Cloud outages rise and UAE firms turn to insurance for protection

Frequent AWS and Cloudflare failures drive fresh demand for outage

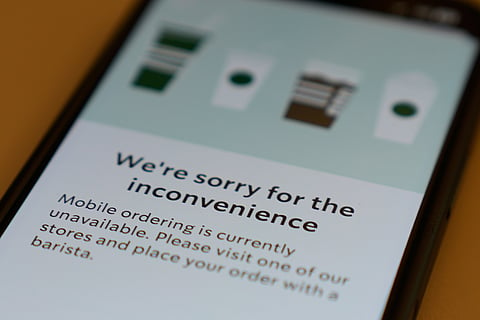

Dubai: After back-to-back global outages from AWS and Cloudflare, businesses in the UAE are beginning to look at cloud insurance the same way they once viewed cyber protection.

Basil Mimi, Co-Founder and CEO of Mantas, said the pattern has been building for years as more local companies migrated core functions to the cloud. He pointed out that “cloud platforms are now the backbone of most UAE businesses,” and with SAP estimating that two-thirds of enterprises rely on cloud systems for daily operations, even a brief outage can freeze sales, break SLAs and stall internal systems. Insurance, he noted, gives companies a buffer when the infrastructure they depend on goes dark.

The real cost of going offline

For small businesses that run payments, deliveries, or bookings through third-party platforms, the damage is immediate. Mimi said a half-hour disruption can wipe out an entire day’s margin once lost transactions, delayed orders, and idle staff are factored in. Outage cover typically reimburses lost revenue and the additional costs needed to keep operations running, while giving firms enough flexibility to handle customer communication during a crisis.

Many companies only understand the scale of the risk after calculating the cost of an hour of downtime. Mimi advised business owners to add hourly revenue to operating expenses and the cost of cancellations or refunds. “Once companies run the numbers, they usually find downtime is far more expensive than expected,” he said.

How insurers assess exposure

Insurance providers are also changing how they evaluate cloud risk. Mimi said underwriters now examine which cloud regions a company relies on, the redundancy built into its systems and how quickly it can fall back to a secondary service. These details reveal how vulnerable a business is when an upstream provider faces trouble.

The mindset has shifted dramatically. “Insurers are no longer treating AWS or Cloudflare outages as rare shocks,” Mimi said. Many carriers are moving toward faster, parametric-style payouts triggered by specific outage events, backed by real-time cloud performance data. The emphasis is now on diversification, with insurers encouraging companies not to depend on a single cloud provider.

One of the biggest misconceptions, he added, is the belief that cloud providers will compensate clients. In reality, most SLAs only offer small credits on the monthly bill. “That does not come close to covering lost sales or refunds,” Mimi said.

A fragile internet beneath the surface

Recent disruptions have also exposed deeper structural weaknesses across the global internet. Shiv Shankar, CEO of Boundless, noted that outages at AWS, Azure, GCP and now Cloudflare show how concentrated critical cloud functions have become. He warned that centralisation means a single configuration error can ripple across thousands of services. Shankar said the long-term alternative is a more distributed infrastructure that avoids single points of failure.

Will Papper, Co-Founder of Syndicate, made a similar point, noting that the rapid spread of failures reflects the digital economy's continued dependence on a narrow set of providers. He said the ecosystem needs systems designed to withstand localised failures without taking entire industries down.

Payments remain the weak link

The payments sector often feels the shock first. Industry experts noted that failed transactions, duplicate charges and customer confusion are common during cloud incidents. Fadl Mantash, Chief Information Security Officer at Tribe Payments, said the complexity of card processing means one break in the chain can bring everything to a stop. He added that resilience requires modular systems, rehearsed failure scenarios and clear response plans.

Governments and corporations are now pushing toward multi-cloud setups, better redundancy and even decentralised infrastructure. The outages of 2025 have made it clear that blind dependence on a handful of providers is no longer sustainable.