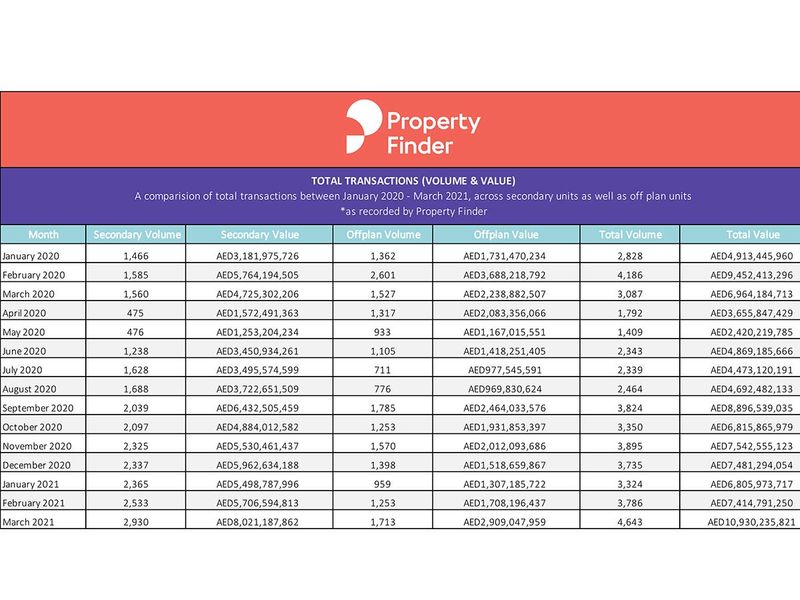

Dubai: Dubai’s developers with completed properties and investors wanting to sell their units are cashing in – sales of ready properties in March have had their best showing since 2015.

Now, 63 per cent of all transactions were for secondary market sales or ready properties last month, further indication that today’s buyers prefer to get the keys to their homes immediately rather than wait a year or more. That’s a 16 per cent increase in February, according to data from Property Finder Group.

Developers have also changed their strategies accordingly – there are now as many post-handover payment plans for ready homes as there are for offplan.

Developers are pushing anywhere from three- to five-year post-handover payment schedules for those willing to put up 10-20 per cent down payment and move in. Market sources say that a good number of those buying now are actual end-users, with investors taking a backseat as the rental market is yet to stabilise.

Mortgage leads

That end-users are getting in is also reflected in the mortgage demand patterns. The number of mortgage pre-approval applications at Mortgage Finder shot up by 85 per cent in the first three months of this year compared to first quarter 2020, based on data from Property Finder. More tellingly, the number of completed mortgages is up 31 per cent for the period.

With the US Federal Reserve in no mood to raise interest rates, it means more time for property buyers in the UAE to keep accessing mortgages at the 3 per cent or even under mark.

“This is due to a number of factors, including the increase in property prices seen in some more established communities, buyers continuing to opt for villa purchases or larger properties in general and also the 5 per cent increase in loan-to-values making it possible for first-time buyers to borrow more,” said Warren Philliskirk, Director at Mortgage Finder.

Secondary surge

As with ready, there is strong buyer interest in the secondary market. Multiple industry sources say that listings by current owners have shot up in these three months. Many of them are willing to match the incentives offered by developers on ready homes, though these sellers may not be as willing to be generous with port-handover payment timelines.

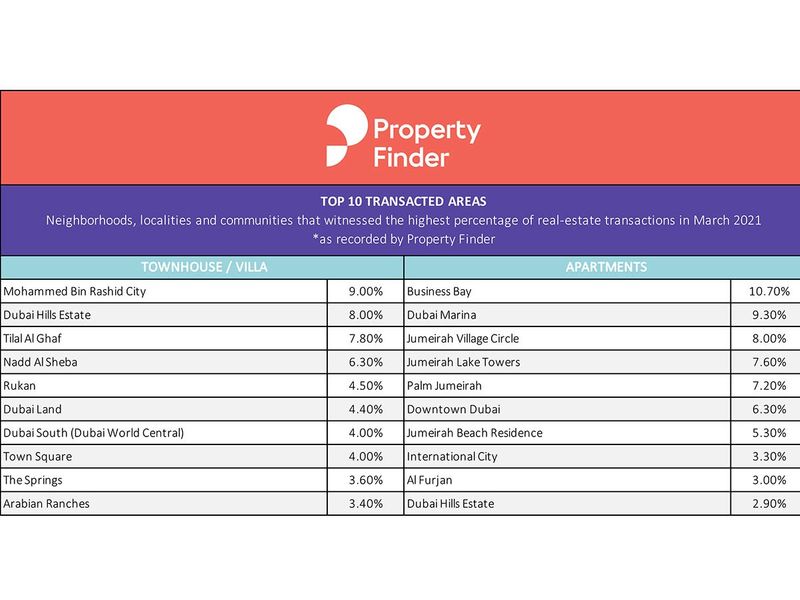

Villas and townhouses maintain their hot streak as homeowners seek the comfort of space to go along with their price and location considerations. In March, 11.5 per cent of all villa/townhouse sales was directed towards Mohammed bin Rashid City, followed by Majid Al Futtaim’s Tilal Al Ghaf (10.1 per cent), Emaar’s Dubai Hills Estate (9.9 per cent), Nad Al Sheba (8.2 per cent) and Rukan (5.8 per cent).

With apartments, 10.7 per cent of all transactions were in Business Bay followed by Dubai Marina (9.3 per cent), Jumeirah Village Circle (8 per cent), Jumeirah Lakes Towers (7.6 per cent) and Palm Jumeirah (7.2 per cent).