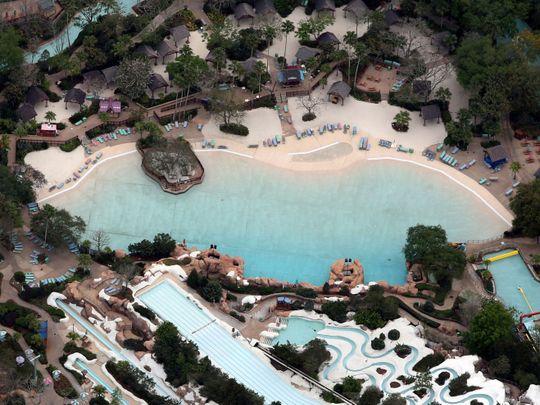

As Walt Disney Co.’s cable channels lost subscribers in recent years and the company pumped billions of dollars into new streaming services, theme parks were a steady source of profit.

Last year, operating income at Disney’s largest division rose 11 per cent to $6.76 billion, making it the company’s fastest-growing profit driver. The results were so strong that Disney promoted parks head Bob Chapek in February to succeed long-time CEO Bob Iger. It’s an entirely different story today.

With the company’s theme parks shuttered all over the world due to the coronavirus, Disney is expected to report a steep drop in profit when it announces financial results on May 5. Earnings from resorts and consumer products may slump by $500 million or more in the period.

The world’s largest entertainment company has many COVID-19-related headaches, including no live sports for ESPN and no theaters to show its movies. Film and TV production has shut down, and its cruise ships are docked. But the parks face a big hit going forward.

Crashing numbers

With fewer people willing to travel by airplane or take their families to crowded places, Disney’s domestic park attendance - an estimated 83 million visitors last year - could fall by half in 2020, according to John Hodulik, a UBS analyst who previously recommended the stock. Profit at the division may tumble to just $500 million this year and $200 million the next.

“The lingering effects of the COVID-19 outbreak will be felt for a number of years, and the parks segment is unlikely to regain previous thresholds for profitability until after a vaccine is widely available,” Hodulik said in an April 20 report.

To reduce costs, Disney executives have taken pay cuts, and the company has put some 100,000 workers, mostly park employees, on unpaid furlough.

Temperature checks

Iger, now Disney chairman, told Barron’s the company was considering taking guests’ temperatures as they enter parks. Beyond that, Disney has said little about when the parks may reopen, what new policies may be put in place or what else the company is doing to control costs.

There are hints at what the parks business may look like in the near future. Disney reopened the hotels and shopping area outside its Shanghai resort in March. Guests are being screened for fever and required to show a government certification indicating they aren’t ill. Visitors must also wear masks and maintain distances from other patrons, according to the park rules.

While Newsom hasn’t specifically addressed theme parks, a reopening plan he revealed on April 28 said concert halls, convention centers and other large entertainment venues are likely “months, not weeks” away. That’s particularly hard on an industry that relies heavily on summer crowds.

Rival Comcast Corp., owner of the Universal Studios theme parks, said this week it will lose $500 million in the current quarter if its resorts remain closed for the period. Profit from the division fell 85% in the first three months of the year.

“I think 2020 is going to be write-off season,” said Dennis Speigel, a theme-park consultant. “We’ve never experienced anything like that. Not during the Great Depression, 9/11 or even the most recent recession.”