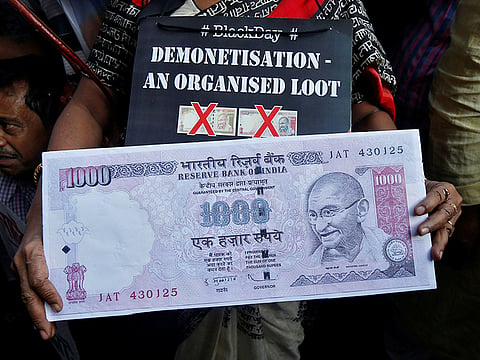

India's currency ban: shock therapy, mock ‘trial’

One year on, demonetisation has raised more questions than it has answered

The clock had just struck 8pm. Living rooms across India were warming up to the clattering of tea cups or coffee mugs after a hard day at work, with one eye on news trickling in from voting-day America. The world’s oldest democracy was all set to elect a new president and one real estate tycoon by the name of Donald Trump had already shown threatening signs of turning the race to White House on its head.

But lo and behold … the scroll on Indian news channels had a breaking story from home: Prime Minister Narendra Modi to deliver an unscheduled address to the nation.

Around the same time, in the inner recesses of 7, Race Course Road, New Delhi -- the Indian prime minister’s (PM) official residence -- a bunch of whiz-kids were on pins and needles. They too had their eyes glued to the TV screen. No, the US presidential elections were light-years away from their minds. Instead, eight months of back-breaking work, endless sleepless nights, innumerable workstation luncheons and dinners – while poring over tonnes of data -- and keeping their work close to their chest the best way they could were finally worth all the effort.

I bow to the people of India for steadfastly supporting the several measures taken by the government to eradicate corruption and black money.”

Jump cut to the Reserve Bank of India (RBI) headquarters at Shahid Bhagat Singh Road, Fort, Mumbai. The sun had just tipped over the horizon and into the blue of the Arabian Sea. It was way beyond day’s play, and the mandarins of half a dozen public sector banks were just that wee bit twitchy for a coffee break at the RBI governor’s office. Just at that moment, the giant television screen in the conference room started flashing images of Modi announcing a “surgical strike”: The most telling monetary policy reform since former prime minister late Indira Gandhi led her garibee hathao (end poverty) clarion call with bank nationalisation almost half a century back. “All 500 and 1,000-rupee currency notes will be banned from midnight, November 8, 2016,” Modi thundered, sending a 1.25 billion-strong nation into a tizzy and triggering a debate that continues to acquire new shades and garner point-counter points by the dozen even a year after. Coffee never tasted so bland as it did at the RBI conference room that night!

Back at 7, Racecourse Road, New Delhi, Modi’s “secret army”, comprising a bunch of tech-savvy, smart, energetic youths breathed a sigh of relief. Under the watchful eyes of Union Revenue Secretary Hashmukh Adhiya -- a Gujarat-cadre Indian Administrative Service officer, hand-picked by Modi for his ‘top-secret’ operation -- eight months of groundwork, data collection, analyses, weighing of the pros and cons … every little detail had been meticulously looked into as the PM kept his demonetisation grand design a closely-guarded secret. So much so, that according to the Economic Times, Union ministers attending the Cabinet meeting at 6.45pm on November 8, 2016 -- where Modi was to finally spill the beans to his colleagues -- were told to come without their cell phones and were not allowed to leave until the PM was done with his televised address.

Today is a sad day for the country as lots of trouble was thrust upon the people a year back. Figures point out that around 135-150 people died as they had only the demonetised currency.”

After one year, 200-odd deaths, a slippery plane of a gross domestic product (GDP) growth trajectory and sordid tales of inconveniences to the commoner, India’s much-vaunted drive for structural reforms to its economy by way of weeding out unaccounted wealth (read black money) and getting at counterfeiters and terror-sponsors has given rise to more questions than it has managed to answer so far.

The jury is still out on whether demonetisation has indeed served its declared purposes.

True, a large section of the population in the world’s second-most populous nation has been forced to get used to digital transactions. True, many hoarders of ill-gotten gains have been made to feel the heat like never before. True, banks are now flush with cash, helping push lending rates southwards ...

But along with these, it is also true that 365 days since Modi’s “surgical strike” on black money and his earnest push for a “digital India”, cash continues to be the king in large swathes of rural and semi-urban India; hoarders continue to convert their black liquid assets into white by way of micro deposits through multiple accounts; while family members of those who lost their lives -- standing in serpentine queues for long hours, just to withdraw a modest Rs4,000 from their accounts -- find themselves in a Kafkaesque ordeal: They have been put on ‘trial’ and held guilty -- without being told what the crime is!

So, is Modi’s demonetisation a success or failure?

The last word is yet to be said. Wish we could sneak a peek today at the faces of those backroom boys -- who were in Modi’s “war room” at 7, Race Course Road, on November 8, 2016 -- for an honest feedback. But for now, your word is as good as mine.

We are not going to sit back now saying we have done demonetisation. We will continue to take steps to eradicate black money.”

Currency ban: Hit parade... or flop show?

Positives:

According to the Union Finance Ministry, the idea of demonetisation and its cost-benefit analysis cannot and should not be put through the lens of windfall margins. Demonetisation was aimed at getting to the root of those funds and sources of income that were floating around the economy, but were never really a part of it owing to the dubious nature of such funds and incomes. Objectively speaking, here are some of the issues that demonetisation claims to have successfully addressed:

1. Shell firms now in I-T dragnet: According to Prime Minister Narendra Modi, 37,000 shell firms have been detected as result of demonetisation. In addition, the licences of around 100,000 shell companies have been cancelled. Over and above these, according to Finance Ministry sources more than 300,000 registered firms with questionable financial transactions have been detected by Income Tax (I-T) and the Department of Revenue Intelligence.

2. Detection of high-value properties: As a direct fallout of the government’s demonetisation drive, all over India, since November 8, 2016, 14,000 properties valued at a minimum price of Rs10 million each have been detected, with irregularities over filing of income tax returns by their respective sellers and buyers. A large number of individuals and entities directly associated with the sales and purchases of these real estate units have been found to have either violated income tax norms or are believed to have been part of suspect transactions. These property dealings are currently under investigation. Moreover, 1,300 cases of high-value purchases of real estate assets were identified, where the value of the asset acquisition did not match the income profiles of the buyers.

3. Rise in direct tax collection: According to data released by the Department of Income Tax, since the introduction of demonetisation, the collection of Advance Tax under Personal Income Tax has risen by 41.79 per cent. The Income Tax Department also said that the collection of Self-Assessment Tax under Personal Income tax has shown a growth of 31.25 per cent in the current fiscal. These simply translate into more funds in the national exchequer.

4. Widening the tax base: A very tangible benefit of the demonetisation drive has been an increase in the number of tax payers in the country. According to data made available by the Department of Income Tax, the number of e-returns filed by individual tax-payers in the country has gone up by 5.7 million, or 25.3 per cent, over the last fiscal. In addition to this, 10.26 million new tax-payers were added to the nation’s tax base. According to the Department of Income Tax, there has been a “marked improvement in the level of voluntary compliance as a result of action taken by the I-T Department on the basis of data of cash deposits in the wake of demonetisation.”

5. Reduction in cash in the economy: After demonetisation, a decline of 20 per cent in cash circulation in the economy has been detected. One major positive associated with this decline in cash flow has been the growing popularity of electronic payment channels such as e-wallets and transactions through plastic cards and internet banking.

Negatives:

A year after demonetisation was announced, it is quite clear that the long-term benefits notwithstanding, in the near-term, the misses far outmanoeuvred the hits. In the immediate aftermath of November 8, 2016, nearly 200 people lost their lives across India for reasons that were easily avoidable if only the government had the level of preparedness that such a gargantuan task demanded. Here are some of the reasons why many have termed the whole exercise a ‘misadventure’ at best and an economic hara-kiri at worst.

1. Banned tender back into banking pool: One of the most prominently stated objectives of demonetisation was to ensure that hoarders of ill-gotten gains (read black money) would be taken to task through this financial blitzkrieg of sorts. However, according to data released recently by the Reserve Bank of India (RBI), 99 per cent of banned tender of 500 and 1,000 rupees have made its way back to the banking pool by way of deposits! According to the RBI, Rs15.28 lakh crore in 500 and 1,000-rupee notes came back to banks, out of a total of Rs15.44 lakh crore that was in circulation.

2. Cash is still king: One of the major reasons in support of demonetisation was that with it, people would be encouraged to rely less on cash and take electronic payment options to heart. However, as the dust settled on the initial euphoria over e-payments, cash is back in vogue. In fact, in rural and semi-urban areas, cash was never truly out of the system – even with notebandi (ban on notes). To site just one case in point: There are 880 million debit cards in India, but there aren’t enough point of sales (POS) terminals to swipe them. The result: Currently, digital payments comprise just 5 per cent of all transactions.

3. Rise in money-printing bill: What an irony! In an attempt to boost cashless transactions, the RBI ended up with a huge bill for printing new currency notes of 500 and 2,000 rupees! As a result of the entire process of demonetisation and remonetisation, the cost of printing new currency notes has gone up by a whopping 133 per cent in the last one year.

4. Battle against counterfeiting comes a cropper: According to National Investigation Agency estimates, prior to demonetisation, the total value of counterfeit 500 and 1,000-rupee notes in circulation was about Rs4 billion. This comprised a minuscule 0.028 per cent of the total currency in circulation in India. Post-demonetisation, of all the returned 1,000-rupee notes, only 0.0007 per cent was found to be counterfeit, while of all the 500-rupee notes that came back to banks, only 0.002 were counterfeit.

5. GDP growth on a slippery plank: In the first quarter after demonetisation was announced, India’s gross domestic product (GDP) growth rate fell to 6.1 per cent, from 7.9 per cent for the same period in the previous year. From April-June, the GDP growth rate declined further to 5.7 per cent, from 7.1 per cent during the corresponding period in the previous year. Along with demonetisation, introduction of goods and services tax (GST) has turned out to be a further dampener for trade and enterprise.

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox