Landmark Dubai court case comes to life in a book

How a British expatriate woman fought back against an international crime web

Dubai: When British expatriate Amber Waheed lost her life savings to a sophisticated financial advisory fraud in Dubai in 2015, she did not sink into despair like some of the other victims. Instead, the one-woman army took on the fraudsters and won a landmark case in Dubai courts. And then she did something more. She encapsulated her experiences in a motivational debut book.

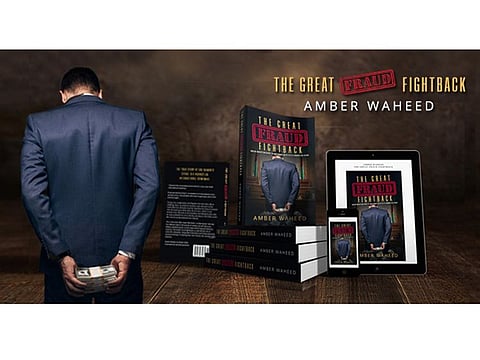

‘The Great Fraud Fightback’, which releases on Amazon next week, looks into the current state of the global financial advisory industry. But more than that, it reinforces faith in the UAE judiciary and offers hope to thousands of people. “I wrote this book because I wanted to make people aware of the legal process in Dubai. The Dubai Court process is a judicial system equal to any other around the world, where they follow the evidence and the law,” said the life and business strategist, whose clients include Fortune 500 companies and international law firms.

The backdrop

Waheed lost £60,000 (Dh301,897) to Neil Grant, an unlicensed British financial adviser who ran Prosperity Offshore Investment Consultants and Prosperity Management Consultancy from a Dubai hotel. A financial expert appointed by Dubai Court in 2017 found that he had misled Waheed into investing into high-risk startups, including waste disposal companies. The following year, Grant was convicted by a Dubai Criminal Court and ordered to pay damages in the Dubai civil court.

According to court documents, Grant had more than 400 clients on his books in the UAE when he first started his operation back in 2004. The average loss to each investor came to £100,000.

Waheed, whose court trials lasted more than two years, said her book details her entire experience; pursuing the legal process and the court systems in Dubai as well as the legal process and court systems in Jersey.

‘Raging epidemic’

“Financial advisory fraud is a raging epidemic. It also appears extremely complex, but when you cut through the smoke and mirrors, you realise it simply involves a range of tricks to manipulate critical financial decisions by vulnerable clients for personal financial gains. “Fortunately, I had kept all the paperwork and notes of crucial moments, meetings, encounters and emails. It didn’t take a long time to convert this wealth of material into a book.”

Waheed said her book targets the average reader who has little or no understanding of the financial advisory industry, but wants to learn more about it before investing and how they can protect themselves from scams. “I hope it saves people a few heartaches,” she said.

In addition to a chapter by international bestselling author and financial educator Robert Rolih, the book also contains legal templates offering a roadmap to help other people navigate similar complex legal cases.