The number of people traveling through US airports set a new post-pandemic record of nearly 1.96 million on Friday in a sign that the global economy is healing.

Europe and even India, which reeled under a second wave, seem to have passed the peak of coronavirus infections. All of this bodes well for UAE and its real estate sector. The country is likely to get in substantial foreign investments as the dovish monetary policy run by major central banks unleash unprecedented liquidity into the system.

Coupled with this is the enormous fiscal stimulus from the US and Europe, which should boost global growth and trade flows. The UAE should benefit from these.

Among the 13 listed real estate companies, the top gainers are Emaar Developments (27.64 per cent), RAK Properties (16.67 per cent), Aldar (15.87 per cent), Emaar Properties (12.18 per cent), Deyaar (8.90 per cent) and Damac (6.15 per cent). For the first quarter, eight of the thirteen companies have announced the results.

Revenue bounce

On an aggregate basis, total revenues have risen to Dh13.91 billion compared to Dh12.71 billion in the first quarter of last year. On a quarter-on-quarter basis, revenues were virtually unchanged over the December quarter. Meanwhile, profits have exploded, with aggregate net profit rising 27.23 per cent year-on-year and 142 per cent quarter-on-quarter. The net profit margin of the entire industry is a healthy 16 per cent.

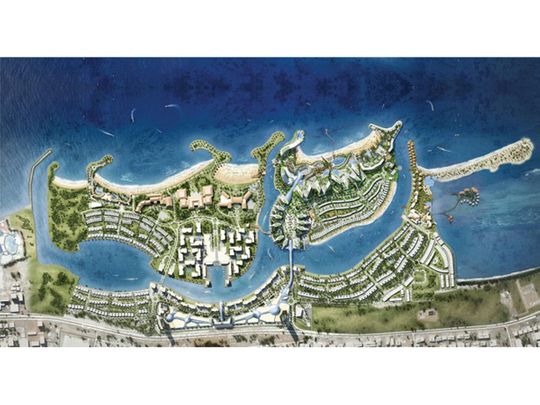

The company with the fastest revenue growth is RAK Properties. The developer of the iconic Mina Al Arab reported a 223 per cent growth in first quarter revenue compared to last year. Profits grew by 433 per cent while the net profit margin is the highest among peers at 43 per cent.

More top-line options

The Intercontinental Resort and Hotel in Mina Al Arab and Anantara Mina Hotel and Resort - which will commence operations in the fourth quarter this year and next year, respectively - are likely to contribute substantially to revenues. Emaar Development recorded a 26 per cent and 20 per cent increase in revenues and net profit, respectively.

Aldar also had a good quarter with revenues rising 16 per cent to Dh2.04 billion and profits by 81 per cent to Dh542 million. This real estate biggie, a proxy for the Abu Dhabi real estate market, also had a decent net profit margin of 27 per cent. Among listed companies, Emaar Malls and Damac are the only ones to have reported a decline in revenues over the previous year. The results also reflect the fact that oversupply still plagues Dubai real estate.

In the current scenario, Aldar, with a market capitalization of Dh28.70 billion and a dividend yield of 3.97 per cent, is suited for investors with a moderate risk appetite. RAK Properties is for the ones who are more aggressive.