.

The prices of essential food items like grains and vegetables may rise by up to 30 per cent in the UAE as energy and utilities costs pressure producers while global commodities prices rise to new highs in 2011, analysts say.

"Food production is a very energy-intensive process. The rice you see in a bag goes through a lot of stages. If oil prices go up, it's going to be seen in prices of goods you buy. If the good is a necessity and there's not substitute for it, producers can pass that extra cost onto the consumers. You're just stuck with it," said Dalton Garis, an Associate Professor of Economics and petroleum market behaviour at the Petroleum Institute, Abu Dhabi.

The spiral of rising prices and costs can cause inflation as the UAE relies on food imports, he added.

Madness

The rise of meat and chicken prices in Australia, Brazil and India by 25 per cent will be passed onto consumers in the UAE, said Hamed Badawi, deputy CEO of Al Islami Foods.

The increased price of energy has led to the use of corn to make bio-fuel instead but this has reduced the supply of corn for chicken feed, he said. Feed makes up 60 per cent of the price of chicken and the corn shortage has forced poultry suppliers to hike prices, he explained.

"All over the world, farmers are paid to grow crops for fuel. It's madness," said Kate Durian, editor of Platts, a global provider of energy information.

Higher electricity costs also mean it has become more expensive to refrigerate the imported products, Badawi said. Dewa announced a 15 per cent increase water and electricity tariff on the minimal consumption starting January 1.

"Definitely the price increase will be passed on to consumers because the producer cannot bear it. If it's just 5 per cent we can absorb it, but not a dramatic increase," he said.

Prices are set to rise over the next six months, Badawi added.

The UAE is susceptible to global commodity prices as it imports most food products.

World food prices rose to record levels in December with higher sugar and meat costs, according to the latest United Nations report. The UN Food and Agriculture Organisation's (FAO) Food Price Index of 55 commodities climbed for six months to 215 points to beat the all-time record of 213.5 points in June 2008.

Sugar rocketed to 398 points in 2010, continuing a three-year upward trend, the report showed.

Pepsi and Coca-Cola, which use sugar as a main ingredient, have already pushed up their prices by 50 per cent starting January 1st after several requests to the Ministry of Economy.

"Over the past 20 years the prices of basic commodities, like rice and sugar, have increased by 300 per cent," a Pepsi spokesperson said to Gulf News in an emailed statement. "Adjusting our price now means that the prices of Pepsi products have effectively increased at a rate of less than 1.5 per cent per annum over the last 30 years."

But some retailers are using the high energy, electricity and commodity prices as an "excuse" to raise prices, said Durian. "The impact on inflation from gasoline is exaggerated," she said, noting that the government subsidises industries' energy costs.

Inflationary pressure is reduced because the high cost of gasoline is balanced by falling consumption in other areas, she said.

An increase in oil prices will even be positive for the economy because the UAE will gain more revenue from its oil exports, said Pradeep Unni, senior analyst at Richcomm Global Services. A small increase in oil prices will not affect retail prices, he said.

Bigger worry

The bigger worry now is the rising cost of electricity, said Durian.

"The focus is shifting from fuel to electricity prices," she said. "There are power stations in Fujairah that don't have gas."

Retailers will use the cost of utilities as an excuse to hike prices and consumers will bear the burden, she said.

"There will be some belt-tightening, people will get environmentally-conscious and in the end it will have an impact of inflation," she said. "Expats have to pay more for their electricity."

Still, 2011 will not mean leftovers and darkened rooms for most expats in the UAE.

"Although sometimes people tend to have a distorted perception of the actual level of prices [impacted by the items one buys most frequently, which is food and gasoline in general], it is important to put things in perspective: What is the biggest component of a household's expenditure? Generally it is by far the housing," Philippe Dauba-Pantanacce, senior economist at Standard Chartered Bank, told Gulf News.

Rents are the biggest part of the consumer price index in the UAE and prices will stay "suppressed" or even "deflationary" because the housing market is facing an oversupply, he said.

"In such an environment, even a possible increase in food prices due to higher global soft commodity prices will not have a major impact on an individual's daily life and expenditure," he said.

Have your say

Do you think a country should build buffer stocks to safeguard against inflation? Should the private sector look into agriculture based industries to help countries boost their food security? Tell us.

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox

Network Links

GN StoreDownload our app

© Al Nisr Publishing LLC 2026. All rights reserved.