Abu Dhabi: Abu Dhabi National Energy Company (TAQA), reported a net profit of Dh1.4 billion for the first quarter of 2021.

The Q1 profits represents an an increase of around Dh2 billion year on year, owing to significantly higher contribution from the oil & gas segment and the Dh1.5 billion post-tax impairment charge in Q1 2020.

TAQA delivered strong performance underpinned by its stable contracted and regulated utilities businesses. Results were boosted by improved commodity prices in the oil and gas segment, reflecting a recovery from softer economic conditions in 2020.

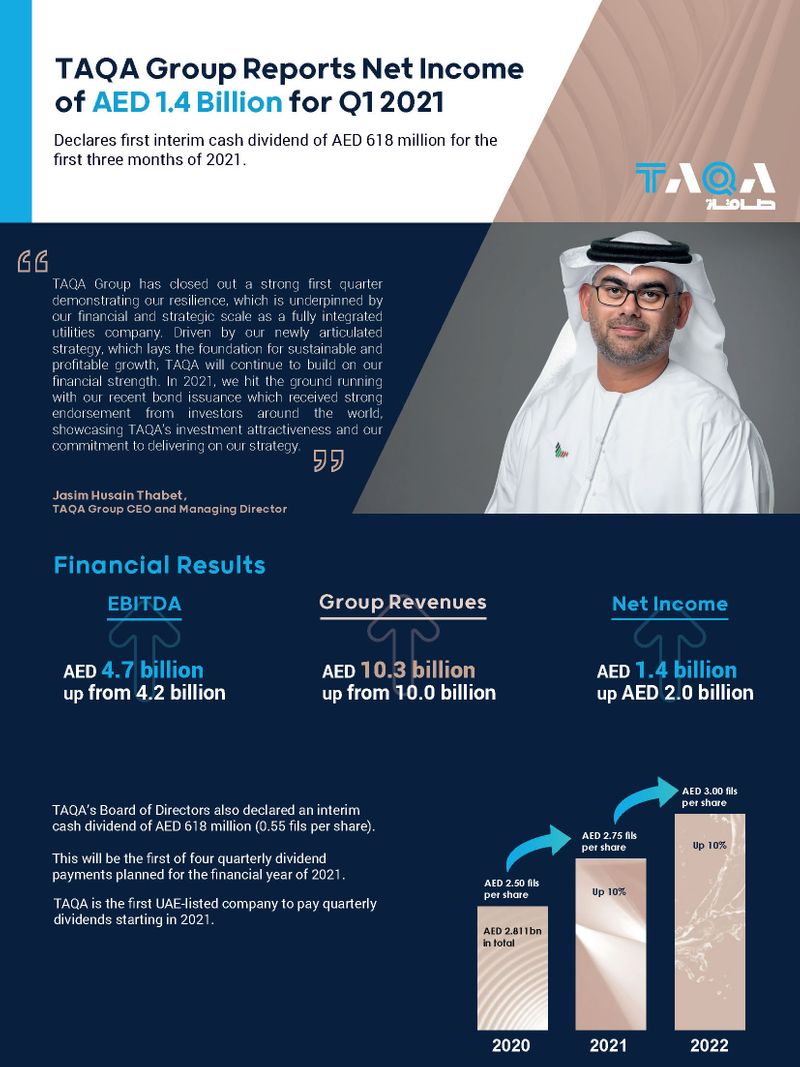

Group revenues of Dh10.3 billion was up 3 per cent than the prior period, primarily due to higher commodity prices within the oil & gas segment.

The group’s EBITDA [Earnings Before Interest, Taxes, Depreciation, and Amortization] was Dh4.7 billion, up 12 per cent, mainly reflecting higher revenues, lower operating expenses and higher income from associates.

Capital expenditure was Dh1.3 billion, an increase of 18 per cent as a result of lower spend in 2020 as projects were delayed or postponed at the onset of the COVID-19 global pandemic.

TAQA’s Board has declared an interim cash dividend of Dh618 million (0.55 fils per share). This will be the first of four quarterly dividend payments planned for the financial year of 2021, in line with the Company’s declared dividend policy.

“TAQA Group has closed out a strong first quarter demonstrating our resilience, which is underpinned by our financial and strategic scale as a fully integrated utilities company. Driven by our newly articulated strategy, which lays the foundation for sustainable and profitable growth, TAQA will continue to build on our financial strength,” said Jasim Husain Thabet, TAQA’s Group Chief Executive Officer and Managing Director.