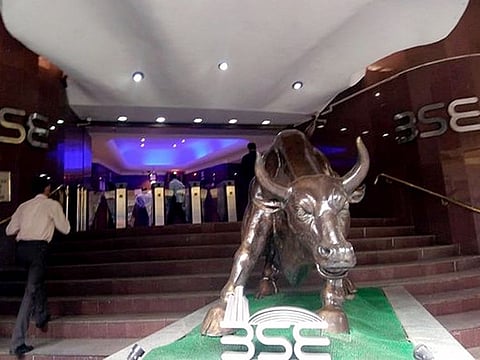

Investors remain bullish on India amid global slowdown: Here's why

India seen as a land of opportunity, as current administration is more business-friendly

Singapore: Even as global economic prospects remain dim, global investors and international agencies continue to be bullish on India.

In a recent interview with The Straits Times (Singapore), Ontario Teachers' Pension Plan (OTPP) president and chief executive officer Jo Taylor said that he sees India as a land of opportunity, noting that the current administration is more business-friendly.

Potential

He said the potential of the past few decades may finally be realised. Taylor also pointed out that India is an attractive investment destination and will be one of its growth markets over the next 5 to 10 years.

"It has a large, growing, and dynamic economy with openness to foreign capital which makes it a strategically important market for us," he said.

Taylor's remarks come as OTPP has been making a big splash in Asia in recent weeks, following the announcement of plans to increase its presence in the region.

Opportunities: healthcare, infrastructure, financial services

OTPP is eyeing opportunities in healthcare, infrastructure and financial services in India. Also of interest are the insurance sector and technology-enabled segments, especially in the financial services industry.

The CAD242.5 billion ($177.8 billion) pension fund is certainly walking the talk as it has opened a Mumbai office and plans to have a founding team of approximately 10 people by the end of this year.

It will comprise a mix of local talent and transfers from its other offices. This presence is expected to scale further as the fund's investment portfolio grows in the coming years.

The local team will build on its existing Indian portfolio and support the firm in sourcing investments, nurturing long-term partnerships, and attracting strong local talent. The office is in the financial hub of the Bandra Kurla Complex and is OTPP sixth global office and third in the Asia-Pacific region.

OTPP is Canada's largest single-profession pension plan and pays pensions and invests plan assets on behalf of 333,000 working and retired teachers.

Reputation

Since its establishment as an independent organisation in 1990, it has built an international reputation for innovation and leadership in investment management and member services. It has over 1,100 employees (according to the World Economic Forum) with headquarters in Toronto, Canada. It also has offices in London, San Francisco, Hong Kong and Singapore.

OTPP invests in a broad array of assets including public and private equities, fixed income, credit, commodities, natural resources, infrastructure, real estate and venture growth to deliver retirement income for its members.

Earlier this month, it announced that it was investing another CAD60 million (Rs3.6 billion or $44 million) in the National Highways Infra Trust (NHIT) which is an infrastructure Investment Trust sponsored by the National Highways Authority of India (NHAI).

Together with its earlier investment in November 2021, this brings its total investment in NHIT to approximately CAD 308 million (Rs18.6 billion).

Infrastructure

Proceeds from the capital raise will be utilised to acquire three additional road concessions from NHAI, after which NHIT will own, operate and maintain a portfolio of eight toll roads in the states of Gujarat, Karnataka, Maharashtra, Madhya Pradesh, Rajasthan, Telangana and Uttar Pradesh.

The roads will span a total length of 636 km and a concession period ranging between 20 to 30 years. NHAI will use the concession fees for further development of road infrastructure in India.

"Our continued investment in the NHIT supports the development of high-quality roads and economic growth in India," said Bruce Crane, Senior Managing Director, Infrastructure & Natural Resources, Asia Pacific, Ontario Teachers'. "We're delighted to further our partnership with the Government of India and build our portfolio of core infrastructure assets in the country."

The investments in India come at about the same time as news broke that OTPP is looking to potentially double its current staff strength in Singapore from 25 to about 50. This would make Singapore its biggest office in Asia, larger than its Hong Kong office which currently has 35 staff.

OTPP joins other Canadian pension funds adding staff and deploying more capital to Asia. Bloomberg reported that president and CEO Blake Hutcheson said that his Ontario Municipal Employees Retirement System plans to triple assets in the region over the next eight years from $9.5 billion now. The Caisse de depot et placement du Quebec plans to invest CAD15 billion (U$11 billion) over five years, the Business Times (Singapore) reported.

Winder range of assets

The Singapore expansion will allow OTPP to invest in a wider range of assets as it builds on its CAD20 billion ($14.7 billion) exposure to the region. Both the firm's real estate unit, Cadillac Fairview, and the infrastructure team already have staff in the city-state.

"Singapore gives us another dimension in terms of dealing with Southeast Asia and Australia," said Taylor. "It's clearly a vibrant financial hub with lots of really helpful co-investors and financial advisers."

Taylor said the fund has no hard target for its Asian assets, though it will naturally grow as it looks to deploy about half of new investments outside North America. Traditionally, the fund has held about 70 per cent of assets in Canada and the US.

Taylor told The Straits Times: "Asia is attractive. It has positive dynamics such as a rising population, a receptive environment for capital, scalability of business, and can be counter-cyclical to North American markets."

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox