The Philippines will tolerate the slide in its currency to a two-month low, with the central bank governor flagging that interventions won’t be effective in the face of global risk aversion.

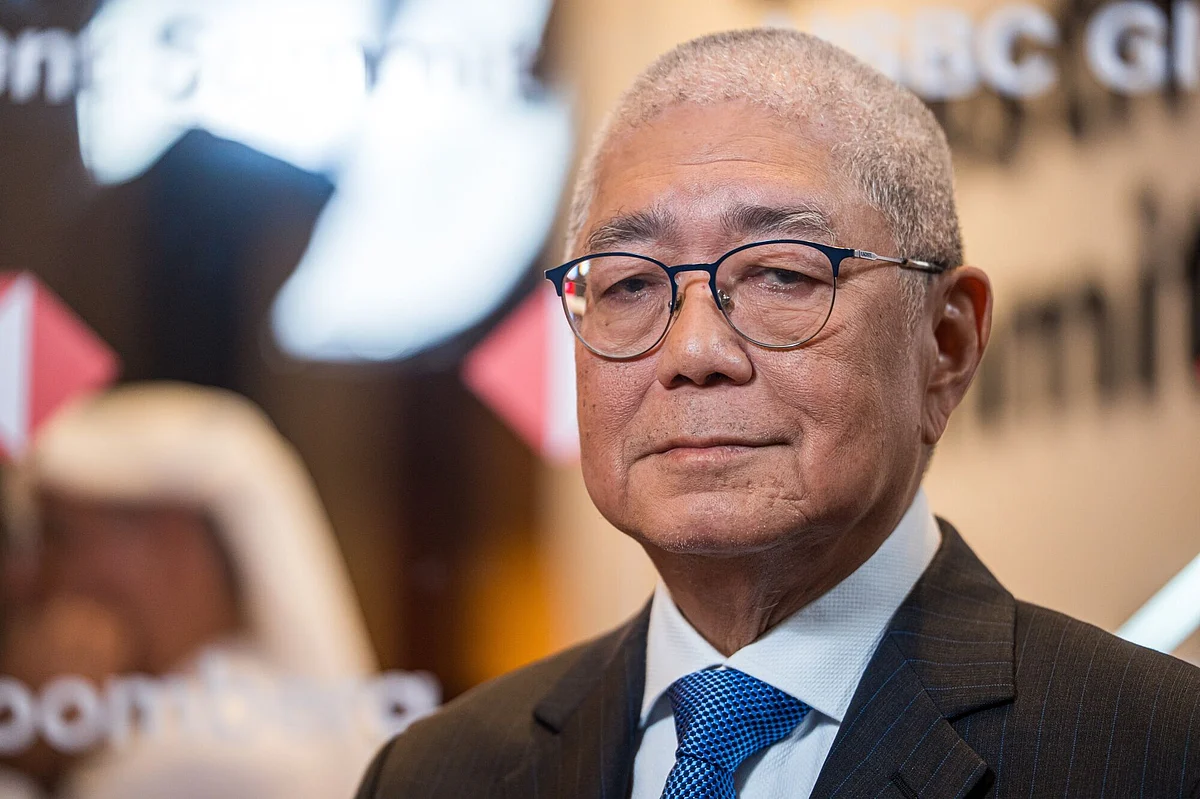

“It’s futile to intervene when it’s a strong dollar story driven by safe haven flows,” Bangko Sentral ng Pilipinas Governor Eli Remolona said in a mobile-phone message on Wednesday.

Asian currencies have dropped against the dollar this week as an escalating conflict between Iran and Israel hurts sentiment.

Import-dependent

With the hostilities triggering a rise in the price of oil, the currencies of import-reliant countries such as the Philippines and India have been particularly affected.

The peso has declined more than 2% this month, making it the worst-performing Asian currency for the period. It fell for a seventh consecutive day on Wednesday to close at 56.98 per dollar.

The drop coupled with the spike in crude risks complicating matters for BSP, which is due to announce its next monetary policy decision Thursday.

Most economists in a Bloomberg survey expect the central bank to lower the overnight borrowing rate by 25 basis points.

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox

Network Links

GN StoreDownload our app

© Al Nisr Publishing LLC 2026. All rights reserved.