Need for cover

GN Focus weighs the benefits and risks of buying private health insurance and makes a case for an informed decision

Is private health insurance worth it? It is a question the world's biggest insurance companies seek to answer. Risk analysts, health experts, computer scientists, all the data crunching and algorithms in the world are not able to definitively determine if and when somebody will get sick or have an accident. It doesn't, however, stop them from trying.

California-based Heritage Provider Network set up a competition last year with a prize of $3 million (about Dh11 million) for anyone who comes up with a predictive algorithm that accurately identifies people at risk of hospitalisation. A humongous industry (not to mention the common person) would love to attain that kind of certainty, but it eludes everyone. While many of us are lucky enough to enjoy health care as part of an employee benefits package, there are those who must ask themselves this difficult question.

There is no simple answer. For the self-employed, a health insurance premium is a gamble; it is a speculative hedge on your well-being. Each individual's health profile is unique, therefore it is impossible to provide an all-encompassing answer to whether one should take a policy — some should, some could do without it, some will regret ever having subscribed, and some will regret having never.

There is talk of health insurance becoming mandatory in the UAE, so this discussion may be futile at some point in the future. But if you are deciding now, the following considerations may help.

1. Family matters

If you have a family (childrenespecially), it is probably prudent to get insurance. Kids are far likelier to get sick or injure themselves. The fact that there are several individuals in a family also makes it much more likely that someone or the other will have to go to the hospital at some point. Insurance companies function much like other businesses in that package deals abound. Insuring an entire family will be cheaper per person. If you are planning to have kids, get insurance >anyway as maternity services in a hospital can also be expensive.

2. How likely am I to get sick (genetics and habits)?

First step. Visit a doctor; pay about Dh200-Dh300 for the initial consultation. This cost, however, may also be worth it to ascertain the general state of your health. Hygiene, diet, smoking, drinking, exercise, stress and sleep levels — all of these things add up to a general likelihood of you falling ill. Answer some questions and doctors will be able to measure to what extent you are subject to the consequences of these factors. More accurately, a family history can help determine your propensity to genetic diseases. If you are of Middle Eastern descent or in fact Emirati, it is a good idea to get a diabetes check done. The ironic thing is that once you get these tests done and find out that you have a higher likelihood of illness than previously thought, premiums are likely to rise. Capitalism and health just don't seem to mesh.

3. How likely am I to get sick (environment)?

Generally speaking, in the UAE it is difficult to end up in a hospital on account of some prevailing disease. Every foreigner is required to undergo a full medical upon arrival in the country (though not when re-entering, but those with visible symptoms will still be scrutinised). Barring diabetes (which isn't contagious), the country has no such epidemics to be worried about. The entire country has access to clean drinking water and sanitised facilities. However, temperatures can hit 50 degree Celsius in the summer. If you are not used to this sort of climate, then many complications can arise — heatstroke, sunburn (it would have to be significantly bad to require medical attention), dehydration and respiratory problems. The last of these can also be caused by dust in the air, of which there is a lot with the construction and general topography. A lot of the country is, however, air conditioned (including bus stops), so it's easy to avoid the outdoors. According to the latest available data from the Ministry of Health, there were almost 44,000 incidences of identifiable diseases in Dubai and the northern emirates in 2008 — this list encompasses everything from the flu to chickenpox to rabies. The UAE region has roughly three million people, giving us a prevalence rate of around 1.5 per cent, which is not bad at all.

4. How likely am I to get into an accident (habits)?

If dangerous activities are a frequent pastime, then maybe health insurance makes sense. Though this logic is paradoxical, assuming that frequent sky divers, for example, have a high tolerance for risk, and insurance is usually only catnip for the risk averse. If you work at a construction site or on an oil rig or with horses, then insurance should definitely be a consideration, if it isn't provided by your employer already (which it should if you have a dangerous job). If you are a reckless driver, then sell your car, but if you're stubborn about it, then get insurance — more on this later.

5. How likely am I to get into an accident (environment)?

According to the Ministry of Health, the number of accident-related injuries, including attempted suicide, in Dubai and the northern emirates, amounted to just over 150,000 in 2008, giving us a prevalence rate of roughly 5 per cent. This is an acceptable probability, a one in 20 chance of getting into any sort of accident that lands you in the hospital.

The biggest contributor to this statistic by far is road accidents. Dubai roads have one of the highest per capita death tolls in the world. In the first ten months of 2011, 28 people have been killed and 25 seriously injured (with another 117 sustaining minor injuries) in Dubai as a result of road accidents. If you are looking for a good reason not to get health insurance, start taking Dubai Metro. There have also been increasing incidents of accidents where people fall out of tall buildings, of which there are several in Dubai. Perhaps living on a low floor is an option for the uber-careful. That said, the lack of crime in Dubai makes up for the dangers as it eliminates an entire category of potential accident causes.

6. The cost and fine print

This depends on many factors — your age, pre-existing conditions, and a barrage of others. You can opt to get policies that offer partial cover or for a limited number of medical services. If you are well endowed with cash and are generally healthy, then a basic plan that doesn't cost much and partially covers expenses is the sensible option. If you don't have piles of money but a steady cash flow and certain health issues, then get a more comprehensive plan. The cost of such policies can be well into tens of thousands of dirhams per year and beyond. Bear in mind that one surgery can cost Dh40,000-Dh50,000.

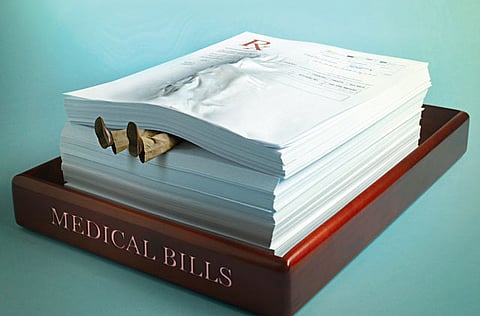

A suitable policy greatly varies from person to person, but there is no shortage of options. Make sure you read the terms of the policy with specific regard to exactly what is covered and to what extent, the length of the contract, when and how premiums can change. In the US, medical problems contributed to about 62 per cent of all bankruptcies in 2007, according to the American Journal of Medicine — a staggering figure. However, more than three quarters of these people had insurance at the beginning of their illness. It might not be exactly the same in the UAE, but many multinational insurance firms that operate in the US are also present in the UAE. The worst thing is to consistently pay for insurance and not be able to avail of the benefits when the time arrives.

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox