From sugary drink tax to plastic bans: 6 new UAE rules coming in 2026

From banking security to mandatory content creator licences, here’s a full breakdown

Dubai: A new year always brings major projects and lifestyle changes in the UAE, from Etihad Rail to the GCC unified visa but 2026 will also introduce several important rules that affect daily life, business operations, the environment, social media, and public health.

If you want to stay ahead of the changes, here are the key regulations coming into effect in 2026 and what they mean for residents, companies, travellers and creators.

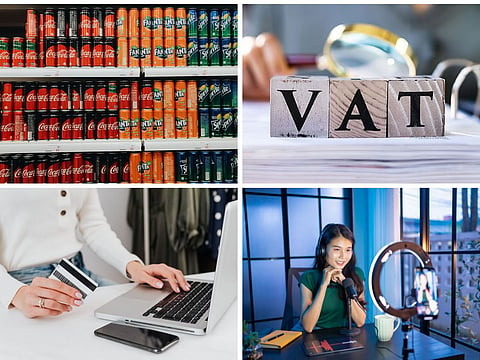

1. New sugary drink tax takes effect

The Ministry of Finance will introduce updated excise tax rules for sugar-sweetened beverages on January 1, 2026.

What’s changing?

The UAE will move from a flat 50% tax to a tiered system based on sugar content. Drinks with higher sugar levels will face higher taxes, while lower-sugar drinks will be taxed at a reduced rate.

Why the change matters:

Aligns the UAE with the GCC’s unified model

Encourages beverage companies to reduce sugar levels

Gives consumers more low-sugar options

The goal is to promote healthier choices while keeping the tax system more efficient and internationally aligned.

2. UAE to enforce full ban on single-use plastics

From January 1, 2026, the UAE will implement a nationwide ban on importing, producing or trading a wide list of single-use plastic products.

This is the next step in the country’s phased plastic reduction plan that began in 2024.

What will be banned?

Dubai will prohibit single-use:

Cups and lids

Cutlery

Food containers

Plates

This follows the emirate’s earlier bans on plastic bags (2024) and Styrofoam products (2025). The goal is to reduce waste, encourage reusable alternatives and support the country’s long-term environmental strategy.

3. Updated VAT rules for businesses

A new federal decree revising parts of the VAT law will come into effect on January 1, 2026, aimed at simplifying compliance and aligning rules with global standards.

Key changes include:

Businesses will no longer need to issue self-invoices under the reverse charge mechanism. They only need to keep regular supporting documents (contracts, invoices, records).

A new five-year deadline for claiming refundable VAT. Any claims made after this period will no longer be accepted.

These changes reduce admin work, prevent long-pending claims, and offer businesses clearer certainty over their tax position.

4. Banks to phase out SMS and email OTPs

Digital banking security in the UAE is getting a major upgrade. Under new UAE Central Bank directives, SMS and email one-time passwords will be fully phased out by March 2026.

What’s replacing them?

Banks will shift to app-based authentication, using secure ID verification methods built directly into mobile banking apps.

Why it’s happening:

SMS and email OTPs are vulnerable to SIM swapping, phishing and interception. App-based verification reduces fraud risks and adds stronger layers of security for both domestic and international transactions.

5. Content creators must obtain UAE’s Advertiser Licence

The UAE Media Council has extended the deadline for all content creators, influencers and advertisers to obtain the Advertiser (Mu’lin) Permit to January 31, 2026.

Who needs it?

Everyone who promotes, reviews or advertises any product, service or content on social media, even if they are not paid.

Why it matters:

The permit helps regulate the fast-growing advertising sector, improves content quality, protects consumers, and strengthens the UAE’s position as a regional media hub.

Key details:

Permit duration for residents and citizens: 1 year, renewable

The permit is free for the first three years as a support measure for creators

Application available through the UAE Media Council website (uaemc.gov.ae)

6. New digital invoicing rules for UAE businesses

The Ministry of Finance has issued new decisions outlining how and when companies must switch to the UAE’s new Electronic Invoicing System, marking a major step toward a fully digital economy.

How it works:

Businesses will be required to issue, exchange and store invoices electronically for all B2B and B2G transactions.

Rollout timeline:

Pilot phase begins July 1, 2026 for a selected group of businesses

Full implementation will follow in additional phases

Benefits for businesses:

Faster and more secure invoicing

Reduced paperwork and errors

Lower operating costs

More efficient tax and financial reporting

The shift will modernise how companies operate and streamline financial processes across the country.

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox