The correction in rents over the past few quarters has allowed many Dubai tenants to upscale their homes or move to better locations. Mario Volpi, sales and leasing manager at Engel and Volkers, has seen several new or existing tenants move to more luxurious properties, taking advantage of the decline in rental prices. “The flight to quality is a phenomenon that happens when it’s a tenants market,” he says.

Upsizing is a key trend particularly this year in the property market, points out Arif Mubarak, CEO of Dubai Asset Management, mainly because tenants are finding more value in the cost to change, while price differentials are much lower than in previous periods. “Also, the majority of people prefer upgrades within the same community and neighbourhood when looking for options to enhance their lifestyle, so they choose bigger homes with different layouts and better views — but essentially within the same community, locality and neighbourhood,” says Mubarak. “Often this is prompted by not just familiarity, but also the convenience of either schools nearby, proximity to workplaces, presence of amenities and community services, as well as central location to key landmarks in the city.”

More negotiations

However, there are more things to understand than just the price difference to be able to fully take advantage of the current market, even as the price correction in the rental market is certainly providing tenants with a lot more bargaining power. Richard Aybar, managing director of Devmark, says many landlords are in fact now actively negotiating with tenants and offering inducements such as price reductions, rent-free periods and even multiple cheque payments. “We have also seen several thousand new homes being delivered in the last 24 months, which again puts pressure on prices,” says Aybar. “Hence, the landlords are keen to ensure their properties are not sitting empty and are willing to negotiate.”

He adds: “In the last two to three years, several residents have moved into bigger and newer properties, which had previously been out of their price range. Several communities such as The Springs and Arabian Ranches, as well as new communities in Dubailand, now offer villa configurations that were previously unattainable for many tenants.”

While all this points to a market heavily skewed towards tenants, Aybar warns it is important to understand the costs associated with moving houses, particularly when upsizing from an apartment to a villa. “The tenant will need a deposit,” he says. “There are also fees for Dewa, internet, removal hire costs, as well as agency fees. Moving to a bigger property can put additional pressure on your overall budget, so tenants should make sure they’ve done the sums in advance.”

New locations

The desire to move, nonetheless, is very strong as tenants find increasing value in newer communities. “The tenants looking for larger properties will find several communities available 20 to 30 minutes from central locations such as Downtown Dubai, Dubai Marina and Palm Jumeirah,” says Aybar. “Typically, the further the community is from the city centre, the more reasonable the price. It is also having an impact with many tenants who are happy to spend an hour in the car to have a larger property.”

Those looking to reduce the commute will also find several opportunities to take advantage of reduced apartment rental rates. “In locations such The Greens, tenants are finding it easier to move up from a studio to a one-bedroom apartment, or to a two-bedroom in Barsha Heights,” says Aybar.

It is advisable to spend only 30 per cent of the income on housing. However, in Dubai most residents with an income below Dh10,000 have to spend almost 40 per cent on rent, especially when rates were at their peak, says Emad Haq, vice-chairman of Haqsons Group.

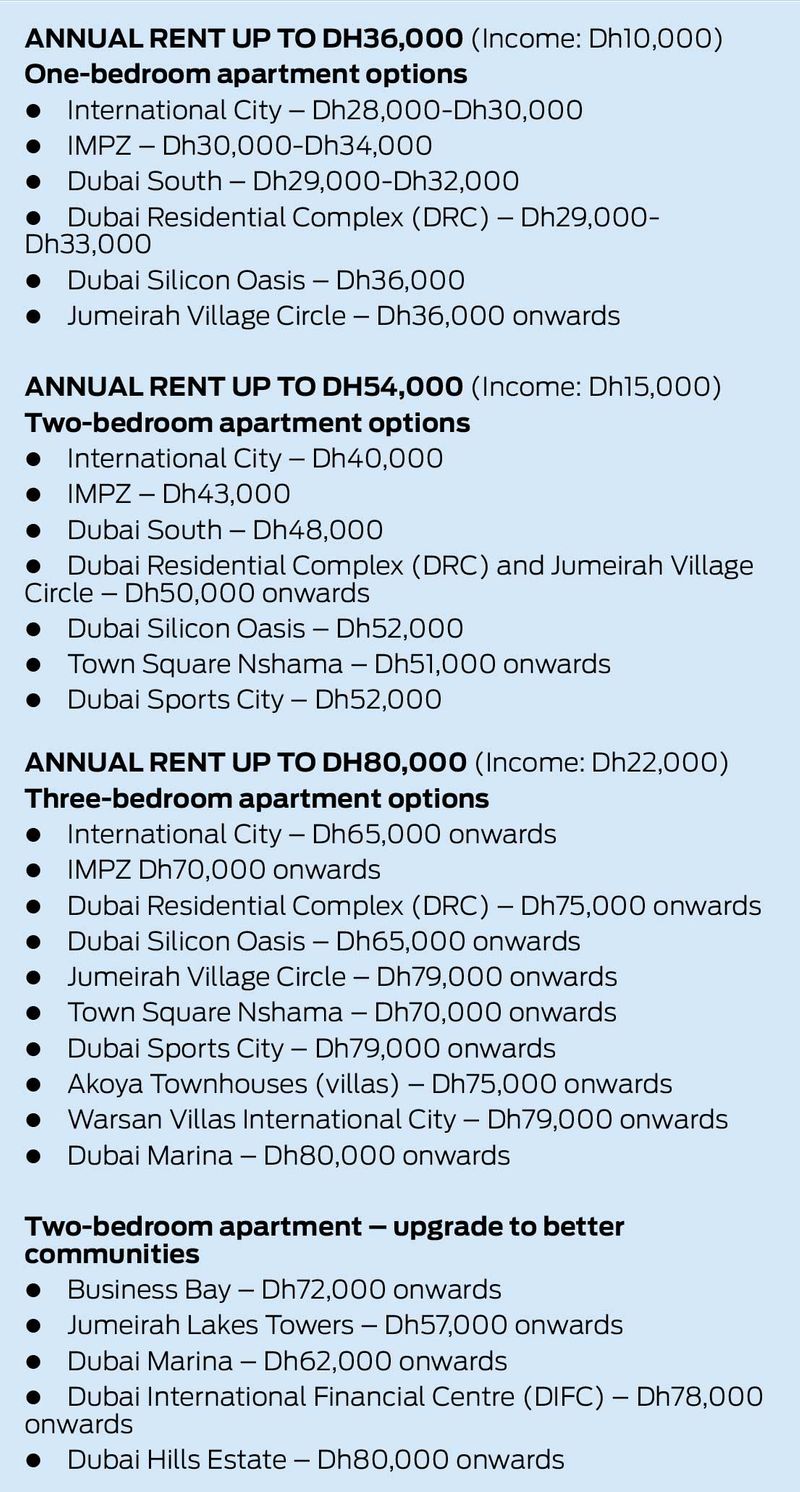

“If the income is Dh10,000, it means the apartment that one should live in should not cost above Dh3,000 per month and that is Dh36,000 as annual rent. [At this price range] people who want to live in a one-bedroom apartment can now do so,” he says. “With an income of Dh15,000, ideally the apartment should not cost above Dh4,500 per month or Dh54,000 annually. [At this price range] people can now get a two-bedroom apartment instead of a one-bedder. When the income is Dh22,000, ideally the apartment that one should live in should not cost above Dh6,600 per month or Dh80,000 per year. People can now live in three-bedroom apartments that they get at the previous rent for two-bedders. Also, people who want to still live in two-bedders can upgrade to better locations at the same rent.”