Indian energy consortium bidding for Adnoc concession

Indian Oil Corporation, Oil India, ONGC Videsh Limited Oil and Bharat Petroleum bidding for the 22% remaining share

Dubai: Four Indian energy companies are bidding for the remaining Abu Dhabi National Oil Company (Adnoc) onshore oilfield concession, India’s Petroleum Minister told Gulf News Monday.

The concession for Adnoc’s 15 onshore oilfields, collectively known as the Abu Dhabi Company for Onshore Oil Operations (Adco), have been open since January 2014 when a deal with Western majors dating back to the 1970s expired.

A 22 per cent share remains open with France’s Total, Japan’s Inpex Corp and South Korea’s GS Energy awarded 10, five and three per cent stakes, respectively, in 2015. Adnoc holds a 60 per cent stake.

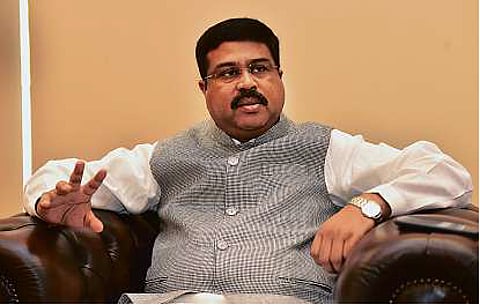

Indian Oil Corporation, Oil India and ONGC Videsh Limited Oil, a subsidiary of Oil and Natural Gas Corporation Limited (ONGC), have made a consortium bid for the concession, Indian Petroleum Minister Dharmendra Pradhan said.

Bharat Petroleum is also part of the bid, the minister’s office later confirmed.

“Indeed India is interested,” Pradhan told Gulf News in an interview at the Indian Consulate in Dubai. Pradhan, who is on a two day visit to the UAE, has previously said Indian companies were interested in the concession without providing details.

Abu Dhabi, the state owner of Adnoc, has been evaluating whether to bring in Asian firms or maintain its relationships with the Western majors since the concession expired.

Exxon-Mobil, Shell, Total and BP had each held 9.5 per cent stakes in the old concession.

Adnoc was not available to immediately comment on the Indian consortium bid when contacted by Gulf News late on Monday.

However, its newly appointed chief executive Sultan Al Jaber was recently quoted by state media as saying concession negotiations are “still open.”

“Having said that, the door is still open to discuss the participation of other international players in the remaining 22 per cent share in Adco,” he was quoted as saying by the state news agency WAM last week.

“In the spirit of partnership we are enthusiastic to work with the industry and to mutually benefit from what is a very attractive, long-term and sustainable opportunity in the upstream oil and gas sector,” he said.

Pradhan, insisting that it is a company-to-company issue, declined to comment as to when he believes a decision could be made on the consortium bid.

Closer ties

Ties between India and the UAE have drawn closer in the past year. In February, His Highness Shaikh Mohammad Bin Zayed Al Nahyan, Abu Dhabi Crown Prince and Deputy Supreme Commander of the UAE Armed Forces, made a state visit to India and in August 2015 Indian Prime Minister Narendra Modi made an official visit to the UAE.

During the February visit, Adnoc and the Indian Strategic Petroleum Reserve Limited (ISPRL) reached a preliminary agreement to store Abu Dhabi crude in facilities in India.

Pradhan said India and the UAE have resolved tax issues surrounding the agreement but that “some other issues” remain. He declined to comment on the issues.

“We are talking it through with each other,” he said. Pradhan said he will meet with UAE Energy Minister Suhail Mohammad Faraj Al Mazrouei in Abu Dhabi on Tuesday.

The two are expected to discuss the storage deal and other UAE investments in India’s hydrocarbons sector proposed by the Indian government in February.

Similar investments in strategic storage, refineries, petrochemicals, fertilizer, liquefied natural gas (LNG) terminals and pipelines would be offered to Saudi Arabia, Pradhan said.

Last week, Saudi Aramco chairman Khalid Al Falih reportedly told the Indian Prime Minister his country is the state-owned energy giant’s “number one investment target.”

Over the weekend, Pradhan visited Iran where he said Indian private and public companies could invest as much as $20 billion in Iran’s hydrocarbon, port and mineral projects.

However, Pradhan said the investments will be tied to Iranian commitments. “If we get favourable and very clear assurances from the Iranian side then our investment can go up to this point," he said.